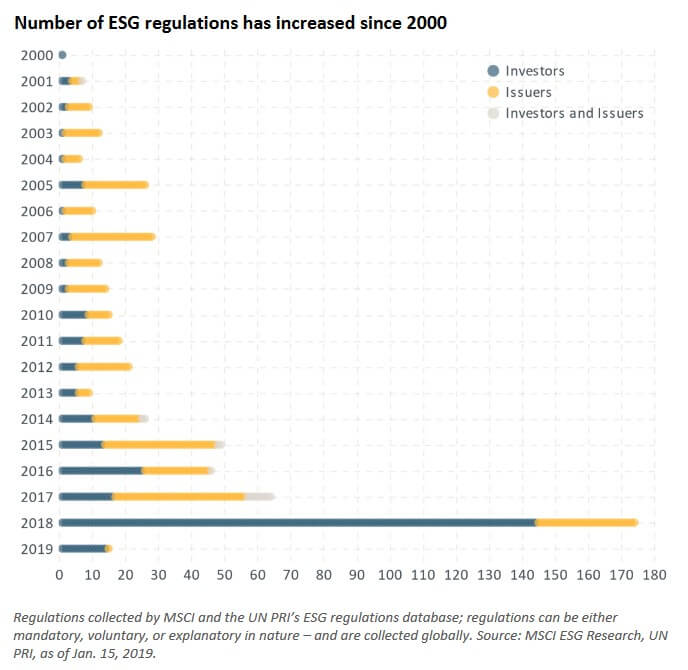

Regulation of environmental, social and governance (ESG) investing, historically focused on corporate-issuer disclosures, is turning increasingly toward investors, according to indexing and risk analytics giant MSCI.

Identifying “regulating the business of ESG investing” as one of the ESG Trends to Watch for 2019, MSCI said in a January report, “it isn't just companies that are fielding ESG-related disclosure requirements. We anticipate that investors, both asset owners and asset managers, will see escalating demands as regulators ramp up scrutiny beyond primarily issuers to focus on the business of ESG investing.”

Of more than 170 regulatory or quasi regulatory measures proposed in 2018, 80% targeted institutional investors, said the report, authored by MSCI global head of ESG research Linda-Eling Lee and ESG research executive director Matt Moscardi.

They noted, for example, that the European Commission “is proposing that investment advisers ask clients directly about their sustainability preferences 'and take them into account when assessing the range of financial instruments and insurance products to be recommended.'”

They concluded that regulatory developments in 2019 “will escalate around ESG investments, rather than ESG disclosures for issuers. For investment institutions that have treated ESG from a narrow, thematic point of view, applying ad hoc divestments or other theme-style offerings, 2019 may well be a year to play catch-up, as measures governing investors' roles and duties compel the development of investment policies that address ESG more holistically as an investment-relevant risk.”

Lee said, “The goal is to improve confidence for the end investor about whether the money they've been investing into a specific investment product is in fact going to a sustainable investment as advertised. If we do this well, then there will be more confidence and transparency that supports continued growth in the ESG area.”

“The Other Trade War”

In the report and an accompanying blog, Lee and Moscardi headlined four other trends: The Other Trade War: Plastic Waste; The Not-So-Distant Future for Climate Risk; The Big Signal Revolution, referring to big data and new investment analytics; and Leadership in the Age of Transparency.

The last two refer, respectively, to new investment analytics stemming from big data; and culture, conduct and related customer-backlash and headline risks.

“The age of transparency means there are fewer and fewer places for questionable corporate practices and even personal conduct to hide,” the MSCI researchers said.

“Investors are starting to insist that, while the parade of CEOs behaving badly may be difficult to predict and avoid, replacing them and cleaning house in the wake of a scandal should not be.”

The report said that a trade war other than the U.S.-China confrontation - surrounding waste - is beginning to unfold, touched off by China's decision to stop accepting solid waste from other countries in 2018, the report said. “How the world addresses the disruption it creates will have ripple effects across multiple industries and countries, ripping the issue from the pages of glossy sustainability reports and thrusting it into investor presentations and financial filings as a subject of business risks and opportunities.”

Climate-Change Economics

Moscardi observed that “there are more investors emerging who are hedging or arbitraging how climate will affect things,”. Some real estate investors may already be facing the consequences of flood zones or sea-level rise.

In Florida, according to MSCI research, “51% of the assets find themselves in the vanguard of rising seas representing approximately $10 billion in capital value,” the report said. “But examining the properties by asset construction dates is even more alarming. If 'high' to 'moderate' flood-risk zones are likely to be inundated by sea-level rise in 2040, we can see that approximately one in five of these mapped commercial assets was constructed in a flood-prone ZIP code after the year 2000, representing $4.4 billion in capital value.

“This means these properties will likely be affected by sea-level rise before the end of their usable life, using the average lifespan of a commercial property estimated at 50 years.”

Beyond real estate, “the U.S. National Climate Assessment report issued in November 2018 directly linked recent extreme weather events to changes in the climate, and projects that the economic impact from climate change could be double the impact of the Great Recession . . . While private assets like real estate may be the tip of the spear, eventually all assets may have to be judged by the same question: Where are the winners and losers in my portfolio?”