American Financial Exchange (AFX), a self-regulated marketplace for bank-to-bank transactions and home of the American Interbank Offered Rate (Ameribor) benchmark, has launched on the blockchain.

The tokenization process, a private application on the Ethereum network, affords complete transparency into pricing and other transaction data that amounts to a “first tape” for the market, as explained by AFX chairman and CEO Richard L. Sandor, who has an impressive record of innovating in derivatives and climate markets. Sandor stresses transparency as a basic tenet of the exchange business.

Since its humble start in 2015 with four banks, AFX has grown to more than 150 bank and nonbank members, and direct lending and borrowing among them is currently around $2 billion a day. The activity has established Ameribor as a viable alternative benchmark ahead of the anticipated demise of the globally accepted but now discredited London Interbank Offered Rate (Libor). (See A U.S. Libor Replacement with Traction)

With a conviction that there should be an “American benchmark,” Sandor geared AFX and Ameribor to the funding realities of U.S. regional and community banks and their varying local-market situations. The exchange facilitates movement of funds from institutions with excess deposits to those encountering greater loan demand.

Ameribor futures were launched in August with AFX's platform partner, Cboe Global Markets. In October, the National Bankers Association, representing minority-owned banks, endorsed the AFX and Ameribor as an approved rate for loan documentation, helping to underscore Sandor's vision of diversity, inclusiveness and “social value.”

Multiple Reference Rates

Ameribor coexists with, and serves an unsecured-credit niche different from, the Secured Overnight Financing Rate (SOFR), the Libor successor chosen by the nation's largest financial institutions that have coalesced in the Alternative Reference Rates Committee. Both are aligned with the International Organization of Securities Commissions' Principles for Financial Benchmarks.

Sandor, in a media briefing coinciding with the blockchain announcement on November 19, said he maintains contact with the ARRC and officials of its convening bodies, the Federal Reserve Board and Federal Reserve Bank of New York. Earlier in the month, the latter opened a public comment period on a proposal for daily publication of SOFR averages and a SOFR index.

Sandor notes that commodity, energy and equity markets commonly have a multiplicity of indexes, and the transition from Libor, which regulators in the U.S. and abroad want to see phased down by the end of 2021, is proceeding that way. J. Christopher Giancarlo, Commodity Futures Trading Commission chairman from August 2017 to July 2019 (and a commissioner since 2014) and now an AFX board member, said he envisions “a blend of different benchmarks” resulting in “a great deal of choice.”

Transaction-Cost Impact

The AFX blockchain initiative grew out of Sandor's interest in the technology and expectation that it can have a significant impact on markets' operations. Compiling his and others' thinking in Electronic Trading and Blockchain: Yesterday, Today and Tomorrow - the 2018 book's foreword is by former Digital Asset Holdings CEO Blythe Masters - Sandor wrote: “As an economic innovator, I was enthralled not only by derivatives in cryptocurrencies, but also by the use of the underlying technology in other new financial products . . . Knowing that somewhere down the road transaction costs would be minimized or even obliterated meant that we could invent what we wanted.”

Sandor, whose pioneering climate exchanges were sold to Intercontinental Exchange, said that blockchain, with its decentralized registration process, “can have huge implications for verification, registration and trading of carbon credits worldwide.” He quoted futurist and blockchain advocate Don Tapscott: “Blockchain may hold the key to changing human behavior on a mass scale, motivating people everywhere to integrate carbon reduction into their daily activities.”

Openness to blockchain, cryptocurrencies and other innovations was a hallmark of the CFTC under Giancarlo, who is currently on the board of advisers of the Chamber of Digital Commerce alongside Masters, Tapscott and others.

Token Creation

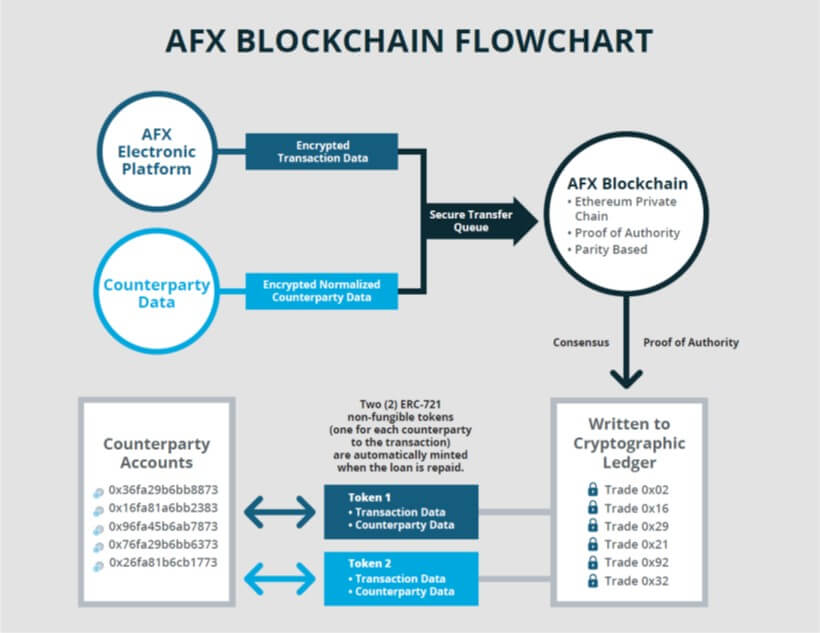

AFX said in its announcement that it “mints two ERC-721 non-fungible tokens for each Ameribor transaction on the AFX platform (for each counterparty to the transaction).”

The tokens are created when a transaction is repaid by the borrowing counterparty to the lending counterparty. “Each token contains encrypted transaction data and encrypted counterparty data,” AFX said, with the counterparty data normalized to preserve anonymity. “Tokens are transferred via secure queue to a private, proprietary, parity-based AFX Ethereum proof-of-authority blockchain. Tokens are then written to a cryptographic ledger to each counterparty's account and are owned by the respective counterparties to the AFX transaction.”

Sandor pointed out that exchanges are in the data business, and there is potentially “predictive value” in the data.

“This is AFX's first major blockchain initiative,” he said in a statement. “We learned a great deal about this new and exciting technology and believe the blockchain has the potential to transform electronic trading and financial markets. AFX is committed to remain in the forefront of this new technology.”

The move follows other financial-market blockchain, or distributed ledger technology (DLT), projects, notably Digital Asset's work with Australian Securities Exchange to replace the legacy CHESS clearing and settlement system.

Fractional Bonds, Tokenized Shares

On November 12, Northern Trust Corp. announced a partnership with Singapore-based BondEvalue for a DLT asset servicing solution that will enable fractionalized bond trading.

The objective is “to allow a wider group of investors access to investments which were historically only available to larger institutions,” said Justin Chapman, global head of market advocacy and innovation research at Northern Trust. “It enables us to continue to lead and develop future market solutions supported by our focus on digitization and blockchain technology innovation.”

Also, on November 19, Deutsche BÖrse said that with Swisscom and three banks - Falcon Private Bank, Vontobel and ZÜrcher Kantonalbank - it completed a proof-of-concept of DLT settlement of tokenized share transactions.

“To enable the execution of a delivery-versus-payment transaction based on DLT, money was made available in the form of cash tokens,” said Deutsche BÖrse, which “provided the cash tokens in Swiss francs through its subsidiary Eurex Clearing. The money was deposited as collateral in the central bank account of Eurex Clearing at the Swiss National Bank. In the following securities transactions, the banks acted as counterparties and exchanged securities tokens against cash tokens using DLT.”