For the largest banks, the Federal Reserve recently finalized rules that will impact stress tests, capital buffers, regulatory reporting and loss-absorbing capacity. In lieu of reporting certain stress testing results, each bank will instead be asked to offer a forward-looking analysis of its income and capital levels under expected and stressful conditions - with those projections tailored to an institution's exposures, activities and idiosyncratic risks.

Financial institutions that take a siloed approach are not well-equipped to provide the needed analysis, which will ensure that capital levels are adequate for normal and stressed exposures. Many large banks are therefore expected to use the Fed's new regulations as a springboard to better integrate their finance and risk units, linking strategic plans to risk mitigation targets.

Advancing Business Performance Management

Performance management, in a business context, can be described as the act of setting and monitoring corporate goals, and subsequently creating effective ways for managers to achieve those goals. While there is no single path toward integration, a vital step in developing a comprehensive enterprise risk management plan is to link strategy and risk appetite to performance management (see Figure 1).

Figure 1: Connecting Strategy and Risk Appetite with Performance Management

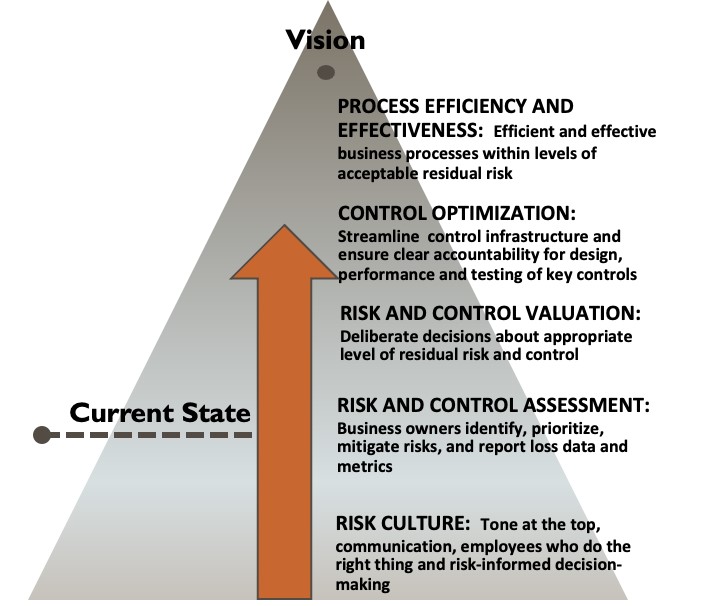

The thread is connected through a variety of functions within a bank, including business, finance, risk and HR. In Figure 2, we show some of the necessary ingredients for organizational integration.

Figure 2: Connecting the Dots

Business performance management can be tracked through process, issue remediation and metric documentation to promote action, accountability and long-term stakeholder value.

Top-down and bottom-up planning must be dynamically integrated, while respecting the calendar-driven board delegations of authority for capital spending and risk-taking. Most other variables change in real-time, and experts must continuously reassess risk tolerances and triggered actions.

Figure 3: Dynamic Planning is Calendar Driven and Triggered

Change Management is Hard

Over two-thirds of bank spending on change initiatives is wasted. When guiding management principles for behaviors are adopted, then key change management, project management and culture initiatives can be implemented to ensure success.

Figure 4: Performance Management Guiding Principles

Results are Tangible

Data aggregation, strong analytics and a common risk taxonomy enable evaluation across the organization, leading to process effectiveness and efficiency.

Figure 5: Management Process Effectiveness and Efficiency

Enhanced enterprise performance management is beneficial to all stakeholders, including investors and employees who want to understand management's readiness and ability to manage.

Parting Thoughts

Digitization, transformation and cultural change are at the heart of strong, ERM-supported business performance management. None of these ideals fall within a single organizational silo, and an effective ERM transition will occur only as a result of a dedicated performance measurement program that rewards calculated risk-taking.

Balancing capital and risk levels could be seen as a purely regulatory exercise, but smart banks view this as an opportunity to take a dynamic approach to data-driven business management.

Brenda Boultwood is an independent risk management consultant and company advisor. She is the former senior vice president and chief risk officer at Constellation Energy, and has served as a board member at both the Committee of Chief Risk Officers (CCRO) and GARP. Previously, she was a senior vice president of industry solutions at MetricStream, where she was responsible for a portfolio of key industry verticals, including energy and utilities, federal agencies, strategic banking and financial services. Before that, she worked in a number of risk management, business roles and as the global head of strategy, Alternative Investment Services, at JPMorgan Chase, where she developed the strategy for the company's hedge fund services, private equity fund services, leveraged loan services and global derivative services. She currently serves on the board of directors at the Anne Arundel Workforce Development Corporation.