As regulators, academics and financial institutions themselves seek answers about recent bank failures, and pontificate on management’s inefficiency in assessing risks in banks' balance sheets, the key question that has emerged is how the financial services industry can forestall future disasters.

The limitations of using a basic set of stress scenarios, and of focusing solely on specific risk drivers, were highlighted in a recent Federal Reserve analysis of bank defaults. The report underscores the importance of banks adopting a holistic, multi-scenario approach to stress testing for capital and liquidity, as well as of the need for boards of directors to become more informed about risks and to take a more proactive approach to oversight.

The problem is that boards lack the detailed knowledge possessed by internal risk management and business-line specialists. This raises concerns about their ability to effectively prevent banks from misleading stakeholders through hiding risk outcomes.

It has therefore become crucial to provide boards with "checklist" tools — comprehensive, high-level overviews that do not rely on detailed data but that can be used to identify significant disparities in the reports received from bank management.

A Three-Pronged Approach

Every checklist should include three steps.

First, a bank’s full range of scenarios should be employed – and subsequently verified by backward stress testing. These scenarios must enable the replication of actual post-stress outcomes with a reasonable probability, based on pre-stress data.

Second, a bank’s performance should be projected on this full spectrum of scenarios (as a supplement to conventional stress testing), and adverse scenarios should be identified to make sure no stone was left unturned.

Third, a bank's strategic plans (e.g., for income, capital and liquidity) should be scrutinized, with the aim of challenging their effectiveness.

These checklist tools can aid regulators in proactively issuing matters requiring immediate attention (MRIAs), before an institution's fate is sealed. They enable the identification of critical issues at an early stage, allowing for timely intervention and the formulation of specific solutions to address MRIAs.

Importantly, the checklist will also provide sufficient time for the implementation of recommended actions. Recent failures in the banking sector have revealed that there was a lack of prompt action from regulators and banks, despite the presence of multiple red flags at firms like Silicon Valley Bank.

Implementing the Three Steps

Now that we understand what's required to improve boards’ risk oversight, the question is which specific actions can be taken – if we want more boards to more fully comprehend risks, and if the ultimate goals are to generate unprecedented scenarios, better project behavior patterns, improve resilience, and be better prepared for future shocks.

Scenario analysis is a logical place to start. Focusing on only a few scenarios from recent history can give a false sense of security, and there is consequently a widespread recognition that more and different kinds of stress tests are needed. If a bank wants to, for example, more accurately capture tail risks, backtesting analysis based on a full range of scenarios is critical.

Alla Gil

While Monte Carlo simulations may seem like a natural choice for capturing the full range of scenarios (particularly when supplemented with additional stress situations, such as cyberattacks or hyperinflation), they may not provide a comprehensive picture.

Standard simulation analyses often fail to capture the unprecedented tails of the distribution, which are primarily driven by market shocks, their ripple effects, and changing correlations between risk drivers. Simply including a few tail scenarios is also an insufficient approach, because these scenarios may not cover the entire distribution of enterprise-level outcomes.

For a holistic view, it is essential to overlay a comprehensive analysis of potential combinations of shocks and their consequences onto simulated normal market conditions. This approach enables the creation of unprecedented scenarios.

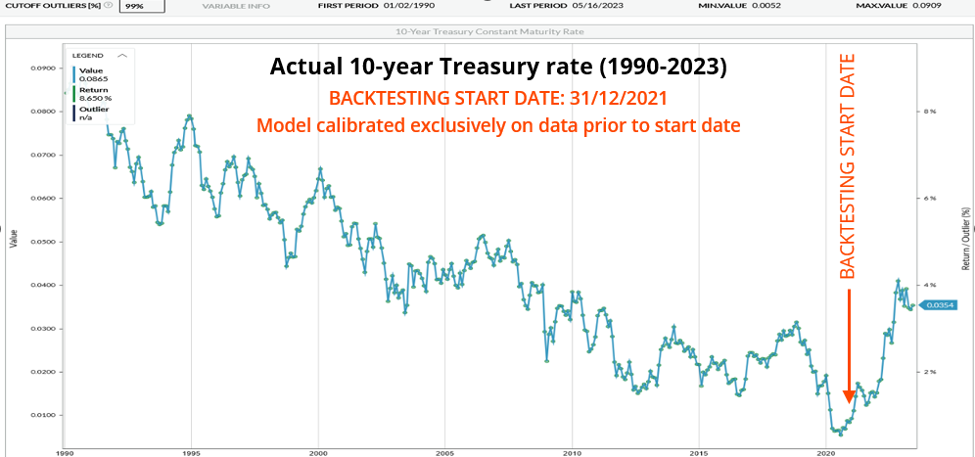

Even based exclusively on the data prior to stress, realized scenarios can be foreseen with reasonable probabilities. Figure 1, which depicts historical data representing the 10-year Treasury rate, is an example of such backtesting of stress testing. The backtesting start date (12/31/21) was specifically chosen because it represented a date before the onset of inflation.

Figure 1: Historical Time Series of 10-Year Treasury Rate

Source: Straterix

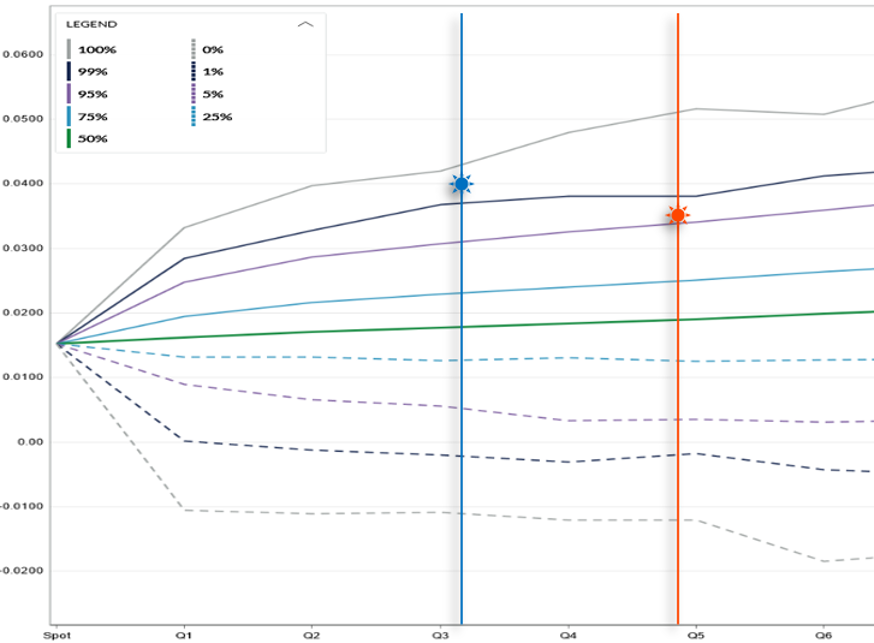

Using only the data prior to the backtesting start date, it is critical to generate scenarios that would capture the realized inflationary outcomes of the following 18 months, as demonstrated in Figure 2 (below).

Figure 2: Simulated 10-Year Treasury Rate Cone (12/31/21 – 6/30/2023)

Source: Straterix

In the fourth quarter of 2022, the 10-year Treasury rate reached 4.25%. This rate was captured at the 99.5th percentile in the simulated backtesting cone – the blue * on the vertical line in Figure 2.

On March 10, 2023, the date of SVB default, this rate stood at 3.70%, and was captured between 95th and 99th percentiles in the simulated cone – the red * on the vertical line in Figure 2.

Emphasizing the insufficiency of a limited set of stress scenarios, the realized rates in our example are more than 200 basis points above the shocks prescribed by IRRBB regulation.

The boards of directors at banks should require such backtesting analysis from their risk management teams. By considering a range of potential future events, including severe economic downturns or market shocks, boards can gain a better understanding of the bank's vulnerabilities, enhancing its resiliency in the process.

Backtesting on the full spectrum of scenarios is one crucial step in the model verification process. A second model-verification step is projecting the behavior patterns of balance-sheet and income-statement segments – like loan volumes and deposit runoffs. This can be achieved by employing explainable machine-learning (ML) methods, such as regression with regularization.

ML methods provide a bank with the flexibility to adapt to changing scenarios and to identify key variables that drive the observed behavioral patterns – while simultaneously enabling a more comprehensive and accurate projection of future outcomes.

Benefits of Reverse Scenario Analysis

The last step toward a more well-informed board entails conducting a reverse scenario analysis, which should ultimately identify the scenarios that could potentially result in adverse outcomes from capital, liquidity or income perspectives. Under reverse scenario analysis, the multiple scenario approach provides a few additional benefits.

First, it offers a bank the ability to calculate implied correlations between the selected key performance indicators (KPIs) and the underlying risk drivers across just the desired scenario subset. These correlations may be substantially different from the average historical ones; moreover, they can be estimated between the KPIs at the selected time horizon and the underlying risk drivers a few quarters prior.

Second, analysis of these correlations enables risk management not only to establish early warning triggers for the adverse outcomes but also to identify what risk factors contribute to their occurrence.

Lastly, senior management in financial institutions can utilize such early warning signals to build contingency plans, avoiding the risks associated with premature or delayed actions. (Given that it takes ample time to develop comprehensive contingency plans, they must be established well in advance.)

Once an organization has identified the range of undesirable values for their KPIs and understands the underlying factors that contribute to them, it can develop a robust mitigation plan. To ensure that they do not inadvertently introduce additional hidden risks, potential solutions must be thoroughly evaluated across all scenarios.

Parting Thoughts

Incorporating checklist tools into the risk oversight process not only enhances the capabilities of boards of directors and external analysts but also empowers advisors and regulators to take decisive actions in response to critical matters, ensuring the overall stability and resilience of the financial system.

Financial institutions of all sizes can benefit from voluntarily disclosing the results of their stress and resiliency tests, boosting customer confidence.

Alla Gil is co-founder and CEO of Straterix, which provides unique scenario tools for strategic planning and risk management. Prior to forming Straterix, Gil was the global head of Strategic Advisory at Goldman Sachs, Citigroup, and Nomura, where she advised financial institutions and corporations on stress testing, economic capital, ALM, long-term risk projections and optimal capital allocation.