Forecasting 6% global growth for this year, the International Monetary Fund says, “We are seeing in some countries a recovery like no other, propelled by a combination of strong fiscal and monetary policy support and rapid vaccinations.”

But that's not the full story of what the IMF terms “a worsening two-track recovery, driven by dramatic differences in vaccine availability, infection rates, and the ability to provide policy support.” Fund managing director Kristalina Georgieva is calling for debt concessions and other urgent assistance to vulnerable, low-income countries, appreciating recently expressed support from G-20 finance ministers and central bank governors for “our efforts to help countries facing unsustainable debt burdens.”

Emerging market debt conditions and relief proposals, policy concerns before the pandemic, have only been magnified since. In a January IMF Blog post, Tobias Adrian and Fabio Natalucci deemed financial stability perils to be “in check so far,” but risks needing to be addressed included rising corporate and sovereign debt and “market access concerns for some developing economies.”

Today, “emerging markets are not out of the woods,” Emre Tiftik, director of sustainability research, Institute of International Finance, said in an interview. “Government budget deficits are set to remain high, leading to further debt accumulation.”

A strong U.S. dollar, rising domestic rates and inflationary pressures are adding to the burdens on emerging market governments, with Tiftik pointing out that their interest expenses are at record highs.

Currencies, Foreign and Domestic

Global credit has been well supported by fiscal and monetary backstops, and especially central bank accommodation. Deutsche Bank Securities head of emerging markets research Drausio Giacomelli said, “Local debt dynamics have worsened, but they have recently seen a reprieve in the form of higher inflation, growth and tax collection.”

High debt, however, is the principal weakness facing the most vulnerable emerging economies, according to Giacomelli, particularly as rates normalize. “In several risky emerging markets,” he said, “assuming funding rates will be lower than growth is dangerous. Even in developed markets this may come back to haunt investors in coming years.”

Chatham House in March pointed to two distinct kinds of risks associated with developing nations' public debt burdens: those associated with build-ups of foreign currency debt; and those related to possibly unpayable domestic currency debt.

The U.K. think tank's paper, by David Lubin, says that to stave off sovereign debt crises, policymakers must “increase their focus on emerging economies' external balance sheets. In particular, the IMF's metric for assessing reserve adequacy (ARA) should play a bigger role in determining whether countries can take on additional liabilities.”

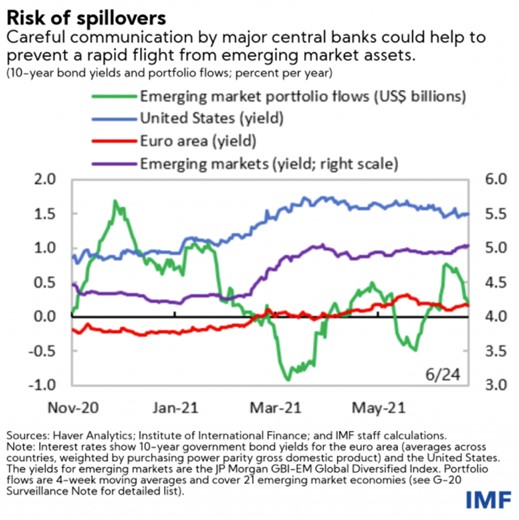

In addition, foreign currency debt will be a big factor in how emerging economies handle the so-called taper, when the Federal Reserve begins to pull back on its asset purchasing and easy money stance.

Eye on Capital Flows

James McCormack, Fitch Ratings' global head of sovereign ratings, said, “We expect the first Fed rate increase will be in 2023, but the slowing of asset purchases - or tapering of the balance sheet - will be much sooner, near the end of this year or early 2022.”

He added, “There are always risks around policy inflection points, how they are communicated, and how they are received by markets, so Fed tapering will need to be monitored closely. If market perception is that the Fed's tightening is proceeding more quickly than previously expected, or at an inflation rate lower than previously envisaged, emerging market capital flows could be affected.”

Debt Service and Downgrades

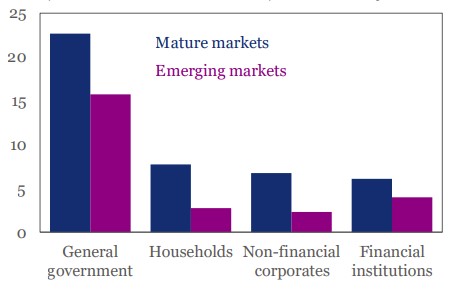

Total emerging market debt as of the first quarter of 2021 was $11 trillion higher than at the end of 2019, at $86 trillion, or 246% of GDP, according to an Institute of International Finance Global Debt Monitor report in May, co-written by Tiftik and IIF economist Khadija Mahmood. It pointed out that with government debt levels up 15% since the end of 2019, along with the revenue hit brought on by the pandemic, “debt service is challenging for many.” In addition, “growing investor focus on climate resilience could put upward pressure on borrowing costs for vulnerable emerging market sovereigns.”

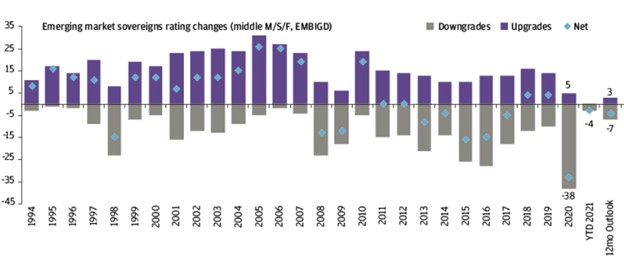

Fitch Ratings views recent, multiple credit downgrades as clues of where Fed moves and other trends will have the most impact. It says the average emerging market sovereign rating has been downgraded by half a notch since the start of last year and is near its all-time low, at BB-.

“The regions most affected have been Emerging Asia and Sub-Saharan Africa, while ratings in Emerging Europe have been least affected,” McCormack noted. “Put another way, Fitch rates 81 emerging market sovereigns; since the start of 2020, 28 have been downgraded (35%), some by multiple notches.”

He sees “two notable risks” moving into the second half of 2021. “First, economic lockdowns or disruptions associated with resurgent virus conditions are possible in all regions,” McCormack explained. “Cases have turned higher recently in Brazil, Indonesia, Russia, South Africa and Thailand, for example.

“The second risk is an abrupt change in external funding conditions, which we don't expect but can't rule out.”

In a quarterly debt strategy report, J.P. Morgan Asset Management's Pierre-Yves Bareau saw emerging market sovereign downgrades continuing to outnumber upgrades in 2021, “but the trend is improving from 2020.”

No Tantrum

IIF's Tiftik advises that investors “not panic,” adding that Fed rate hikes will be slow and moderate. “Emerging markets' reliance on U.S. dollar funding is much more moderate than in the run-up to the 2013 taper tantrum,” Tiftk continued. And with foreign exchange reserves “high enough” in many emerging markets, “FX-denominated debt is still attractive.”

While overall sentiment is to remain cautious, a massive retreat is not anticipated.

“Emerging markets are still the engine of growth, and their growth model is mainly debt-driven,” Tiftik said. “They account for 55% of the global economy, and their profit share is expected to surpass 60% over the next five years. Any slowdown in emerging market growth amidst a potential EM debt stress will be a major drag on global growth.”

Bareau of J.P. Morgan Asset Management concluded, “As we look ahead, we see the expected rebound in global growth as supportive for emerging market debt, though the inevitable tightening of financial conditions that follows may present headwinds. We favor credit over rates as monetary policy normalizes, preferring issuers with exposure to commodities and those with lower financing needs.”