While economists and market pundits remain divided on whether a recession is coming or not, it is worth investigating how policymakers would react if it were it to happen. In the past, a combination of fiscal and monetary expansion has worked well in overcoming recessionary forces.

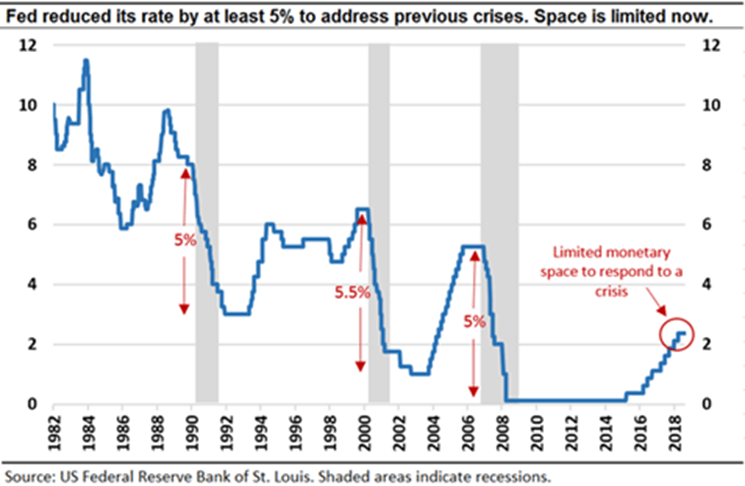

Illustratively, a fiscal stimulus of $800 billion and a reduction in the U.S. federal funds rate by 5 percentage points (to near-zero) managed to subdue recessionary pressures after the 2008 crisis. However, the space for such policy action is relatively limited this time around.

Capacity for a fiscal stimulus is currently constrained by high U.S. fiscal debt levels (105% of GDP as compared to 62% in 2007), while that of monetary expansion is restricted by low interest rate levels. The upper range of the federal funds rate target is at 2.5%, the lowest level as compared to previous pre-recession periods (see chart, below). In recent recessions, the Fed reduced this policy rate by at least 5 percentage points - but, at current levels, such a decrease would push rates to below zero.

The Federal Funds Rate: No Longer a Recession Mitigator

Ominous Yield Curve?

In July 2005, Alan Greenspan, the Federal Reserve chairman, confidentially told 25 members of a U.S. Senate committee that there was no need to worry that the yield curve had flattened and was close to inverting. He argued that the curve had lost its ability to predict recessions.

Eight months later, Ben Bernanke, the newly appointed Fed chairman, reiterated the same view to members of the Economic Club of New York, reasoning that interest rates in nominal and real terms were too low for the economy to slow down. Two years later, Lehman Brothers collapsed, and the world entered its worst economic crisis since the Great Depression of 1929.

On March 22 of this year, the U.S. yield curve inverted for the first time since 2007. On May 29, the 10-year yield closed 12bps lower than that of the 3-month. With a near perfect record of predicting past recessions, the yield-curve inversion stoked fears that a U.S. recession could strike soon.

Given the interconnected nature of the world economy, it is fair to assume that a U.S. recession (like the last one) would spread to other countries through direct and indirect transmission channels, dampening their growth prospects. Collectively, the recent slowdown in Europe, U.S.-China trade tensions and the Brexit mayhem have made the global environment more fragile.

Moreover, the IMF's downward revision of its 2019 global growth forecast, from 3.5% to 3.3%, highlights the possibility that the BRICS economies - the main engine of global growth over the past decade - might not be able to compensate sufficiently for the deficit.

Past Remedies Not a Cure for Current Maladies

As policymakers contemplate how to use the tools at their disposal to fight the next crisis, it is increasingly important that they consider the repercussions of employing traditional fiscal and monetary expansion. While the combination of these two measures achieved their main objective of generating growth after the 2008 crisis, they also led to heightened fragility in three key areas:

First, historically low interest rates (over an extended period) encouraged companies around the world to take on cheap debt, while governments were forced to issue debt to recapitalize banks and stimulate industries. As a result, global debt-to-GDP rose from 202% to 234% over the past decade. The growth in debt has been particularly large in emerging countries, where debt-to-GDP has increased sharply from 107% to 180% over the same period. Indeed, China's debt-to-GDP alone jumped from 145% in 2007 to 253% in 2018.

Second, low interest rates fueled a rise in risky investments. In their search for higher returns, investors' appetite drifted to the far end of the risk spectrum - particularly in leveraged loans and high-yield corporate debt. Both asset classes involve lending money to borrowers rated BB+ and below, which are typically categorized as junk. The value of outstanding leveraged loans doubled over the last decade to $1.2 trillion, while the value of outstanding high-yield bonds grew from $689 billion in 2008 to a peak of $1.4 trillion in 2015.

Third, the uneven pace of recovery and divergence of monetary policies in U.S., EU and Japan has caused sporadic bouts of volatility in global stock markets and emerging countries' currencies. Indeed, foreign portfolio investors have rebalanced their portfolios at the smallest sign of monetary policy normalization, triggering capital flight and disrupting markets.

With higher debt levels, riskier investments and frequent volatility, the world economy has become increasingly vulnerable to shocks. In the event of a slowdown, it is highly likely that the period of easy money could be extended. Fiscal stimulus packages and ultra-low (or negative) interest rates could further increase market-wide leverage and speculation, exposing the three fragilities described above. A shock in any of these areas could have a contagion effect - leading, eventually, to a global crisis.

New Ideas: Governments, the Private Sector and Development Banks

It is ironical that the same policy actions that helped the world recover from the 2008 crisis have also inadvertently created the fragilities that could trigger the next one. Given the limited potential of traditional macroprudential tools, solving the next crisis may require a new economic thinking.

For instance, using innovative instruments that incentivize investments in the midst of a recession, the burden of reviving growth could be shared between governments, the private sector and development organizations. Governments could launch new PPP infrastructure projects, provide the initial equity investment and complement it with credit enhancements for the remaining portion.

By providing the seed capital and by enhancing the credit quality of infrastructure projects, governments could mobilize additional capital from the private sector. What's more, the countercyclical mandate of national and multilateral development banks could be leveraged to target investments into specific sectors that are worst hit by the recession.

Governments could also use their foreign exchange reserves as guarantees to promote private sector infrastructure and other growth-generating investments - the top 10 countries with the most reserves have over $8 trillion in reserves.

Even if we choose to ignore the recent yield-curve inversion, policymakers should accept the limitations of their current policy tools and identify new ways to fight the next crisis. For one thing is clearer than ever before: crises are inevitable. Delaying the inevitable might just make the fall far worse.

Sidharth Kamani (FRM) and Julien Demeulemeester both work at the New Development Bank in Shanghai. Kamani is a financial risk professional; Demeulemeester is an economic researcher.

The opinions expressed in this article are the authors' alone and do not necessarily reflect the views of their employer.