The U.S. Treasury Department's Office of Financial Research (OFR) has introduced Bank Systemic Risk Monitor (BSRM), an interactive tool for monitoring key banking industry metrics in an accessible, graphical format.

The OFR, which was created by the Dodd-Frank Act of 2010 to support the Financial Stability Oversight Council's systemic risk assessments, displays BSRM on its home page alongside longer-standing tools such as the Financial Stress Index and Financial System Vulnerabilities Monitor.

“The BSRM is a collection of key risk measures for monitoring the largest banks and their interconnections,” the OFR said in a bare-bones announcement on February 18, without additional comment or analysis. “It allows users to easily assess a bank's systemic risk capital surcharge (if any), total assets, leverage, and reliance on short-term wholesale funding.”

The systemic monitor supersedes and expands upon a G-SIB Scores Interactive Chart that was based on the Basel Committee on Banking Supervision's indicators for identifying global systemically important banks.

In December, in its Annual Report to Congress, OFR said, “We intend for the tools to show emerging trends in the financial system and to further the OFR as a leader in financial stability monitoring and analysis . . . We plan to create more tools that complement existing ones and leverage other agencies' expertise.”

Basel Scores, Contagion, and Funding

The BSRM makes accessible data points that figure in policy discussions and academic research on systemic risk and financial stability, particularly in terms of anticipating or preventing severe crises like that of 2008-'09.

The monitor's “Basel Scores” rank international G-SIBs by averaging five categories of the Basel Committee's assessment methodology: size, interconnectedness, substitutability, complexity, and cross-jurisdictional activity - with JPMorgan Chase & Co. and HSBC in the top two positions for 2019. Also shown are capital surcharges applicable to U.S. G-SIBs.

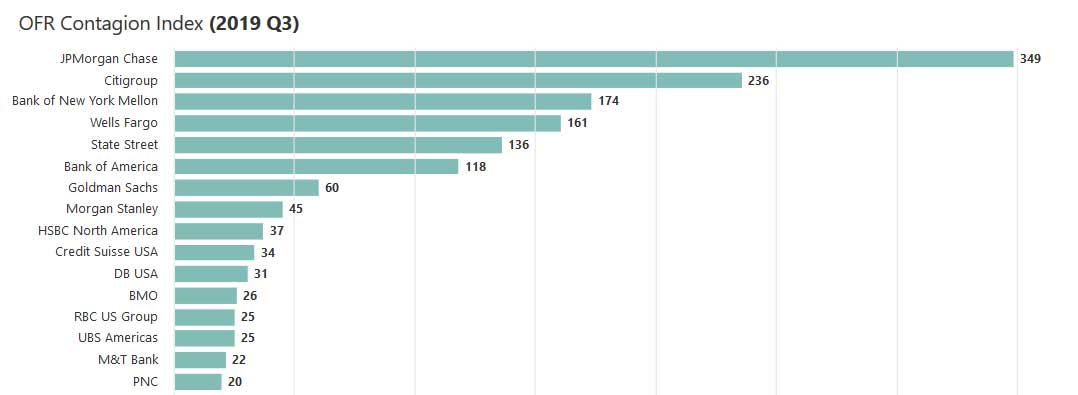

The OFR Contagion Index, a function of connectivity, net worth and outside leverage, “measures the loss that could spill over to the rest of the financial system if a given bank were to default,” as explained in the BSRM. JPMorgan Chase had a high score of 349 as of the 2019 third quarter, followed by Citigroup at 236.

In the section on short-term wholesale funding, one set of data shows short-term funding dependence, or banks' short-term wholesale funding amounts as a percentage of total liabilities. U.S. units of Barclays, Credit Suisse and Deutsche Bank occupy the top three spots.

The OFR has had a longstanding interest in the repo market and in February adopted a final data collection rule that it said “will enhance the ability of the Financial Stability Oversight Council to identify and monitor potential risks to U.S. financial stability by closing the data gap related to centrally cleared repo transactions.”

A rate spike and volatility last September led to extended Federal Reserve repo operations and sparked high-level conversations about interactions among monetary policy, regulatory and reserve requirements, and overall banking conditions, as Fed vice chair for supervision Randal Quarles noted in a February 6 speech.

“Sensible Indicators”

The measures in the OFR tool “help us to assess the level and change in systemic risk,” as it pertains to the global banking system, notes Stephen Cecchetti, Rosen Family Chair in International Finance, Brandeis International Business School.

Chester Spatt, Pamela R. and Kenneth B. Dunn Professor of Finance and director of the Center for Financial Markets at Carnegie Mellon University's Tepper School of Business, says the OFR is presenting “very sensible indicators of systemic risk,” though he would prefer that they also include capital-market-based measures of global banks' vulnerability to shocks, especially relatively large shocks.

Spatt, a member of the Systemic Risk Council and a former Securities and Exchange Commission chief economist, points out that the BSRM does not incorporate data related to other sources of risk to the domestic and global economy - as illustrated by the coronavirus or the prevalence of record low interest rates. “These factors and risks are system-wide and could pose systemic consequences,” he says, and thus would be helpful if factored in.

David Fanger, senior vice president, financial institutions group at Moody's Investors Service, says that some of the OFR data is not as up-to-date as he would like to see for analysis purposes, and thus is limited in its ability to anticipate a sudden or unexpected rise of systemic risks. However, he notes that the monitor does offer “great graphics” that make it easy to digest and utilize the extensive bank data.

Cecchetti of Brandeis welcomes the OFR monitor, as “it collects in one place publicly available information on U.S. banks that is difficult for most people to gather on their own.” He sees it as a complement to work of the NYU Stern V-Lab (SRISK) and the Federal Reserve Bank of Kansas City's Bank Capital Analysis.

“The type of information the OFR tool provides helps us to publicly monitor system resilience, especially in the face of recent moves in the United States to weaken capital regulations,” Cecchetti says. He notes that the office was mandated as an independent agency to collect data, perform research, develop and publish risk measurement tools, and collaborate with the Financial Stability Oversight Council, and “creating and publishing a systemic risk monitor is an important part of this work.”

A limitation, Cecchetti says, is that the OFR tool focuses solely on banks, and banking accounts for less than a third of financial intermediation in the U.S. A comprehensive view of systemic risk would require equivalent information on mutual funds, insurance companies, pension funds, private equity, asset managers and the like, and include mechanisms to monitor systemic market instruments like repo and securities lending.

Katherine Heires is a freelance business journalist and founder of MediaKat llc.