Despite worries late last year that Hurricane Ian would cause significant losses in the insurance-linked securities market, new-issue ILS – primarily catastrophe (cat) bonds – set a new record in the first half of 2023. According to a Swiss Re report, the $9.85 billion total through June exceeded that for all of 2022 and for all but three prior years.

New issuance in 2022, at $9.8 billion, compared with $12.8 billion in 2021, $11.3 billion in 2020, and $5.5 billion in 2019.

“Investors globally saw an opportunity in the temporarily dislocated ILS market and successfully raised money to support growing demand in the new-issuance pipeline,” Swiss Re said, and there are indications that the growth trend is continuing.

Cat bond pricing fell to distressed levels in late 2022, and spreads widened across all perils. However, losses to indemnity bonds were minimal, and index-linked cat bond losses were well below estimates before Ian hit in September.

Cat bond prices rebounded this year as the traditional insurance and reinsurance market hardened and prompted issuers to seek additional capacity in the ILS market. Spreads began to stabilize in the first half, Swiss Re noted, tightening to well below the inflated levels of 2022’s fourth quarter but still well above historical cat-bond levels.

Source: Artemis

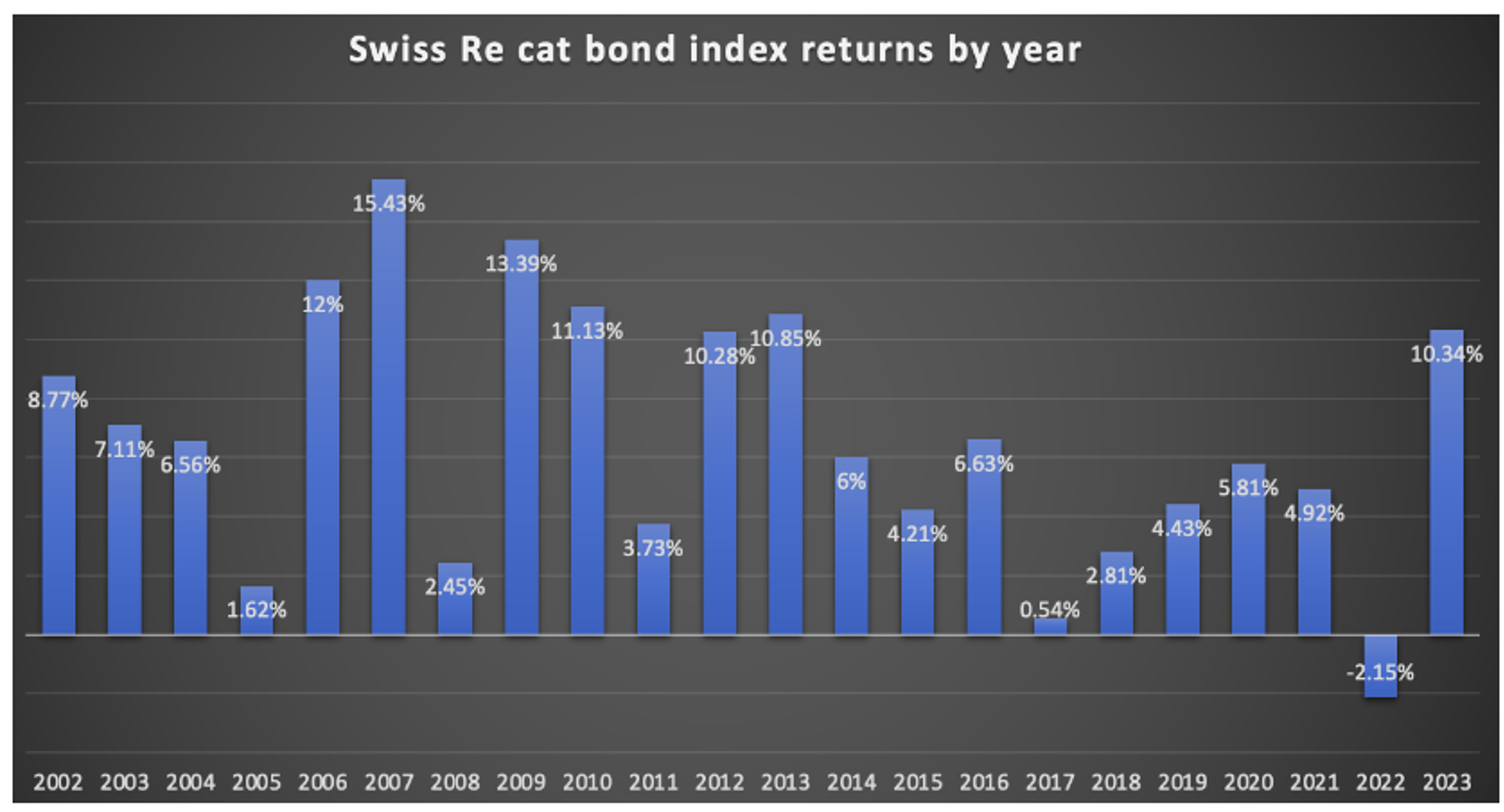

The Swiss Re Global Cat Bond Total Return Index returned 10.34% in the first half, Swiss Re said, and through August, six new ILS sponsors had issued bonds. The trend could turn, however, if certain factors come into play, such as softening in the insurance and reinsurance market or catastrophes causing heavy cat-bond losses.

A Rising Floor on Rates

John Seo, managing director, Fermat Capital Management, said that while the current hard market will eventually soften, cat bonds will not likely return to pre-2017 levels, when the average coupon fell below 5%.

“We think the floor on rates is structurally higher by 20% to 30%, even if you take into account the inflow of capital,” Seo said, as reinsurers reprice catastrophe risk. “Cat bond rates will remain firm, maybe not at 2023 levels, but if they do come down it won’t be by much.”

John Seo, Fermat Capital Management

Seo said that Fermat ILS funds, which now total $9.8 billion, have been getting more investments from family offices, life and other general insurance companies, and pension funds. They find cat bond returns attractive as they reallocate away from equities.

Regulators may also be supporting the trend. A European Central Bank/European Insurance and Occupational Pension Authority paper in April examined how increased use of cat bonds could supplement the overall supply of catastrophe insurance in the European Union.

Margherita Giuzio, of the ECB’s Macroprudential Policy and Financial Stability Directorate, discussed in a June podcast how cat bonds complement traditional reinsurance and lower overall coverage costs by transferring tail risk assumed by insurers to the capital markets.

Boosting Liquidity

Most of this year’s cat-bond growth came from existing investors, observed William Dubinsky, managing director and CEO of Gallagher Securities, and deal innovations could prompt still larger allocations to the asset class. One example would be to structure the bonds for newer perils such as trade credit, making them more accessible to specialist investors familiar with such perils in non-ILS form.

“You could see a combination of existing property ILS investors and others who are experts in trade-credit risk but not necessarily in the property ILS market,” Dubinsky said.

Drawing in new sponsors could also grow the cat bond market. One promising area, from Gallagher Securities’ perspective, is private “cat bond lite” deals, which are smaller than the $100 million typically viewed as the minimum for sufficient liquidity. Such sponsors could include smaller insurance companies – those unable to tap the market covered by Securities and Exchange Commission Rule 144A for private placements – and others augmenting larger transactions.

William Dubinsky, Gallagher Securities

Existing cat bond lite deals have some liquidity, but less than broadly syndicated transactions, Dubinsky said. His capital markets team is working with insurance managers such as Gallagher affiliate Artex Capital Solutions, which manages special purpose vehicles for cat bonds, to find ways to reduce costs and increase liquidity.

“If we do that, we’ll have a much larger market there,” he said.

Coming Cyber Bonds

Also anticipated is the first cyber cat bond under Rule 144A, allowing it to trade among qualified institutional investors via broker-dealers. Expectations for this fall have shifted to 2024 because of market participants’ focus earlier this year on the fallout from Hurricane Ian in the property cat market.

Gallagher Securities placed the first cyber private deal, for $45 million, in early 2023 for specialist insurer Beazley. Although tradeable under Rule 144A, the privately placed bonds under Section 4(2) must trade without a broker-dealer intermediary, thus requiring significant acknowledgements and due diligence by the counterparties, rather than the buyer simply hitting the bid.

While there is momentum for more cyber deals, Dubinsky said, investors must see a pipeline to warrant the time and resources to make that novel investment.

Beazley has returned to the market twice to increase its deal size, now approaching $100 million, said Seo of Fermat, which has invested in it. “This is a normal and healthy way for new markets to get started,” he added, noting that the first cat bond, issued by USAA’s Residential Re in 1997, was also placed privately under Section 4(2). The 144A market was tapped when the market was sufficiently “seeded and educated.”

Seo said that the cyber catastrophe risk supports roughly $10 billion in premiums, indicating that the extreme-catastrophe risk covered by cat bonds could range between $10 billion and $20 billion in losses. Covering just a portion of that risk could dramatically increase cat bond issuance.

The main obstacle, Seo continued, is the requirement to issue the bonds from offshore jurisdictions such as Bermuda, which involves significant travel and other expenses for sponsors.

The U.K. enabled cat bond issuance on its shores in 2017, Seo said, but travel costs for many sponsors and time delays in the issuance process have inhibited offerings from there.

In the U.S., Representative James Himes, Democrat of Connecticut, introduced a tax bill in 2021 that could have enabled onshore cat bond transactions, but it was not acted upon. In another try, Himes and five other Congress members from both parties sponsored the Catastrophic Risk Transfer Act of 2023 (H.R. 3014), which was referred to two House committees in April.

Topics: Investment Management