Islamic financial services has tallied a decade of positive growth, reaching $2.19 trillion in global assets as of 2018, according to the most recent Islamic Financial Services Board (IFSB) data. That figure was up 6.9% year-over-year, and in many jurisdictions the growth has outpaced that of conventional finance.

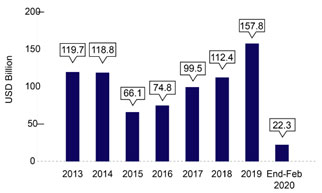

Islamic banking assets reached $1.56 trillion in 2018, reflecting a compound annual growth rate of 10% between 2008 and 2018. Sukuk issuance in 2019, at $157.8 billion, rose 40% from the year before, the Malaysia International Islamic Financial Center (MIFC) said.

Single-digit banking growth in recent years is a measure of the maturity of the sector, which is facing risks similar to those of conventional financial institutions, with the COVID-19 pandemic now being a common denominator, Bashar Al Natoor, Fitch Ratings' global head of Islamic Finance, says in an interview.

Banking Assets Lead

The Islamic finance industry consists of five main pillars, led by Islamic banking which accounts for 72% of the assets. That is followed by sukuk, or Islamic bonds, at 24%. Islamic fund assets and Takaful (Islamic insurance) account for the remaining 4% (source: IFSB).

Islamic banking is systematic in more than 10 Muslim-majority countries, while establishing a niche presence in the U.K. and elsewhere. In countries with significant Muslim populations, such as Indonesia and Turkey, Islamic banking's market share is around 6%, an indication of its growth potential.

Also, over the past 10 years, sukuk has gained in familiarity and acceptance, as sovereigns use it as a vehicle to access capital markets and diversify their sources of funding.

“Jurisdictions such as Saudi Arabia, which raised SAR15 billion in March 2020, have the benefit of their ability to issue local-currency sukuk due to their established domestic debt markets, in contrast to most other GCC [Gulf Cooperation Council] jurisdictions that lack local-market depth,” Fitch said in a recent note.

Bashar Al Natoor, an Islamic finance market veteran who joined Fitch in 2007, has headed the Islamic finance practice since 2015, and is based in Dubai, answered a few questions about the state of the market and its risk outlook.

How would you describe Islamic banking's status on an individual country basis?

There is greater acceptance and adoption in the top 10 countries where Islamic finance continues to be concentrated, namely the six GCC countries plus Malaysia, Turkey, Pakistan and Indonesia.

Countries in Africa - Tunisia and Morocco for example - are trying to develop their own Islamic banking industry. Nevertheless, the sector remains within the early stages of development. In the United Kingdom, Islamic banking and Islamic finance make up less than 1% of the sector's assets.

We expect Islamic finance and Islamic banking to grow in the long term, especially in countries where there is support from the government and consumers.

How does Indonesia stand apart?

What makes Indonesia unique is its high potential. It has the largest Muslim population in the world and is a fast-growing economy. Nevertheless, Islamic finance development is still at the early stage. The sector also benefits from government support. In 2019, the government launched the Indonesia Islamic Economic Masterplan with a target to increase the market share of Islamic finance from 8.5% in 2018 to 20% by 2024.

While notable, two barriers to the sector's growth exist, namely consumer awareness and confidence in the sector. Stakeholders will have to play a dedicated role to help remove these barriers. It is noteworthy that Indonesia is not alone in facing these issues. Other jurisdictions like Turkey and Morocco face similar challenges with consumer awareness and confidence.

What is the growth outlook, and does it differ by segment?

The Islamic finance industry is expected to mark single-digit growth in the short to medium term. This is due to the industry becoming more mature and is a reflection of slower growth in countries where Islamic finance is concentrated. We expect to see sukuk play a larger role in capital markets, as both governments and corporates focus on diversifying their funding sources and plug budget-deficit gaps caused by lower oil prices.

Global Sukuk Issuance to February 2020

What are the significant risk factors?

Islamic banks' risk factors and mitigants vary from country to country. A common risk factor currently is the COVID-19 pandemic. To illustrate: While Islamic banks in Indonesia are likely to be affected to a similar degree as conventional banks, those with significant exposure to the tourism sector are likely to be more affected. If the outbreak prolongs, there is a potential downside risk to the sector's growth and asset quality.

In Malaysia, we expect Islamic banks' credit profiles to remain broadly steady, with adequate loss-absorption buffers to withstand near-term challenges, though we see risks to asset quality and profitability should the COVID-19 outbreak be prolonged. In Turkey, asset quality pressures faced by Islamic banks are significant, as for conventional banks, due to seasoning risks following rapid financing growth, exposure to risky segments and above-average foreign currency financing, given potential lira depreciation.

In Saudi Arabia, one of the GCC countries where Islamic banking is an integral part of the banking system, about 80% of financing is Sharia-compliant (Islamic banking plus Islamic windows of conventional banks), and in Kuwait, Islamic banking's share of total banking sector assets is around 40%. Each bank's expected performance is subject to their standing in terms of asset quality and liquidity and exposure to different sectors.

In many countries, government relief packages amid the coronavirus pandemic should help to soften the near-term effect for Islamic banks.