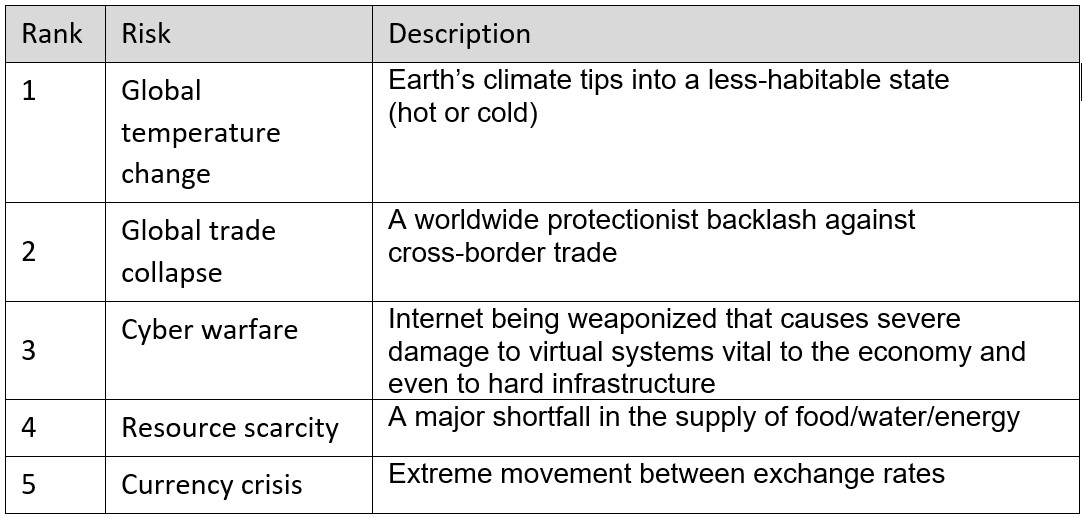

Global temperature change ranks No. 1 on a list of 15 extreme risks compiled by the Thinking Ahead Institute (TAI).

The institute, a not-for-profit outgrowth of Willis Towers Watson Investments' Thinking Ahead Group, which dates back to 2002, raised the climate issue two places higher than it was in a 2013 ranking of “potential events that are very unlikely to occur but could have a significant impact on economic growth and asset returns should they happen.”

Currently placing second is global trade collapse, up from fifth in 2013, followed by a new entry, cyber warfare.

Tim Hodgson, head of the Thinking Ahead Group, pointed to a general trend of “financial risks falling down the rankings and non-financial extreme risks growing in significance. Global temperature change becomes the highest-ranked risk due to our assessment of higher likelihood coupled with significant impact - in the extreme this would mean mass extinction.”

High-ranking economic and financial risks include currency crisis at No. 5, depression at No. 6, banking crisis at No. 8 and sovereign default at No. 9. Currency crisis rose three places since 2013, while each of the others dropped two places.

Deflation, Stagnation Threats Ease

The TAI top 15 includes for the first time, in addition to cyber warfare, biodiversity collapse (at No. 11) and abandonment of fiat money (14), as summarized in a September 9 news release. Deflation, insurance crisis and terrorism fell out of the top 15.

Stagnation, or a prolonged period of little or no economic growth, is down by eight places, at No. 10. Resource scarcity, referring to food, water and energy, fell to No. 4 from No. 1 six years ago.

TAI's outlook bears some similarity to that of the World Economic Forum's 2019 Global Risks report, released in January, which had as its top five in likelihood: extreme weather events, failure of climate-change mitigation and adaptation, natural disasters, data fraud or theft, and cyber attacks.

The WEF separately ranked the top risks in impact: weapons of mass destruction, failure of climate-change mitigation and adaptation, extreme weather events, water crises, and natural disasters.

Another annual macro assessment, the Control Risks RiskMap, came up with these five themes for 2019: U.S.-China trade rift foretells a new global order; the global data switchback ride; American political gridlock; extreme weather disruption; and multinationals becoming nationless.

Greenhouse Gas Effect

Regarding temperature change, TAI focused its concern on continuing increases of greenhouse gas emissions exacerbating “the risk of rising global temperature. The passage of time, with no meaningful actions taken, means we are six years closer to the point of no return,” the institute's report said.

A potential consequence: “Extreme weather of all types, and related hazards such as wildfires, will disrupt property insurance markets; rebuilding will become a more significant part of the economy.”

TAI's discussion of trade conflicts, protectionism and nationalism led to a warning that “symptoms of rising populism and narrow-minded world views are driven by a more tenacious underlying disease: rising inequality. It is unlikely to go away anytime soon.”

Virtual to Physical

In view of “the risk of the internet being weaponized . . . clear evidence points to targeted cyber attacks on the rise,” TAI said. “More than 10 billion malware attacks were blocked in 2018, the most ever recorded to date by the SonicWall.”

Cyber war fallout could extend to damage to physical infrastructure “of a scale to disrupt business and economic activity,” and to destruction of financial records “on a massive scale, essentially wrecking the financial system.”

The TAI top 15 are culled from a “long list” of 30 extreme risks that include such scenarios as alien invasion, cosmic threats, pandemic, technological singularity, and World War III.

“As investors, we are trying to navigate a highly volatile, uncertain, complex and ambiguous world,” said Thinking Ahead Group senior investment consultant Liang Yin. “The scenarios are most effective when they are used, in a deliberately created interactive environment, to make explicit - and to challenge - assumptions that underpin your investment portfolios or your business strategy.”

“While interesting in its own right,” says TAI's report, “we believe the consideration of extreme risks can be useful in helping to design more robust investment portfolios and more robust risk management processes.”

“Pre-mortems” and Hedges

“A complex world can and will deliver extreme outcomes that are hard to imagine when working with a normal distribution,” said Hodgson of Thinking Ahead Group. “That means extreme events are much more likely than previously thought. To navigate through this complex world, we suggest investors need to be open-minded, avoid concentrated risks, be sensitive to early warning signs, constantly adapt and always prepare for the worst.”

The institute recommends “pre-mortem” exercises, “trying to determine in advance what could, colloquially, kill you. We believe that being adept at pre-mortems means you are a better risk manager and can react more flexibly in the event of an extreme event happening, particularly as the event is unlikely to evolve precisely along the lines predicted.”

And there are suggested hedging strategies for institutions:

- Hold cash, which in past periods has held its value through episodes of deflation and inflation - though there is no guarantee that this will be the case in the future.

- Derivatives as a form of insurance, though this can require precise conditions to be met.

- Hold a negatively-correlated asset. “There is no single asset that will work against all possible bad outcomes,” the report states. “Further, there is no guarantee that the expected performance of the hedge asset will actually transpire in the future event.”

Topics: Enterprise