Inflation has put the profitability of both life and non-life insurers under strain. In light of the risk of sustained inflation, the U.K. Prudential Regulation Authority (PRA) has urged insurers to factor in these effects and to determine their long-term impact. Given that inflation has the potential to impact businesses in different ways, this exercise is far from trivial.

The effects of inflation can be felt through a variety of channels that impact certain lines of business differently. Life insurers might face a drop in sales or experience a higher termination rate, either via higher lapses or by increased non-renewal. This kind of “demand destruction” typically starts slowly, but gains momentum once inflation persists.

Scenario analysis is powerful, writes Sander Dekker of Ortec Finance.

To non-life insurers, the inflationary pressure is felt mostly in rising claim costs, being a cost-driven phenomenon and the result of higher input prices for basic materials and labor. Especially for insurers that provide in-kind policies, this “claim inflation” appears to have moved even faster than general CPI, causing additional concern.

Not surprising, therefore, is the PRA announcement to focus more on inflation’s long-term impact. As a prelude to this, the regulator urged insurers to factor in all inflation effects and to come up with ways to manage them.

Managing the Pressures

Depending on business type and mix, insurers have limited options, each with their own pros and cons. These include:

- Adjusting asset allocations

Typically, well designed portfolios tend to hold up relatively well under inflation scenarios. However, insurers could consider alternative investment strategies with increased exposure to real assets, or other investments that offer higher inflation protection. Nevertheless, the drawbacks of this strategy can be higher volatility or a larger mismatch in terms of duration and liability cash flows. - Capping risk in new products

Many life products are still sold without upside restrictions. Especially for longer dated contracts, like indexed annuities or universal whole life, the cumulative effect of inflation compensation could be high. Considering that these risks cannot always be fully priced in, insurers might wish to avoid these risks completely, for example by introducing an indexation cap in new product terms. - Differentiating premiums

The non-life price renewal cycle is relatively short. This allows for much more flexibility in considering alternative pricing strategies. Insurers might want to base their pricing on different levels of inflation, e.g., including distinguishing between general price increases versus core CPI. As products tied to the latter proved to be less susceptible to inflation volatility, these could be offered at a more attractive rate.

Managing the Additional Complexity

To determine the impact of inflation and to evaluate the possibilities of mitigating them, insurers need to consider the overall impact on their businesses, derived from a consistent risk modeling framework. What can make the evaluation particularly challenging is the number of elements impacted by inflation – pricing, capital requirements, profitability and commercial aspects – are interlinked but often at different cadences, requiring a holistic approach.

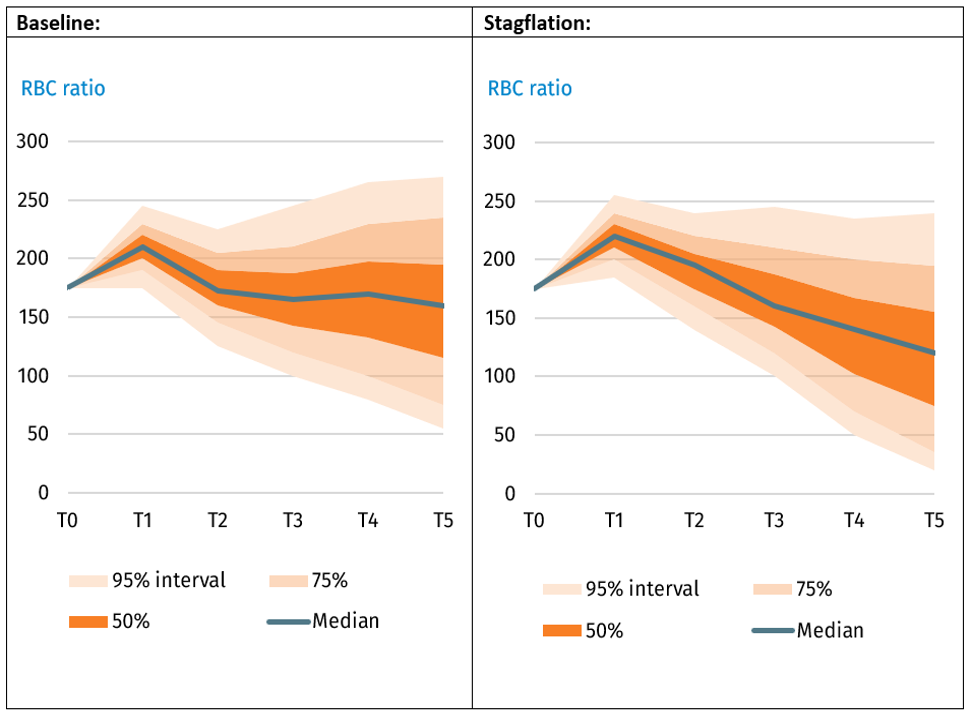

Scenario analysis forms a powerful approach to support decision-making in uncertain environments. Both deterministic as well as stochastic methods can combine inflation scenarios with strategic decision making as a way to analyze the overall impact. As an example, it is possible to demonstrate the result of stochastic simulation for an insurer offering indexed annuities. The results are based on two different economic environments, i.e., a baseline and stagflation. All other factors are fixed.

Example 1: No inflation cap

To assess the overall impact of inflation, analysis could start from investigating the Life insurer’s capital ratio, here based on the RBC framework. By keeping all else fixed, but considering only a different economic environment, the above results suggest that a period of stagflation would be significantly harmful to capital.

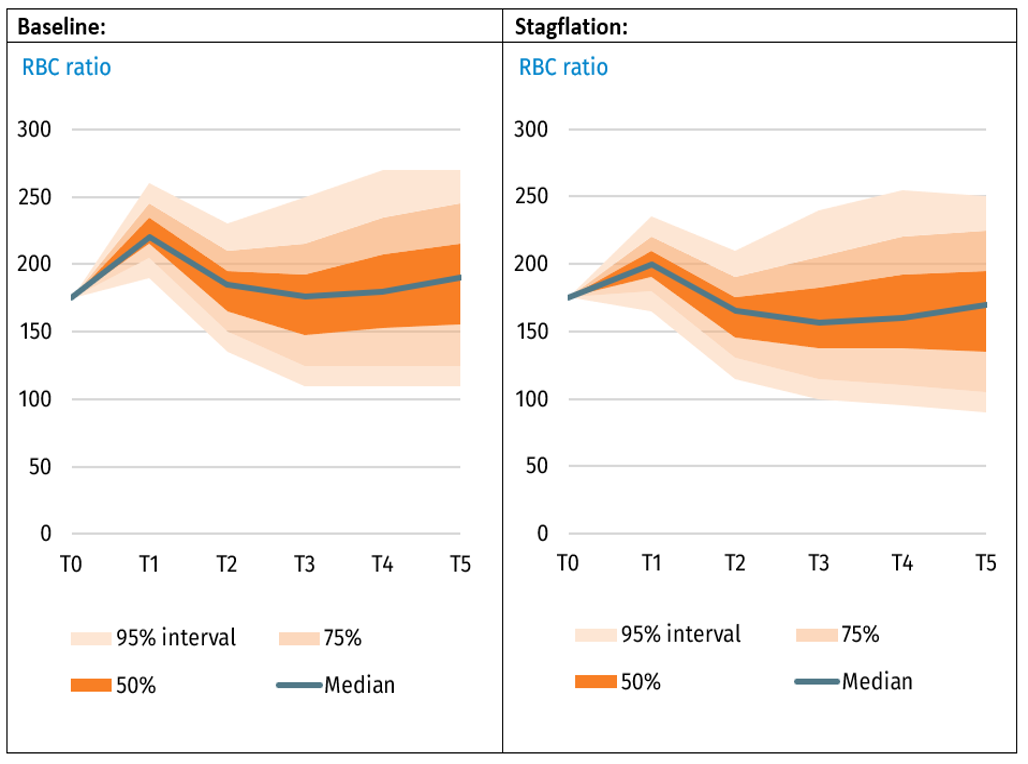

Assume now that as a mitigating option, this insurer will put a capping system in place, limiting the indexation to a long run historical average, one could compare the impact on a like-for like basis.

Example 2: With indexation cap

It appears that by enabling the capping system, this insurer has – on an average basis – improved its ratio development, both in terms of its expected mean and in terms of volatility. The relative benefits are stronger under stagflation, where the capping system pays off more.

Off course mitigating options like this cannot be assessed in isolation. In fact, by changing the indexation terms, there could be less demand for this product. By combining all relevant factors stepwise, investors can find out their true sensitivity to inflation and formulate an optimal strategic response.

Sander Dekker is senior consultant at Ortec Finance, a leading provider of risk and return management solutions for insurers, pension funds and other institutions.

Topics: Market