[Editor's Note: We would like to welcome Thomas Day, the co-owner and vice-chairman of ShortFin Capital Management and TBA LLC, as our new FRM Corner columnist. Thomas has a wealth of financial services experience, and plans primarily to offer practical advice for assessing and managing culture and governance issues. He'll share thought-provoking insights and ideas, with the hope that readers can put them to work immediately.]

In credit risk training, level 101, you learn the “5 C's” of credit: cash flow, collateral, capital, capacity and character. While all of these elements are important, character is arguably the most vital.

If the character and integrity of the credit counterparty is questionable, it doesn't really matter the veracity or strength of the cash flow or collateral: these things can be diverted, manipulated or otherwise diluted.

It is the character of the people - the borrowers - that matter the most, and there are precious few algorithms for assessing character. Such an evaluation can only be made through personal judgement, intuition and establishing a relationship with the counterparty.

This same fact is true for large or small organizations. Whether we're talking about a bank, a regulatory agency, a hedge fund or a small- and medium-sized enterprise (SME), it is the character, integrity, values and personal ethics of the people that ultimately determine performance.

In bank supervision, this was often reduced to an assessment of “Management,” the “M” in the CAMELS risk rating system. Yet, the training techniques for assessing management, governance and culture have been - and remain - poor. Indeed, it's not a simple matter to distill a view on management and leadership, culture and governance.

While many who passionately believe in the efficient market hypothesis (EMH) might suggest these matters are smartly compounded into prices and risk by way of a semi- or strong-form version of the EMH, recent history suggests that the market does a poor job assessing culture and governance.

After all, according to MarketWatch, banks have been fined a staggering $243 billion since the global financial crisis. While many of the fines have been related to misleading statements to investors, the problem is clearly related to incentives, and incentives drive performance: good and bad.

How do you “teach” good culture? Good governance? Solid morality and ethics? Sounds boring, and it doesn't really seem to fit into the ethos of “eat what you kill” - the primary religious faith of market efficiency disciples.

But there must be a better path. There must be accountability. Mustn't there? The size and frequency of the fines assessed to date seems to suggest a dirty underbelly within the broader industry, both at banks and non-banks. The general feeling: malfeasance pays.

Donna Howe, the founder and CEO of Windbeam Risk Analytics, says that fraud is a particularly tricky issue to manage, partly because of the mindset of financial institutions and partly because regulators tend to relax supervisory requirements during prosperous economic times. Complicating matters further, she says, is that business leaders generally grouse about governance as a “money pit” when times are good.

All of this could lead to more volatile systemic risks. “Fraud is fascinating to investigate, primarily because nine out of 10 fraudsters believe they have the right to defraud you! They honestly don't feel that they are criminals. It's all caveat emptor,” says Howe, a former board member of the Global Association of Risk Professionals. “Maybe we need to re-label governance as accountability.”

This is very true. Accountability is critical, but who is responsible for creating that accountability? The market? The board? The regulators? The CEO? The senior managers? All of the above?

First and foremost, accountability must be driven by the culture of the organization, which may take years to establish, and a single rogue executive to destroy. It's not fashionable and trendy terms (like “ESG,” today) that drive such a culture, but, rather, mundane things like vision, mission and values.

The culture of the firm must create many other values, and then enforce them. This requires controls, formal and otherwise, to ensure that values, mission and goals are met. These goals are not just financial but include many “soft” and non-financial (non-algorithmic) objectives. And if they aren't met, heads must roll, beginning with the chief executives and, in some cases, even board members.

As we all know, this type of accountability has largely been absent in the aftermath of the GFC. Even after the creation of the Financial Crisis Inquiry Commission (FCIC), and subsequent analyses like the 635-page Levin-Coburn report on the financial crisis, we have yet to see transformative change -- regardless of the self-congratulations about enhanced capital levels, stress-testing and purported enhanced systemic resiliency.

And, no, Mr. Geithner, the stress tests didn't save the financial system. The largess of the Fed's balance sheet, in fact, saved the system, which perversely allowed flawed cultures and governance models to persist.

Balancing Culture with Risk Assessment

All of this talk about culture is not to suggest that that mathematics and advanced algorithmic techniques are unimportant in risk management. Throughout my career, in fact, I have been fascinated with both. As a former commissioned examiner with the Office of the Comptroller of the Currency (OCC) and the Federal Reserve System (FRS), for example, I was fortunate to be involved in capital markets supervision, on-site horizontal examinations and technical training courses in trading and balance sheet management topics (as an instructor).

Early-on, a mentor, economist Perry Mehta, advised that technology could overwhelm and displace “people,” given that banking is, at its core, “not that complicated.” I know there are some who will be appalled at this perspective: non-complex banking. How is this possible?

At its core, banking and finance is about assessing risk. Risk assessment, in turn, is about the objective evaluation of data. Data analysis, of course, relies on the use of algorithms and databases.

It was urgent that I learn all I could about models, financial mathematics and data manipulation at the start of my career, though I never became too proficient in big-data analysis. Rather, I was ushered into a whirlwind of training courses that helped me better refine my skills regarding quantitative techniques

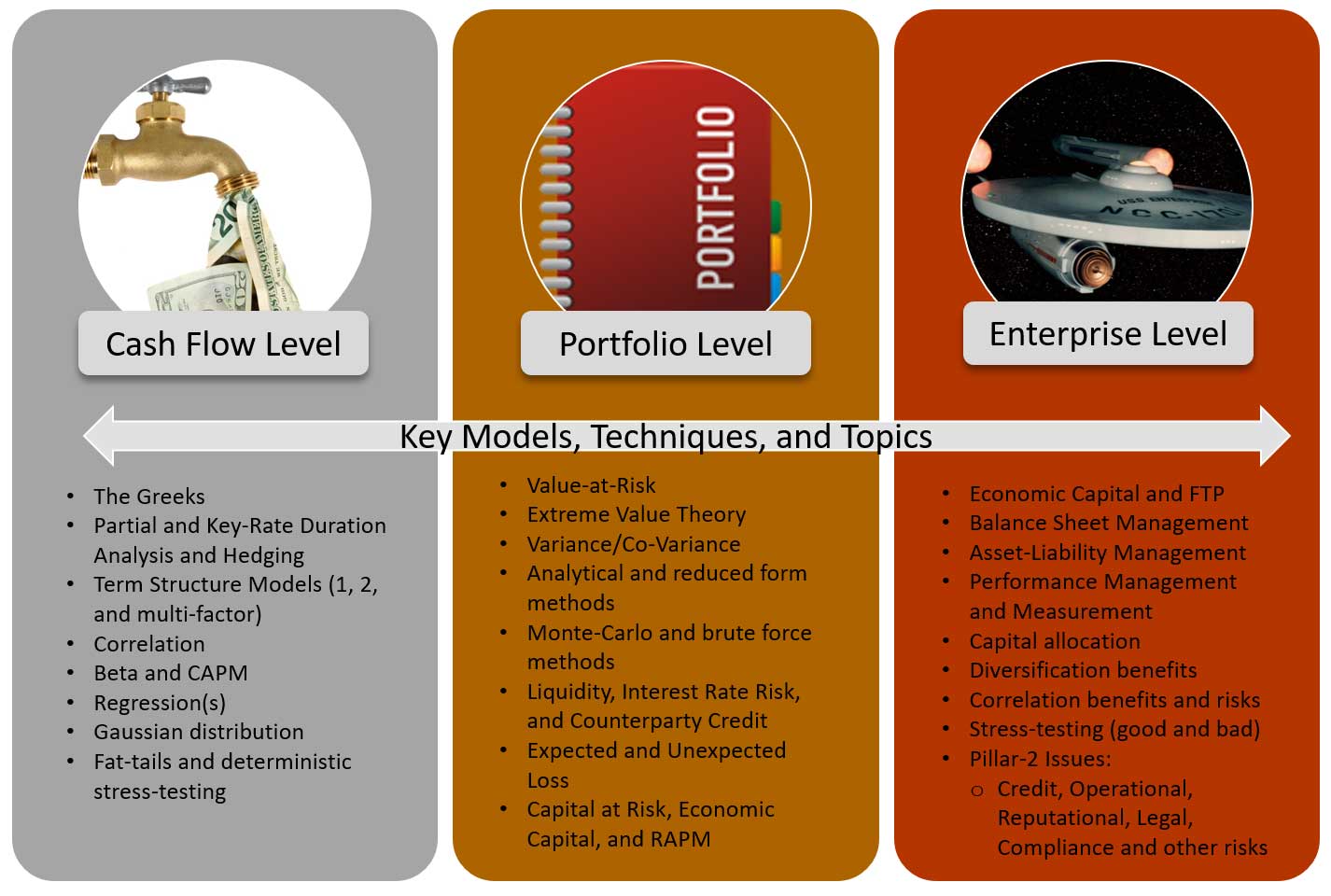

I spent years - literally years - poring over books and reading all I could about the application of models to financial risk management topics (see figure, below). Big Data analysis might have been a far better use of my time.

Risk Management Basics: Key Models, Techniques and Topics

While all the topics in the figure above are necessary and important to understand, they are also insufficient. Banking is about much more than just mathematics. Sophisticated risk measurement techniques can mesmerize, but can also divert attention from things that matter even more - like culture, governance and accountability (CGA).

Forging a New Path

The path forward on CGA includes, firstly, dialogue and education. After this, actions need to be taken. But by whom?

It is my personal belief that actions need to come bottom-up, not top-down. This includes regular employees of firms blowing the whistle on practices, procedures or results that violate strong principles of solid CGA.

The Wells Fargo accounts scandal seems a perfect example, but there are many. The processes for blowing the whistle and escalating flaws to the proper “authorities” must be enhanced. This is step one.

Practically, we can start improving CGA tomorrow by doing a very simple thing: forwarding this article to those who need to hear the message and by appointing yourself an ambassador for better practice. It is arrogance to think that culture is a top-down manifestation: all employees can be proactive.

Strong culture and governance are emergent phenomena that occur properly when a firm places a high value on character and ethics. Attitudes that are intolerant of bad behaviors, or behaviors that lack integrity and moral value, should be rewarded.

Intolerance of bad behaviors is an attitude that each of us can adopt, and it is my hope that we all make this a priority. We all must become progressively less tolerant to those business practices, tactics and strategies that dilute better culture, governance and accountability.

Thomas Day is the co-owner and vice-chairman of ShortFin Capital Management and TBA LLC. He is an engaged investor in distressed assets, and is highly interested and actively involved in digital smart-contracts that represent debt obligations. He is a leader of several business start-ups, and sits on the board of directors of two different organizations. He can be reached at Thomas.E.Day@me.com.