While the start of summer has many of us thinking about vacations and outdoor activities, it also kicks off hurricane season, along with the onset of other severe weather-related patterns. Understanding what natural disaster risks are lurking in your loan portfolios should be an essential part of your portfolio risk management process.

Mapping these risks to your loan exposure can give you an edge in proactively managing these risks through insurance and concentration risk policies and analysis, among other strategies. Risk managers spend considerable time understanding financial and nonfinancial tail risk events. Making sure you include natural disaster events in your analysis will help you better manage and prepare for these less understood but increasingly significant risks.

Climate Risks, and their Costs, are Increasing

Regardless of the causal factors for observed changes in climatological events, empirical evidence suggests that natural disaster risk is rising. According to a report by Aon Re, economic losses associated with weather-related disasters in the US topped $650 billion in both 2017 and 2018 -the largest back-to-back natural disaster losses on record for the US.

Globally, 70% of all economic losses since 2000 were due to tropical cyclones (including hurricanes), flooding or earthquakes. Other major perils include tornados, thunderstorms and windstorms, drought and wildfires.

The incidence and severity of these extreme-weather events varies, as does the prevailing geography of their occurrences. Getting a handle on these statistics is key to understanding the impacts natural disasters pose to your portfolio.

Natural Disaster Effects on Loan Portfolios

Beyond loan losses, natural disasters pose several risks to banks. Along with the potential for business disruption of various forms, banks face strategic, reputation and other risks when a disaster strikes. Hurricane Katrina, for example, shut down access to basic banking services, such as ATMs, for most of New Orleans, leaving the banks operating in that area reeling for months.

Moreover, through its ability to cause short-term local and/or long-term macroeconomic downturns, a natural disaster could wreak havoc on loan portfolios - particularly those with large geographic concentrations in disaster-prone areas. Banks, for example, with substantial agricultural loan exposure could face significant credit risk under a severe prolonged drought event. Therefore, with the apparent increase in weather volatility, understanding the potential credit loss of your loan portfolio from natural disasters is worth the effort.

Consumer and commercial loan portfolios should be included in such assessments. The credit risks associated with natural disasters largely come in two major forms: (1) effects on default from damage or destruction of property that triggers a default; or (2) impacts from lost income that reduce repayment capacity.

On the consumer side, secured assets such as homes and autos should be reviewed based on their proximity to high-risk areas (e.g., Tornado Alley or 100-year flood zones), as well as the terms and availability of relevant insurance policies. Commercial real estate loans would similarly fall into this category, segmented perhaps by those with and without some form of guarantee.

Natural Disaster Risk Management Strategies

Similar to other risk management assessments, the size and complexity of your loan portfolio should dictate the type of natural disaster risk analysis required. Smaller institutions could leverage readily available mapping software to display where their loans are geographically distributed, and then start with simple overlays with one or more of the major disasters they face.

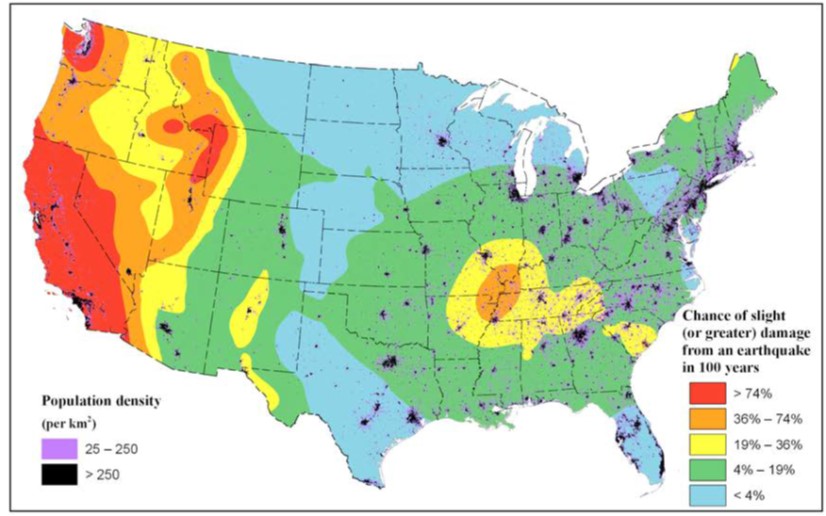

For example, a California community thrift with 100% of its mortgage loans concentrated in a four-county area of the state would want to understand how their loans are distributed by earthquake incidence and severity. Information provided by the US Geological Service, such as the data shown in the figure below, can help guide this process.

Potential for Earthquakes Across U.S. Regions

To develop estimates of maximum potential future losses under various user-defined disaster risk scenarios, firms could also track dollar exposure at the county or zipcode level. For more complex portfolios with greater geographic dispersion and exposure to several natural disasters, more sophisticated tools are in order.

Years ago, as CRO for a large west coast bank, I commissioned a major reinsurance company with experience in catastrophe risk modeling to assess disaster risk on our large-loan portfolio. Going into that analysis, we had concerns primarily surrounding earthquake risk, since the company had experienced significant losses during the Northridge California earthquake of 1994.

Physical details on each property collateralizing our held-for-investment mortgage portfolio were sent along to the reinsurance company. For example, the type of roofing and building materials, the year when the house was built, square footage and other attributes were inputs to the physical loss analysis. Using this company's geophysical simulation models, the reinsurer produced a series of hazard maps for several disaster risk types, along with expected estimates of dollar losses for each disaster type.

The results were illuminating. It turned out that earthquake risk, while substantial, was not the bank's largest disaster risk. Instead, wildfire risk was a greater risk to the bank due to a much higher incidence for these events in our loan portfolio.

In turn, leveraging this information with our historical experience from the Northridge earthquake, we developed estimates of default propensity and loss severity net of earthquake insurance coverage where applicable. Subsequently, we used this analysis to develop several risk mitigation strategies.

Some of the strategies considered included purchasing catastrophe insurance on a portion of the portfolio. We obtained bids from several companies on various risks, and then compared coverage and price to determine whether we would purchase a policy or self-insure. Without this information, we would not have been able to evaluate options with any degree of confidence in our analysis.

One of the concerns we had then - and that still exists today - is whether insurers would pull out of disaster-prone areas or vastly reduce coverage on policies. Consequently, we integrated the hazard maps with our regular portfolio monitoring processes and developed concentration risk profiles based on the critical natural disaster risks our portfolio faced. This facilitated conversations regarding the overall lending footprint of the bank going forward, as a factor for diversification and possible loan sales and credit risk transfer vehicles.

Parting Thoughts

Regardless of whether we're simply experiencing a particularly unlucky part of the weather cycle in recent years or there is an underlying, long-term systemic change in climate underway, the incidence and severity of natural disasters are on the rise.

This, of course, has significant implications for risk practitioners, who need to find ways to better understand and manage the risks of extreme-weather events. Leveraging a wealth of new geospatial and disaster risk technologies for portfolio credit analysis is a good place to start.

Clifford Rossi (PhD) is Professor?of?the?Practice and Executive?in?Residence at the Robert H. Smith School of Business, University of Maryland, and a Principal of Chesapeake Risk Advisors, LLC. He has nearly 25 years of experience in financial risk management, having held a number of C?level positions at major banking institutions. Prior to his current posts, he was the chief risk officer for Citigroup's North America Consumer Lending Division.