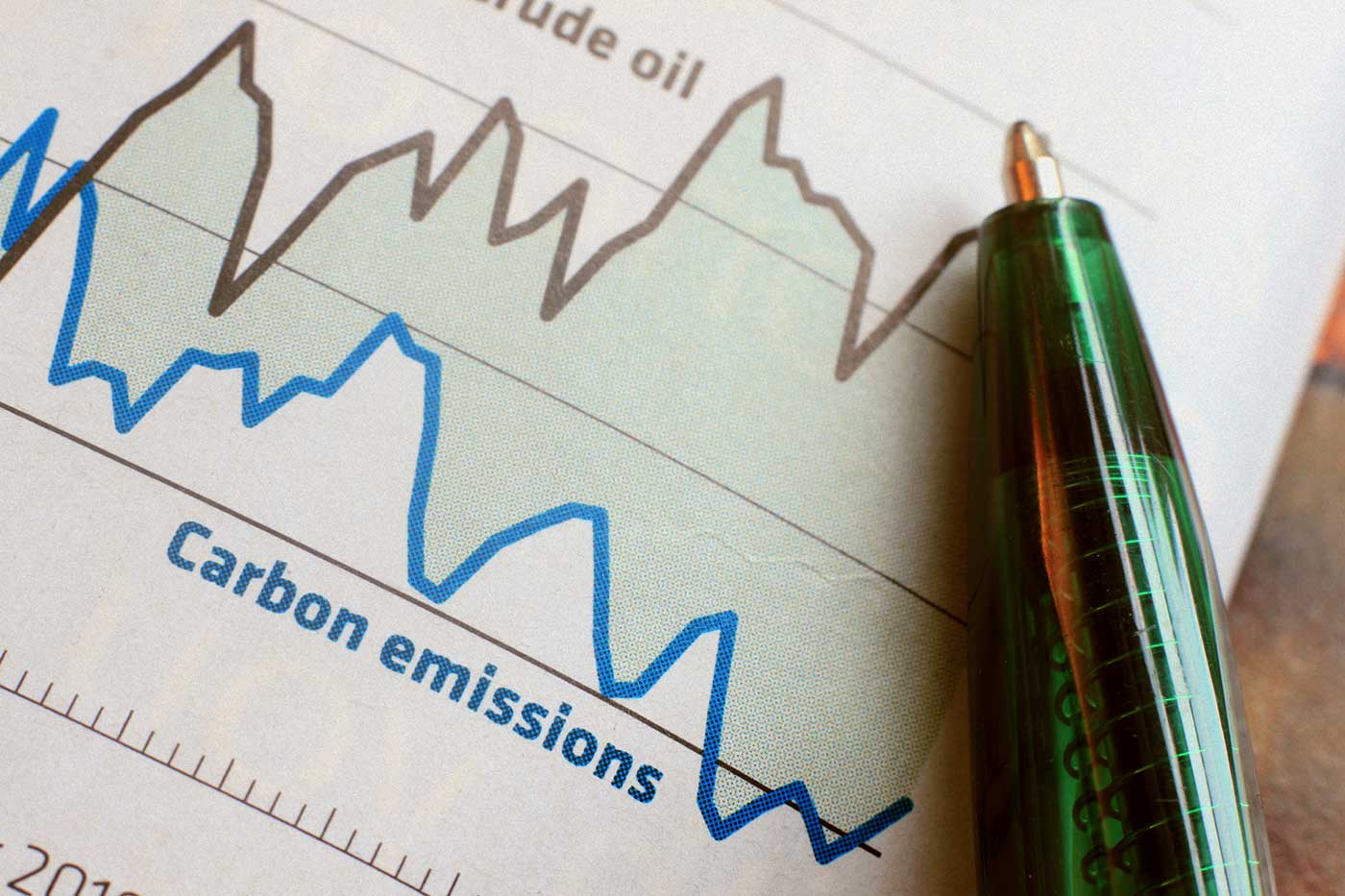

Many firms recognize that climate financial risk is a complex, far-reaching risk with unknown systemic consequences that could affect all parts of their portfolio. However, they are grappling with how to introduce it into their day-to-day processes.

In the past, climate financial risk was treated as part of corporate social responsibility (CSR), but it is now moving firmly into the mainstream. How can this new risk type be properly measured, mitigated, monitored and managed?

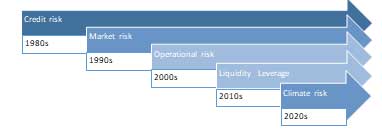

The first step to overcoming initial implementation hurdles is to acknowledge that climate financial risk is one in a long line of risk types that have been progressively identified and managed over time.

The tools and techniques to measure and manage new risk types typically evolve slowly. In contrast, climate financial risk management needs to move at a faster pace, spurred by changes in the physical environment, heightened regulatory focus and investor pressure. Despite differences, those tackling climate financial risk management today can learn from the natural progression (e.g., steps, concepts and mistakes) of, say, credit risk, market risk and operational risk.

Regulatory Evolution of Financial Risk

Management of all of the established risk types started with first movers, and then evolved progressively. The first movers identify the risks, experiment with different definitions and develop measures by trial and error

The concepts then become more and more accepted and adopted, while continuing to evolve, until there is a general consensus about how to define, measure and manage the risk. This development lifecycle can take decades

In contrast, firms today need a fast convergence on a workable measurement and management approach to climate financial risks, to ensure that risk management isn't left behind as the physical environment and the real economy evolves in response to climate change. The more collaboration there is between different actors - including the real economy, financial institutions, regulators and NGOs - the quicker this convergence will occur.

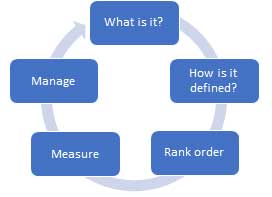

Characteristics, Definition and Ranking

Before trying to measure or manage climate financial risk, what is being assessed, and why, needs to be understood. You may want to know, for example, the greenhouse gas emissions of a portfolio, or whether that portfolio is aligned with the Paris Agreement, or how it could be affected by increasing physical risk.

Once the characteristic that is being assessed is identified, it needs a clear, simple definition that all employees who work with it can understand, from the front line to the board. For example, if the greenhouse gas emissions of the portfolio are being assessed, are you measuring the total amount of emissions, or the greenhouse gas emissions per unit of production (or per dollar of profit)?

A firmwide strategy for managing climate financial risk must also be established and communicated. To manage this risk, of course, you have to understand it and be equipped with the right tools. Past experience has shown that identifying ways to adjust the amount of risk that a business is exposed to is key to obtaining business buy-in.

While taxonomies that classify companies, bonds, products or projects from 'green' to 'brown' are being developed, it often isn't clear how these classifications relate to risk measures, and further work is needed to create a risk-based taxonomy or incorporate climate change into existing risk taxonomies

Irrespective of the approach that is used to produce a risk taxonomy that reflects the financial risks from climate change, a clear method for ranking the risks arising from both physical and transition risks - from least to most risky - is a must.

The goal should be to build a global standard for ranking climate financial risk, with clear criteria that can be readily applied, enabling stakeholders to compare risk data easily across firms. For example, a global approach, based on companies' greenhouse gas emissions, could be developed to rank companies potential increase in probability of default (PD) due to transition risk.

The Climate Financial Risk Cycle: Identification, Measurement and Management

Measure and Manage

Most risk measurement uses historical data to predict the behavior of current customers, products or investments. In contrast, climate financial risk measurement involves assessing risks in a future that is not like the past, which means that further development of scenario analysis is required.

Financial institutions can manage climate financial risk using techniques - such as collateralizing exposures and increasing spreads or premiums for higher risks - that are employed with other risks. However, like retail mortgages in the last financial crisis, there is the potential for unrecognized wrong-way risk, and for collateral to be worthless if physical risks and/or transition risks increase.

In fact, there are arguments that some climate financial risks are unhedgeable. Care therefore needs to be taken that mitigation and management actions account for a future with high physical and/or transition risks.

With increasing social awareness about climate financial risk, financial institutions should also ensure their management and mitigation actions do not give rise to reputational risks that are larger than their risk appetite.

Parting Thoughts

Embedding climate financial risk into existing risk management practices is not an easy task, but companies need to get started.

To ensure that measures are consistent across firms and geographies, and that time and effort isn't wasted creating similar but incompatible outputs, firms need to incorporate lessons learned from the development of established risk types. This will help to create an environment where portfolios and financial flows are aligned with the Paris Agreement, and climate financial risks are reduced.

Maxine Nelson, Senior Vice President, GARP Risk Institute, is a leader in risk, capital and regulation. In her career, she has held several senior roles where she was responsible for global capital planning and risk modelling at banks. She also previously worked at a UK regulator, where she was responsible for counterparty credit risk during the last financial crisis.