As we surpass 60 days since the first 100 COVID-19 infections were confirmed in the United States, states and local municipalities are debating how and at what pace to reopen their economies. Some have already begun, while others have put forward conditional plans.

Lockdown measures have been effective in sharply reducing the daily growth rates in new infections, but have come at a high cost for households and businesses alike, as the economy has ground to a halt. Impassioned arguments from both sides of the “open everything now” vs. “open later” debate underscore the significant health, financial and psychological costs extracted by the virus, and fear of a potential “second wave” of the pandemic.

Standard risk management practices can provide a solution by offering objective guidance for optimizing the economy's restart. The first step in every risk management procedure is identification: we need data to assess the scope and nature of the threat we face.

Any decision of consequence involves tradeoffs, and is highly dependent on the information available at the time. In early March, faced with a rapid increase in infections and deaths due to the coronavirus, it was appropriate for state and local governments to institute lockdown measures and for the federal government to announce a national emergency. Lacking information, our best course of action was to freeze, lest our actions make the situation worse.

The pause has accomplished two important public health objectives. Social distancing slowed the spread of the disease, and it gave us time to collect data and coordinate action between agencies. But action - or inaction - is not costless.

Shutting down large sectors of the economy reduced output by an estimated 25 to 40 percent annualized. Idling over 30 million workers would have pushed millions of families into poverty, if not for unemployment insurance and government transfer payments.

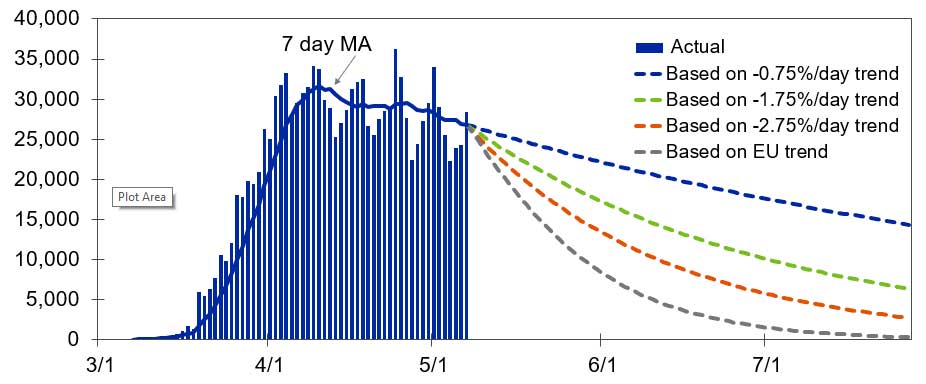

We do, however, now have a much better understanding of COVID-19 - not only its transmission and risk factors but also the vulnerability of specific sectors of the population. Based on recent trends, the number of new infections in the US appears to have stabilized and - assuming a trajectory of infections similar to Europe's - should decline steadily throughout May and June before abating, with daily case growth falling below 1,000 by early- to mid-July (see chart, below).

Number of confirmed COVID-19 cases in the United States

Sources: Johns Hopkins CSSE COVID-19 Data Repository, Moody's Analytics

Periodic outbreaks will still occur after July, but they are expected to be localized, given continued surveillance. Of course, the uncertainty around these forecasts is significant, with downside risks of either a slower decline or a second wave of infections.

Analysis, Action, Mitigation and Monitoring

The second step in the risk management process is analysis. Based on both epidemiological and economic data, we can attempt to quantify the impact of the lockdown. The challenge is to define the most appropriate metric. As the old adage goes: “What gets measured, gets managed.”

While much of our attention has been focused on estimating the number of deaths due to COVID-19, we should also consider the number of premature deaths and long-term quality of life issues related to the economic costs of extending lockdown measures.

Poverty is well-known to be the single greatest risk factor when it comes to health, responsible for far more deaths each year than even the most pessimistic COVID-19 estimates. Less extreme, but still worthy of consideration, is the observation that individuals who join or rejoin the workforce during recessions tend to have permanently lower economic prospects.

In the risk manager's rubric, analysis is followed by action. This is by far the most difficult and ethically challenging step; effectively, we are trading off lifespan reductions due to COVID-19 with lifespan reductions from other causes.

Further complicating matters is the fact that impact projections are estimated - the fatality curves we model have wide confidence intervals. While the confidence intervals may narrow over time as we gather more data, waiting might cause one or even both of the curves to shift upward.

An additional complication is the time delay between cause and effect. Both the number of viral infections and economic outcomes operate with a lag, so our current data is limited. We have to make decisions based on forecasts of what will occur weeks, months or even years in advance.

The most powerful risk reduction tool a financial risk manager has is the ability to extend credit - or not - in the first place. Once a loan is extended, efforts to manage default risk through servicing are far less effective.

Similarly, the most powerful tool in the hands of government officials today is their initial decision to relax a lockdown. Once they reopen, it may be extremely costly - if not impossible - to lock down again. This asymmetry suggests erring on the side of delayed reopening.

This brings us the fourth risk management tool: mitigation. We mitigate the risks of large, consequential projects by breaking them down into steps, each with observable checkpoints.

A city does not need to go from a total lockdown to opening up every business overnight. A prioritized and staggered approach allows city managers to observe outcomes and change course quickly, without jeopardizing their entire community's health.

Often underappreciated but perhaps the most important, monitoring is the final step. Testing, tracking and other monitoring will be vital in restoring the confidence of the general public. Psychology will play an outsized role in the success of any effort to restart the economy.

If consumers remain fearful, it won't matter that city managers or state governors declare a region “open for business.” With household consumption driving 70% of all economic activity, consumers' spending activity will determine the success or failure of any restart.

As infection rates fall in many areas, it is understandable that people focus their attention on the uncertain economic future. Despite the difficulties the lockdown continues to cause for millions of families, the direct and indirect downside risks of letting up too early continue to exceed the risks of extending the lockdown unnecessarily.

While government support should be sufficient to address the income shortfalls facing most households during this time, it is appropriate to define plans with clear milestones for a gradual transformation of our economy and society. We must come to terms quickly with the fact that there will be no grand reopening of the economy.

Parting Thoughts

Rather than despair of innocence lost, we must focus our attention on a soft re-launch of the economy. As the ultimate risk manager, it was appropriate for government to step in and impose a lockdown at a time of extreme uncertainty.

Going forward, the government must continue to monitor the situation and take appropriate actions to keep the public safe. Moreover, it will also need to provide the data, analysis and tools necessary for individuals to make fully-informed decisions regarding their own personal safety.

For risk managers across disciplines, the COVID-19 crisis emphasizes the importance of having a well-thought-out framework to guide decision-making in a time of stress and uncertainty. Identify, analyze, act, mitigate and monitor can be our mantra, whether we are insuring properties against natural disasters, determining the likelihood that a borrower will default on a mortgage, or maximizing public health and security.

Cristian deRitis is the Deputy Chief Economist at Moody's Analytics. As the head of model research and development, Cris specializes in the analysis of current and future economic conditions, consumer credit markets and housing. Before joining Moody's Analytics, Cris worked for Fannie Mae. In addition to his published research, Cris is named on two U.S. patents for credit modeling techniques. He can be reached at cristian.deritis@moodys.com.