An alarming 43% of board members in Europe believe that COVID-19 represents a fundamental threat to the survival of their organization. That's according to a Board Agenda-Mazars-INSEAD Leadership in Risk Management report. Another finding is that 96% of the respondents believe their controls and processes perform well (even if only half say they do not receive enough information to evaluate threats).

What are we to make of such seeming contradictions?

Prior to COVID-19, a majority of companies were attempting some form of transformation. That could be a digital transformation (digitizing processes), an agile transformation (creating more flexible work processes), the introduction of AI and other forms of data analytics, or even adapting to Industry 4.0 technology.

Arguably, this is the big story of the past decade. Since the 2008 crisis, corporations have chosen more and more to innovate their process models rather than their technology. Uber, born in the last crisis, is, after all, just a set of processes built into an app, as is Airbnb (another child of 2008). Agile is a process innovation, as is “digital.”

Mainstream companies were grappling with “process model innovation” or “operating model innovation” in the run-up to the pandemic. Now, suddenly, they face transformed markets that will impose further operating model transformation obligations.

Adapting Operating Models

For example, there is the argument that COVID proves the case that global value chains are non-adaptive in periods of crisis. Logically, then, companies should begin re-localizing their value chain tasks. This is an operating model choice. The OECD says that would be a poor choice, but nonetheless, firms need to start understanding how to mitigate the disruptive risk of pandemic events to global value chains.

A second set of examples lies in the digitization of fundamental services such as health and education. Telehealth inevitably will be a long-term beneficiary of COVID, with likely repercussions on how seriously medicine will, in future, take body metrics collected by tech companies such as Apple. Education is likely to undergo permanent change simply because of the way western education systems have been set up to service students from Asia.

The conundrum, in brief, is that most attempts at transformation fail to meet the expectations of their sponsors. And that is in stable economic times. This raises the question: What needs to be done to increase the chances of successful adaptation, now that we are faced with a transformation in the external environment? What process model adaptations have to be made, and how can we radically improve the success rate?

In our view, there needs to be a shift away from large-scale transformation and towards strategies that bring multiple benefits quickly to companies. COVID has shown that we can adapt very quickly. To do so permanently means redesigning how firms operate.

Economic Impact

The background to this new adaptation process is turbulent, to say the least. There are, of course, winners and losers in the COVID-19 economic story. Aerospace, hospitality, academia, non-food retail and energy belong to the latter category to varying degrees; e-commerce, logistics, major food retailers, office and home furnishings belong to the former.

These represent significant shifts in spending patterns. But, in the aggregate, there is a dark cloud on the medium-term horizon - outside China, which benefited unexpectedly when it lifted lockdown restrictions earlier and became a major exporter of medical equipment and materials.

The IMF calculates that the global economy shrank by over 4% in 2020 but will rebound 5% in 2021.Much of the projected growth, however, is expected in China and India.

For a small and open economy such as Ireland, COVID-19 will increase debt stock by over 14% (assuming a late 2021 return to normal) and decrease private spending by over 15%.

In the U.S., there were almost 7 million more unemployed people in October 2020 than in March, a figure that excludes those who left the labor force altogether. A December 2020 analysis by the CREATE group at the University of Southern California suggests that medium-term GDP loss could range from 14.8% to 20%, though that should be mitigated by Biden administration relief measures.

The Forecasting Challenge

Part of the problem going forward is unknown unknowns; past epidemics provide only a guide, rather than a base for prediction.

At the start of COVID 19, some analysts asserted that the majority of the impacts would be short-term, with political leaders encouraging that point of view. There was a general assumption that, even if COVID lingered, the impact would lessen over time. The reality is that the impact was systematically underestimated. The winter 2020-'21 wave was vastly more damaging to health than the first wave.

The pandemic, but particularly the recovery, poses interesting challenges for risk management because of the difficulty in predicting future economic activity.

There are other aspects of this that will influence executive decision-making. In the crisis, we have witnessed extraordinarily rapid change. The mere effort of, say, an SAP, organizing 100,000 remote workers within a matter of days, is one example. But perhaps more enduring will be the way in which a highly regulated industry, medicine, managed to reduce the development and approval cycle of vaccines down from 10+ years, to 11 months.

Shortening the Change Cycle

Some of the disruptors, such as Uber, and derivatives like Deliveroo and Airbnb, began life in the 2008 downturn. Elon Musk took over as Tesla CEO in 2008 and began production of the first Tesla car in 2009. Also in 2008, Apple launched the App Store, giving the fledgling iPhone (2007) the boost that made it the most profitable phone ever made. The first Android phone launched in 2008, the year that Salesforce launched its defining software-as-a-service (SaaS).

Going even further back, the World Wide Web, eBay and Amazon were all products of recession in the 1990s recession. Google rose to prominence in the dot-com bust of the early 2000s.

Of course, not every great, groundbreaking company or initiative is a consequence of adverse conditions. But two points arise from these observations.

First, during recessions, renewal is already underway. Currently, that is taking the form of initiatives such as experience platforms. Amazon, for example, launched Discover in 2020. It allows people to connect virtually to have in-person lessons or guides to local amenities. And creative responses can occur in surprising places. Air Asia has moved into digital remittances. Instagram, with the Artist's Support pledge, enables craft-makers and artists to sell products for free, if for every five products sold, they bought one from another artist.

Second, we seem to be in an accelerated cycle of what Schumpeter called creative destruction. Significant disruptive bursts have occurred in every decade since 1980. Convention had it that creative destruction, in so-called Kondratiev waves, happened every 50 years. Not now!

Planning for Shorter Cycles

We recently worked in a financial services company whose risk officer told us that he considered his role to be solvency risk. In other words, the company could lose a few million on his watch, provided it didn't put solvency at risk.

The picture is bigger than that. Not taking actions that pre-empt medium-term solvency risk carries with it the likelihood that the horse will have bolted by the time solvency risk becomes obvious.

We can say, categorically, that the creative destruction cycle is much shorter than in the past, and firms need to find ways to respond to the challenge that periodic shakeouts bring.

In our experience, change programs take half as long to plan (18 months) as they do to execute (three to four years). Both of these timeframes are too long and anyway misrepresent the nature of change. If the creative destruction cycle is every 10 years, then a change program will take roughly five, barely time to get a new operating model up and running before the next crisis arrives.

This kind of ponderous process will not cut it as we come out of COVID and encounter the full economic impact.

Agile over Traditional

That points to the need for new tools to support strategic changes in direction in response to disruption risk, i.e. to have methods that present alternative courses of action for boards to scrutinize as a crisis is in train.

What might these look like? In our book Transformation Sprint, we introduced the new idea of a generative operating model. In most cases of transformation, firms hire consultants to describe their existing (or as is) state and then to map out a future or target operating model. The transformation is then the gap in between, the execution of change.

It relies on old-fashioned and trusted, but flawed, risk management techniques (such as RAG [red-amber-green] statuses that created “watermelon reports,” green on the surface but hiding underlying red flags). What companies really need is an agile approach to becoming agile, not a traditional approach.

So here are two important concepts: Agile approaches to transformation, and generative operating models.

They fit together, as generative operating models provide a way of describing all operating model components that are candidates for change. They might be, right now, location, the innovation management system, portfolio management, ways of working (delivery), ecosystem management, security, capabilities and so on.

The generative operating model allows for the fact that each of these is malleable and changeable and will be for some time to come. In other words, there is no fixed destination. What's needed is a learning environment where teams can grow the skills that allow them to understand (a) what changes are needed, and (b) what skills will be needed when those changes are made.

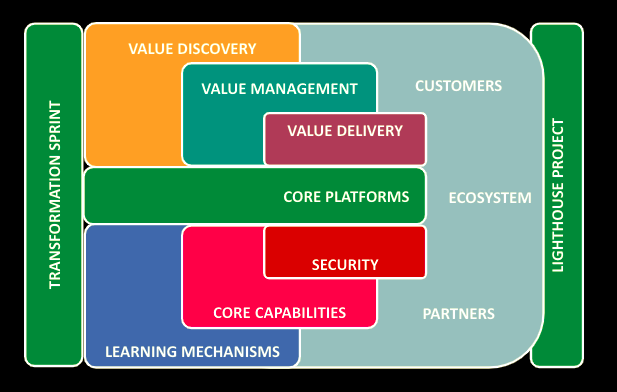

An Example of a Generative Operating Model

Concepts Outlined

This in turn leads to another new concept, the lighthouse project.

These new terms are beginning to mount up, so let's define them and their relationship with each other:

- Agile transformation planning provides a company with an adaptive philosophy towards change, in place of the grand plan. In agile environments, all work is broken down into short cycles. We call this one a “transformation sprint.” It means the actual planning of a significant change taking only four weeks, rather than 12 to 18 months, to deliver.

- Lighthouse projects make that speed possible as an output of the sprint. Lighthouse projects are those that have a structural impact on the operating model. Imagine that you have scaled transformation back to one project. This project has to have a structural impact. It needs to enable a change in the operating model.

- The generative operating model is one that is open to evolution and change, and where staff are encouraged to experiment with ideas about which areas of the operating model need to change. And, of course, it is made up of all key functions.

- The lighthouse as a learning environment. When a project is designed to have a structural impact and still be small-scale, it becomes a laboratory. The delivery cycle is extremely fast, with project value arriving a month after launch and thereafter every two weeks. Delivering value at that cadence requires a rethink in how projects are broken down. In place of project logic - the schedule, milestones, deliverables, budget - you have to think about value. What will I deliver of value in two weeks' time? You also have to think of an audience, because lighthouses are there to be seen. They are presented weekly to leaders.

Conclusion

Change requirements will come thick and fast as the medical emergency of COVID-19 recedes. Unique economic conditions will be a new layer of demand on companies that already were under pressure to change.

The old tools of change management will not be capable of delivering. Agile change planning can help get the cadence of new value delivery right and mitigate the extreme risk of creative destruction. To get there, risk managers need to embrace the generative operating model.

The goal of the generative operating model is to acknowledge that we do not know enough about the precise direction change should take.

Instead of a transformation plan, we have discrete sprints that target different functions within the operating model.

Each of these becomes a laboratory where the team learns about the changes that are actually needed, and the new skills requirements that change brings.

Above all else, this requires us to rethink the notion of a project and move away from old project definitions and structures to lighthouse projects that act as living laboratories of change.

Haydn Shaughnessy (@Haydn1701) is co-author, with Fin Goulding, of Transformation Sprint: How to Fix Broken Transformations in Just 4 Weeks. A recognized authority on innovation and an independent consultant to many major financial institutions, Shaughnessy is also a research fellow at the University of California, Irvine. His previous contributions to GARP Risk Intelligence include Transformation Management: 5 Steps for Risk Managers and A New Era of Disruption.

Fin Goulding is former international chief information officer of global insurer Aviva and has served in a similar capacity for Visa and HSBC as well as Lastminute.com, Sabre Holdings and Travelocity. He has successfully led IT departments and transformations at several of these organizations. He is a Fellow of the British Computer Society.