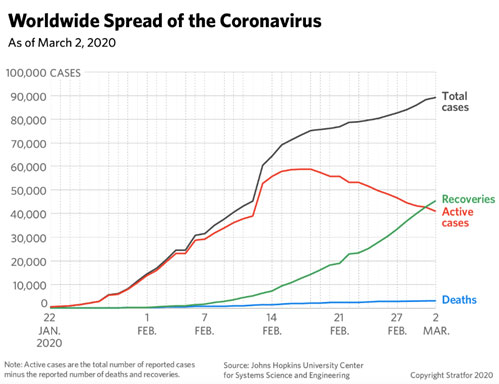

The coronavirus outbreak sent equity markets into a tailspin and macroeconomic forecasting into overdrive. Publicly discussed scenarios ranged from cautiously benign to alarmingly pessimistic, as some analysts projected zero growth in large-corporate profits, while Moody's Analytics doubled its recession probability for the first half of 2020, to 40%.

Just as the economy and its prospects and risks are seen as globally interconnected, so are the factors at work in the financial markets, in the consumer spending that accounts for the majority of gross domestic product, and in the supply chains in which China is an often-common denominator.

“Global value chains, which are essential engines of economic development and GDP growth, have traditionally been designed to optimize for cost competitiveness,” says the World Economic Forum. “The coronavirus underlines the need for companies to focus on risk competitiveness as well . . . The final economic toll of this crisis is yet unknown, but it's likely this crisis will be far more disruptive than anything we have experienced in the past.”

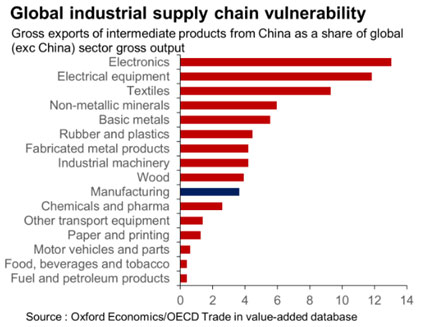

Risk- and crisis-management preparations for long-term supply disruptions are called for, says the WEF, which has been collaborating on this issue with consulting firm Kearney. They cited a Dun & Bradstreet report which included a finding that “at least 51,000 (163 Fortune 1000) companies around the world have one or more direct or Tier 1 suppliers in the impacted [Chinese] region, and at least five million companies (938 Fortune 1000) around the world have one or more Tier 2 suppliers in the impacted region.”

“With the impact of the outbreak on the Chinese economy - which makes up about 20% of global gross domestic product - the cascading effect might cause a drag of approximately one percentage point on global GDP growth if containment is delayed beyond the summer of 2020,” said the Dun & Bradstreet report, dated February 11.

“Typical Black Swan”

Supply-chain disruptions and knock-on effects could be so devastating as to overwhelm the monetary and fiscal counter-measures that governments have at their disposal, according to Gregory Daco, chief U.S. economist of Oxford Economics, a firm that has been particularly blunt in its warnings and conclusions.

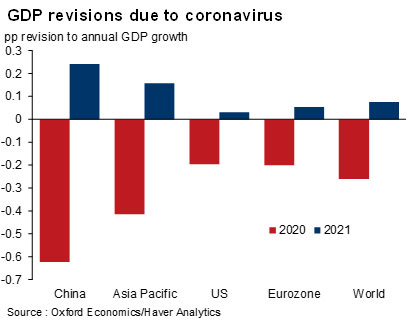

In one scenario of the Oxford Global Economic Model, the firm says, “the pandemic is limited to Asia, and world GDP falls $0.4 trillion (0.5%) in 2020 compared to our baseline forecast. In a global pandemic, it drops $1.1 trillion (1.3%).”

“Coronavirus is a typical black swan,” Daco asserted during an Oxford Economics Global Outlook conference in Washington, D.C., on February 26, and could thus precipitate the first quarterly decline in world GDP since the global financial crisis.

“Asia would be the worst affected, but the U.S. and Eurozone would not be untouched,” Daco said. “There is a risk of financial contagion.”

Although offering a hopeful note that “global conditions should strengthen in H2 as the disruption fades,” Oxford Economics was projecting 2020 global growth of 2.3%, the weakest since 2009.

The OECD lowered its 2020 best-case global growth estimate to 2.4% from an “already weak” 2.9%. Its worse-case view: 1.5%.

Oxford Economics said at the end of February: “The pernicious global economic effects of the COVID-19 virus are battering the financial markets, sending stock prices into correction territory in record time and driving interest rates to record lows. Households held $30.3 trillion of equity shares, both directly and indirectly in retirement plans, at the end of the last year's third quarter. The 15% plunge in stock prices over the past week has vaporized $4.5 trillion of that wealth.”

Recovery Is Maturing

Economist Daco said supply chains in electronics, electrical equipment and textiles stand to be hit the hardest, because of the Chinese share of output in those sectors. (Pharmaceuticals, though lower on his chart [see below], is being monitored for supply-chain dependencies by the U.S. Food & Drug Administration.) U.S. tourism would suffer, as it is accustomed to having 2.8 million annual visitors from China spending an average of $6,000 each.

The prolonged post-crisis recovery continues in the U.S., with a record-low unemployment rate, “but it is cooling, it is maturing,” Daco said. A tapering of consumer spending could in turn limit the ability of companies to maintain or raise prices, thereby squeezing profit margins.

Former Fed chair Janet Yellen deemed a U.S. recession “conceivable.”

On the trade front, Daco said, “Tariffs are sticky - they take about four years to dissipate” even after agreements are reached, and protectionism can recur when economic conditions sour. “We're at a record high for trade uncertainty as a share of total economic uncertainty,” he added.

“What the business sector needs is stability,” Daco said. “It hasn't had any for the last 18 months.”

Rates and Other Expectations

In line with other economists, Daco had been expecting a Federal Reserve interest rate cut in the middle of 2020, but he came to believe it could come as early as March. The Fed announced a half-point reduction on March 3.

Daco called tightening financial conditions “the key game changer in this outbreak,” according to a Reuters report. At the consumer level, “You tend to be more cautious about your outlook because you're worried.”

Hence Federal Reserve Board chair Jerome Powell's statement of February 28 that amid a fundamentally strong U.S. economy, “the coronavirus poses evolving risks to economic activity. The Federal Reserve is closely monitoring developments and their implications for the economic outlook. We will use our tools and act as appropriate to support the economy.”

By the following Monday, March 2, a combination of Fed, Bank of England and Bank of Japan messaging, subsequently joined by the European Central Bank, was raising expectations for concerted action and near-term rate moves, and markets reacted favorably. Along with its March 3 change in the federal funds rate, the Fed reiterated that its policy-making committee “is closely monitoring developments and their implications for the economic outlook and will use its tools and act as appropriate to support the economy.”

The markets would be uplifted by a liquidity boost, said Nigel Green, chief executive and founder of independent advisory firm deVere Group, but there was skepticism as to how effective the central banks would be. “However, in general, the markets are looking for a reason to return to being bullish - which has been their default position for an unusually long time,” Green said.

Geopolitical Dimensions

“This feels different than the other market crisis in that it involves disruptions to daily life,” Moody's Analytics chief economist Mark Zandi said in the New York Times. “This isn't financial. This is not some obtuse thing on a screen. Schools may close. I may not be able to get pasta or oatmeal.”

“There are plenty of risks in terms of financial stability, and also a lot of geopolitical risks,” said London-based consultant and former Italian Treasury chief economist Lorenzo Codogno, also in the New York Times. “The situation is intrinsically fragile. In my view, the coronavirus could be the tipping point.”

DeVere's Green on February 26 pointed out that “major economies, including Japan, Germany, India and Hong Kong, are already facing a serious downturn.” Investors, he added, “also need to consider the impact of the U.S. presidential election, the tensions between Iran and the U.S. and how oil prices will be hit if these intensify, and perhaps most significantly, there's the simmering trade war between the U.S. and China - the world's two largest economies” - and how the slowdown could affect China's ability to step up purchases of U.S. goods, as committed in their Phase One trade deal.

In February, when COVID-19 prompted the cancellation of MWC (Mobile World Congress) Barcelona - not the only such decision affecting a sizable business gathering - Gary Roboff, senior adviser of the Shared Assessments third-party risk management program, commented: “Although canceling the congress was the right thing to do, the coronavirus could have been better contained if China had been better prepared to recognize and treat the disease once it became clear the illness was caused by a previously unseen agent. Whether officially designated a pandemic or not, planning to quickly contain the spread of disease should be a central focus for elected officials at all levels.

“Scenario-based planning and on-the-ground testing is common in some environments and is notably absent in others. Hopefully the consequences of the coronavirus outbreak will serve as a call to action where it's most urgently needed.”