Many of us grew up thinking of all the places we could go and the problems we could solve, a la the main character in Harold's purple crayon. Harold's special crayon allowed him to imagine the world as it needed to be. Protecting apples and sailing an uncharted sea were among his-whiteboard-thinking ideas.

The stakes are much higher now. Whether it's civil unrest, pandemic response, unprecedented unemployment, climate change, uncomfortable supply-chain dependencies or new geopolitical schisms - we understand the way we live in the world must be remade.

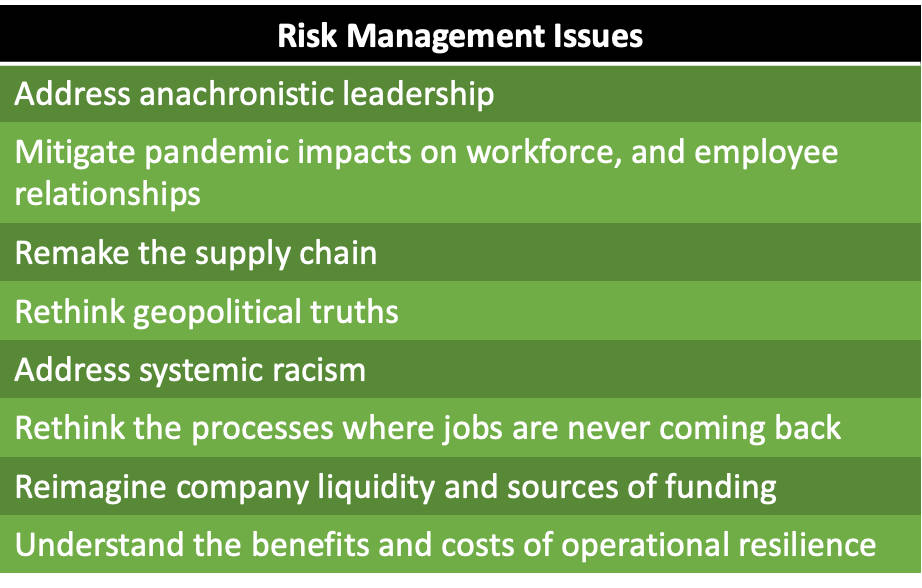

Figure 1: Topical Risk Challenges

With so many challenges, it feels like there are unprecedented risk management problems to tackle, ranging from culture, to process, to technology and people. We could name many more change opportunities, but it's clear the breadth and type of challenge lends itself to reinvention rather than incrementalism.

Problems, and Potential Solutions

None of these are simple issues. And always working against us is time. If the goal is to both beat the clock and solve today's problems, the following five-step risk assessment process will deliver.

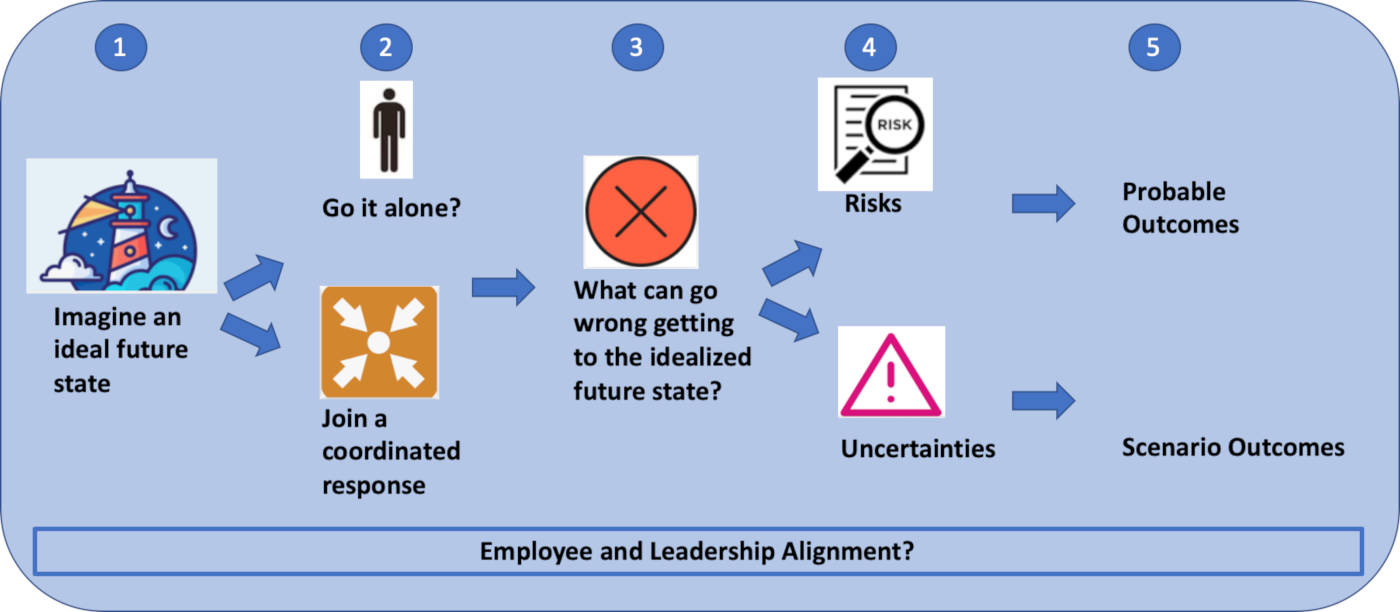

Figure 2: A 5-Step Measurement Approach for Today's Problems

Let's take the example of a firm's global supply chain, impacted by the pandemic, geopolitical change, climate change and altered consumer demand patterns. Often, the best-case outcome will not be a single firm braving it alone, but rather coordination within and across industries to solve the supply-chain issue and address pandemic workforce concerns and climate change.Most companies are responding to all the challenges listed above.

Proper risk assessment now requires management focus on the “Top 5” risks for achieving the ideal future state - with the aim to gain a deep understanding of what can go wrong, and the open-mindedness to consider starting over when an approach seems off base.

It's also important to ensure consistent risk awareness at all organizational levels, and to encourage and inspire Gen Z workers to contribute to a global solution. The idea it to align risk and strategy, employees and customers, senior management and new hires.

We have the opportunity to change organizational focus, and our approach to solving problems and leading the organization. It's clearly time to cede power to the new generation under open-minded leadership. The best risk analysis of strategy is probably not coming from the current leadership, but our experience can matter in facilitating how to get the ideas executed.

CROs must take decisive steps to manage over the next six months. Not just to survive, but to ensure the organization and its people thrive. When changes are large, risk assessment techniques can be employed to take into account the desired outcomes and the threats to getting there.

Parting Thoughts: Integrating Risk Assessment into Strategic Change

Today, we are risk assessing the reimagined. The CRO team is asking, “why not?” rather than “why?” We are starting with a clean whiteboard, and drawing on a collective genius to improve a broad set of outcomes.

We must step back and ask whether our response can be part of a global coordinated effort or whether all aspects must be developed and executed internally. Given the approach imagined, we should seriously ask what can go wrong and boil this down to a “top 5.”

Moreover, we need to ask whether the outcome is about risk or uncertainly, and perform the needed risk assessment. This may all sound familiar; the difference is that speed more important than ever, and the management of the risks and uncertainties must help us reinvent the business.

Brenda Boultwood is an independent risk management consultant. She is the former senior vice president and chief risk officer at Constellation Energy, and has served as a board member at both the Committee of Chief Risk Officers (CCRO) and GARP. Previously, she was a senior vice president of industry solutions at MetricStream, where she was responsible for a portfolio of key industry verticals, including energy and utilities, federal agencies, strategic banking and financial services. Before that, she worked in a number of risk management, business roles and as the global head of strategy, Alternative Investment Services, at JPMorgan Chase, where she developed the strategy for the company's hedge fund services, private equity fund services, leveraged loan services and global derivative services. She currently serves on the board of directors at the Anne Arundel Workforce Development Corporation.