Financial industry executives continually bemoan - often without precisely disclosing - the high costs of compliance, which has stimulated interest and investment in automated solutions, particularly for anti-money-laundering requirements.

A survey from LexisNexis Risk Solutions provides some visibility into AML cost data for firms in the U.S. and Canada. Based on a poll of 140 compliance decision-makers, aggregate AML spending exceeds $31.5 billion per year, with the U.S. accounting for 84% of the total.

Per small company (under $10 billion in assets), that broke down as $1.5 million in the U.S. and $1.4 million in Canada. It was $14.3 million for a mid-size and larger firm in the U.S., slightly higher than the $14 million in Canada.

U.S. respondents reported an average 16% annual rise in AML costs over the past 24 months, well above Canadians' 6%. In projected 2019 increases, the Canada average for both AML and sanctions compliance is 6%, while the U.S. estimates edge downward, to 14%.

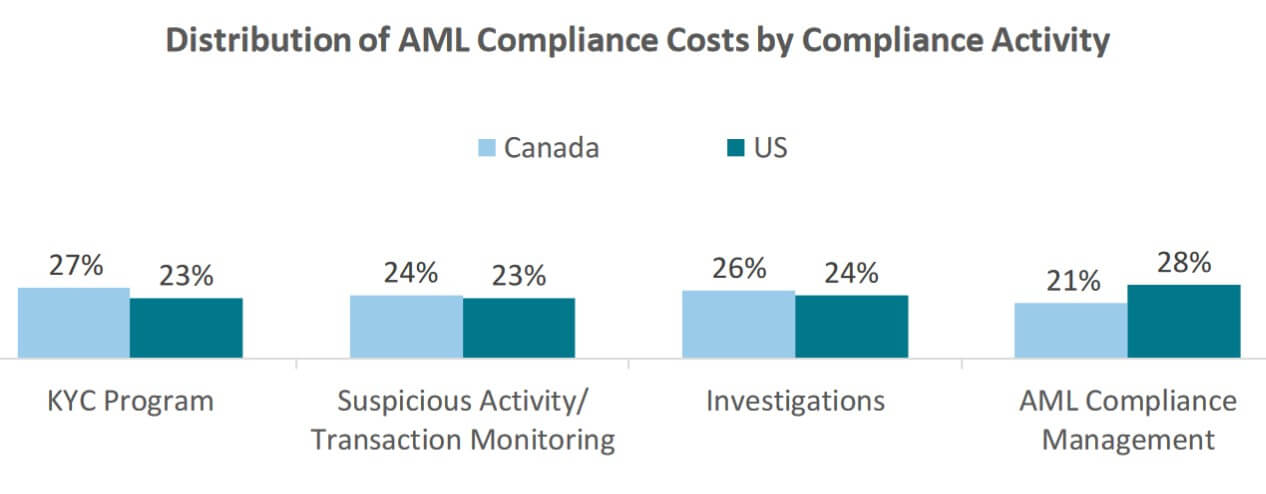

The figures cover such financial-crime compliance processes as customer on-boarding, identity verification, investigations, watch-list screening and transaction monitoring.

Scale and Technology

Scale and the ability to invest in and leverage technology tend to be advantages for larger organizations over others, though all are managing a significant labor-cost component. For smaller organizations, labor accounts for 61%-62% of AML compliance costs, compared with 52%-54% at the larger ones.

As a percentage of total assets, smaller firms' cost of AML compliance goes as high as .85%, versus .08% at the larger firms, “driven by the fact that there are certain overhead investment requirements regardless of scale,” the LexisNexis unit said in the report released in July.

Sixty-three percent of those leveraging none or only one new compliance technology or service reported that their AML activity still had a negative impact on productivity. That compared with 36% of those with four or more technologies or services. In the latter group, 45% saw no productivity impact from AML. (Nineteen percent in both groups said their productivity impact was positive.)

Firms in the U.S. and Canada “which effectively use compliance technology more are able realize a lower average cost per FTE [full-time employee] than those who do not,” said the report's “key findings” summary. “This is important since human resource costs tend to trend upwards year-over-year, and quite sharply when firms are faced with increasing regulatory pressures.”

"U.S. and Canadian financial firms effectively leveraging compliance technologies spend an average of $78,000 annually per full-time compliance employee, versus $140,000 for those who don't,” said Daniel Wager, vice president of global financial crime compliance strategy, LexisNexis Risk Solutions.

From KYC to AI

In a stark example of how technology deployment differs by institution size, 70% of the larger firms and 45% of the smaller ones use cloud-based Know Your Customer (KYC) utilities. The percentage split is 37-14 for unstructured data analysis and text analysis, and 28-12 for machine learning and artificial intelligence.

Of all survey respondents, 95% expect cloud KYC utilities to be standard in AML compliance in five years (compared to 66% currently using). Similarly seen gaining in acceptance over that period are shared interbank compliance databases (to 90% from 55%), unstructured data analysis and text analysis (73% from 34%), in-memory processing (68% from 38%), and AI-machine learning (68% from 25%).

Technology can confer a customer-service advantage, such as in speeding up, and reducing necessary paperwork in, customer due diligence, LexisNexis Risk Solutions director of financial crime enforcement strategy Jennifer McIntyre said in an interview.

“Those firms that leverage compliance technologies are able to focus on improving business results and supporting international expansion,” she noted.

One finding from the report, on customer acquisition: “Over one-third (37%) of firms that leverage less AML compliance technology indicate losing 3% or more of prospective customers due to customer walkouts or refused accounts, compared to only 21% of firms that leverage more technology.”

Reputation Protection

Respondents were asked to state the top three drivers of AML initiatives, and those mentioned most were reputational risk (69% U.S., 79% Canada), regulatory compliance (69%, 68%) and improving business results (63%, 52%).

"As compliance regulations grow in complexity, North American financial firms will be challenged to protect their reputation and avoid costly enforcement actions,” said LexisNexis' Daniel Wager. “The common reaction of adding more labor resources will not result in a profitable long-term solution, but instead often leads to diminishing returns, especially if investments in technology don't keep pace.

“Combining the right core data quality with technology results in cost savings, more effective compliance and smoother customer acquisition. With faster due diligence, reduced friction and a more comprehensive understanding of customers, financial institutions often see a reduction in financial crime over the long term.”