Market participants have never underestimated the difficulties of transitioning away from the Libor (London interbank offered rate) by the end of 2021, but as the countdown continues, the magnitude of the challenges are ever more evident.

“The scale of complexity and risk management around this is about to take off,” said Stephen Farrell, a partner in Deloitte's banking and capital markets audit and assurance group, and a leader in its financial benchmark assurance and advisory practice.

The U.K. Financial Conduct Authority, whose then-chief Anthony Bailey in 2017 took the lead in setting the deadline, proposed on November 18 a plan to wind down the panels for collecting euro, sterling, Swiss franc and yen Libor panels.

In conjunction with a parallel move by ICE Benchmark Administration, FCA was effectively clarifying the hard transition deadline, if not exactly what to transition to. Announcements followed on November 30 proposing to ensure what the Federal Reserve termed “a clear end date for U.S. dollar (USD) Libor [and] promote the safety and soundness of the financial system.” Fed vice chair for supervision Randal K. Quarles described the plan for ending new Libor contracts and allowing legacy contracts to mature as “orderly and fair for everyone - market participants, businesses and consumers.”

In the meantime, market participants must manage legacy Libor-based debt and derivative transactions while pricing new deals over one of several Libor replacements. They will confront different pricing methodologies and spread adjustments, often in different jurisdictions with different transition timelines and rules.

“There are five working groups [guiding the transitions to replacement benchmarks], and whilst everyone wants to see regulatory alignment of transition targets and transition methodologies across all the currencies, there's a good chance that won't happen,” Farrell said. “You will most likely have differing reference rates, calculation and transition mechanisms, and benchmark structures to replace Libor.”

Various RFRs

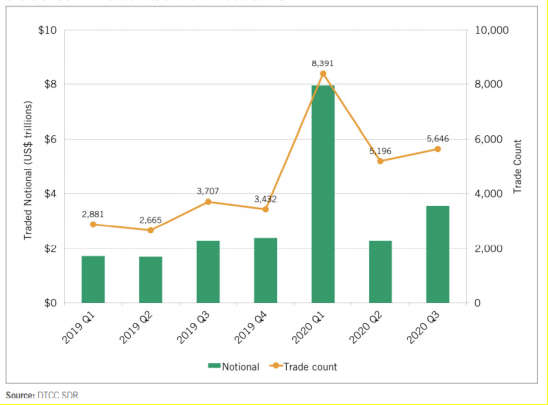

The huge volume of floating-rate financial products priced in U.S. dollars (USD), upwards of $200 trillion, has prompted the largest financial players and regulators to focus on the secured overnight funding rate (SOFR). Depending on where they do business and seek financing, however, they may have to adopt other so-called risk-free rates (RFRs), generated from live transactions rather than banks' often subjective Libor submissions. The RFRs are at different stages of development and generated from different sets of transactions:

- In April 2018, the Federal Reserve Bank of New York began publishing SOFR, generated from secured overnight repurchase agreements (repos) that routinely total hundreds of billions of dollars.

- The Sterling Overnight Index Average (SONIA) was first launched in 1997 and revamped in April 2018 to strengthen its status as the U.K. Libor replacement. The unsecured rate is generated from interest rates paid on eligible sterling denominated deposit transactions of £25 million or more.

- The European Central Bank's Euro Short-Term Rate(ESTR), first published on October 2, 2019, is replacing the Euro Overnight Index Average (EONIA) and is calculated using unsecured fixed rate deposit transactions over €1 million.

- The Tokyo Overnight Average Rate(TONAR), an unsecured rate published daily by the Bank of Japan based on transaction data from money market brokers, is slated to replace yen Libor by 2022. However, the unsecured Tokyo Interbank Offered Rate (Tibor), based on interbank lending rate submissions, already provides a liquid alternative, similar to the situation with ESTR and the long-existing Euribor.

- The Swiss Average Rate Overnight (SARON), based on the secured rate of interest paid on overnight repos, is currently functional and used primarily by the Swiss banks and corporates.

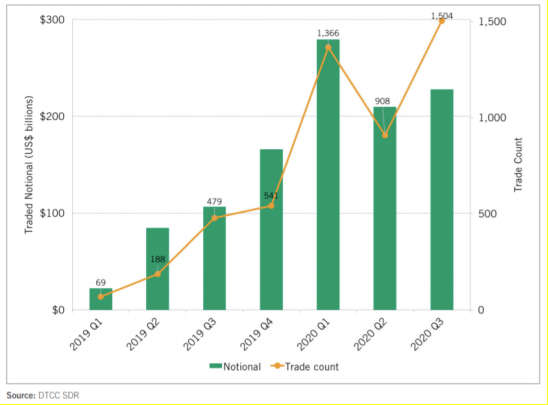

Liquidity a Key Indicator

A key issue among all the RFRs, according to the chief operating officer of regulatory strategy and policy for a major global bank's transition office, is building sufficient liquidity to draw different market participants into the process. The benchmarks, however, are building liquidity at different speeds, requiring participants to track when it is appropriate to transition to them.

The executive noted that SONIA and SOFR both currently have “reasonable levels” of derivative activity, required to develop a forward-looking term rate. But while SONIA is now being used to price loans, there is “almost zero cash-product activity in the U.S.”

That's unsurprising, since use of USD Libor vastly outweighs that of other currency Libors. “So it was always going to be a slower burn globally to get off USD Libor and on to SOFR,” Farrell said.

As for Europe, Farrell said, the market's adoption of ESTR is progressing but may be impacted by Euribor's continued popularity. He said that “when you think about floating-rate derivatives, lending, mortgage products,” Euribor dominates and “will continue to exist for the medium term.”

A similar tension in between TONAR and Tibor could potentially fragment liquidity in Japan. And while the largest U.S. financial firms have coalesced around SOFR, there is no regulatory mandate to adopt it, and there are alternatives including Ameribor, which reflects the rates at which institutions lend to one another over the American Financial Exchange. Ameribor is being used by regional banks to price loans - a step ahead of SOFR on that front. U.S. regulators in a recent joint statement gave a stamp of approval for Libor alternatives besides SOFR.

Term Structures

Potentially leading to further liquidity fragmentation, especially in the U.S., is the development of term structures enabling borrowers to understand more accurately their future interest payments and cash flows. Term rates for SOFR and Ameribor can now be calculated in arrears in different ways. In addition, the Alternatives Reference Rates Committee (ARRC), convened by the Federal Reserve to help guide the transition, has recommended the launch of forward-looking SOFR term rates in the first half of 2021, generated from futures and swaps transactions, similar to Libor term rates.

The market may winnow benchmarks down to those most effective, but until that determination, financial institutions must have systems and processes flexible and robust enough to handle the various conventions and settings.

“If a client comes tomorrow and wants a loan based on three-month, simple-average SOFR, and not the compounded average, banks will either have to accommodate the requirements or send the client away,” said Alexey Surkov, a partner with Deloitte Risk and Financial Advisory and a co-chair of the ARRC Operations/Infrastructure Working Group.

Surkov said the ARRC favors the more precise compounded approach, while the Loan Syndications and Trading Association recommends the simple-average calculation, exemplifying how conventions have yet to be widely accepted.

“My expectation is that it will be some time before true consensus emerges at the product level about what conventions to use and how best to use them,” Surkov said.

Fragmentation Concern

Joshua Roberts, associate director of hedging and capital markets at Chatham Financial, said that more than half of sterling-denominated swaps by notional value are priced over SONIA instead of Libor, and pricing new floating-rate debt with overnight SONIA is becoming standard. He also noted significant progress trading SONIA-based options and volatility products.

However, developing a forward-looking term SONIA could end up fragmenting liquidity and increasing costs, a dynamic that could also occur in the U.S. when forward-looking term rates arrive.

“If there's fragmentation of the market, where the largest players use SONIA overnight and others find term SONIA more convenient, then they would lose access to the full pool of liquidity, and so borrowing costs might go up,” Roberts said.

Operational Headaches

The biggest institutions are addressing the necessary operational challenges, but among regional banks there are wide differences in preparedness, said the transition-managing bank executive. For example, many are likely to find the transition from forward-looking Libor to term structures calculated in arrears, and adjusting their middle- and back-office systems, to be especially challenging.

“How do you organize a specific plan that touches on all the necessary work streams, legal issues, IT, operations, risk and so on, to drive this change?” the banker said, adding that the significant liquidity provided by regional banks, especially in North America, could be hampered by transition delays.

Surkov said Deloitte recommends that clients catalogue their external systems referencing Libor, then gauge their vendors' readiness.

“If someone tells me today they don't know where their vendors are in the Libor transition, I would say they need to remedy that very quickly,” he said, adding systems must accommodate domestic benchmarks and other RFRs globally.

Surkov said most systems already accommodate different benchmark conventions; Canadian products often reference the Canadian Bankers Acceptance Rate instead of Canadian Libor and the various Libors' nuances.

Basis Risk

Still, adapting to a very different environment for floating-rate financial products is bound to create complications that must be resolved. For example, the U.S. repo market has suffered occasionally from a lack of liquidity, causing secured SOFR to swing dramatically while unsecured SONIA has remained relatively stable.

“That creates basis risk between those rates for cross-currency swaps and multi-currency facilities, because the two benchmarks behave quite differently,” Roberts said.

Vendors are updating systems to enable market participants to deal with the Libor transition challenges and the new floating-rate environment, and the ARRC recommends they complete those changes by year-end 2020. However, that leaves lenders and borrowers little time to spare, because they should start pricing new floating-rate products over the RFRs in 2021.

“Organizations have to then make sure internal processes, data feeds, controls - all the internal infrastructure - are appropriately upgraded to handle the new rates,” Surkov said. “That poses risks because that work can take several months, and it happens at the back end of the process.”