For the first time in the 15 years of the World Economic Forum's Global Risks Report surveys, the five highest-ranking risks in likelihood over a 10-year horizon are environmental: extreme weather, climate action failure, natural disaster, biodiversity loss and human-made natural disasters.

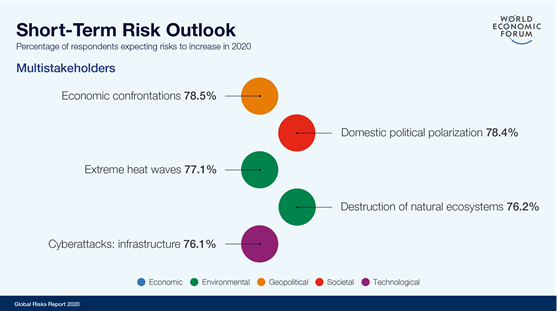

The short-term outlook, however, is clouded by economic concerns, including stagnation, trade conflicts and debt. Economic confrontations and domestic political polarization top the ranking of risks expected to increase this year.

As WEF president BØrge Brende writes in a preface to the 2020 risks report, “The global economy is faced with a 'synchronized slowdown,' the past five years have been the warmest on record, and cyberattacks are expected to increase this year, all while citizens protest the political and economic conditions in their countries and voice concerns about systems that exacerbate inequality.”

Brende also warns of the possibility of “an extended low-growth period, akin to the 1970s,” with insufficient policy ammunition to reverse such conditions. “Unless stakeholders adopt multilateral mechanisms for this turbulent period, the risks that were once on the horizon will continue to arrive,” he says.

And as summed up in a section of the report titled The Fraying Fundamentals: Risks to Economic Stability and Social Cohesion:

“The global economy is at risk of stagnation. Rising trade barriers, lower investment and high debt are straining economies around the world. The margins for monetary and fiscal stimuli are narrower than before the 2008-2009 financial crisis, creating uncertainty about how well countercyclical policies will work. This uncertainty is exacerbated by a tense geo-economic and geopolitical landscape, as well as by domestic challenges.”

Infectious diseases - currently in the headlines because of the coronavirus - ranked 10th in impact as a long-term risk at the time WEF's multistakeholder survey was conducted. According to the executive summary, healthcare systems are “under stress” in many countries, and progress against pandemics is “being undermined by vaccine hesitancy and drug resistance, making it increasingly difficult to land the final blow against some of humanity's biggest killers.”

CEO Unease

The anxieties in WEF's Global Risks Perception Survey, based on responses from some 800 members of forum communities, mirror those of the PwC 23rd Annual Global CEO Survey, released on January 20 as the forum's Davos, Switzerland meeting was getting underway. With nearly 1,600 respondents in 83 countries, a record-high 53% predicted a decline in the rate of economic growth in 2020, compared to 22% expecting improvement. Those voting negative were 29% in 2019 and only 5% in 2018.

The pessimism is more pronounced in North America, where 63% predicted a decline and 10% an improvement.

“Given the lingering uncertainty over trade tensions, geopolitical issues and the lack of agreement on how to deal with climate change, the drop in confidence in economic growth is not surprising,” Bob Moritz, chairman of the PwC Network, said in a prepared statement. He added that because “the scale of [the economic challenges] and the speed at which some of them are escalating is new, the key issue for leaders gathering in Davos is: How are we going to come together to tackle them?”

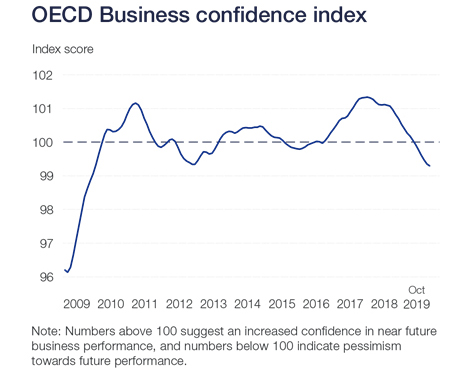

An Organization for Economic Co-operation and Development (OECD) Business Confidence Index cited by the WEF had fallen for 14 consecutive months through the end of 2019.

Public Mistrust

In another report coinciding with the Davos gathering, the 20th annual Edelman Trust Barometer, CEO Richard Edelman of Edelman Intelligence notes that public trust in business, government and other societal institutions has eroded despite positive economic indicators and long-term gains in income and employment.

“In past years,” Edelman writes, “good economic conditions have presaged rising levels of trust, and this link still applies in developing markets in Asia and the Middle East. But in the developed world, major violations of the social contract - corporate malfeasance, government corruption, fake news - have upended this relationship. In developed markets, trust has become uncoupled from GDP growth because people feel they are not getting their fair share of growing prosperity. National income inequality is now the more important factor in institutional trust.”

The WEF report says that the sobering “fundamentals” will only be exacerbated by growing social unrest and financial inequality around the world, along with concerning factors such as geopolitical uncertainty, digital fragmentation and continued environmental degradation.

It also points to perceptions that economic systems are rigged or unfair and to how income inequality has risen in many countries - particularly in advanced economies - and has reached historic highs in certain locations. Violent protests in Hong Kong, Chile, Lebanon and Iraq are viewed as related, in part, to the stresses of inequality.

In addition to the 800 risks perception survey participants, WEF's 2020 report incorporates input from the 200 members of its Global Shapers Community, described as representing “a generation of emerging, global social entrepreneurs and leaders,” and including many Millennials.

WEF's strategic partners are Marsh & McLennan and Zurich Insurance Group; academic advisers are the National University of Singapore; Oxford Martin School, University of Oxford; and Wharton Risk Management and Decision Processes Center, University of Pennsylvania.

The Global Risks Report serves as a tool to “set the 2020 context for our clients,” as they assess the relevance and potential impact of risks over short, medium and longer terms, says Michael Poulos, president of Marsh Risk Consulting. The findings are a useful “page setter for strategic conversations” to help consulting and insurance clients identify what to hedge against and what will potentially create opportunities for their businesses.

Growth and Conflict

The economic backdrop is one of sluggish growth. The International Monetary Fund downgraded its global GDP projection late last year, from 3.7% to 3.4%, and Japan was the only one of the world's seven biggest economies not decelerating. (In a January update, IMF said: “Global growth is projected to rise from an estimated 2.9% in 2019 to 3.3% in 2020 and 3.4% for 2021 - a downward revision of 0.1 percentage point for 2019 and 2020 and 0.2 for 2021 compared to those in the October World Economic Outlook.”)

Regarding trade tensions, the WEF says restrictions are at historic highs and could slow global growth by 0.8 percentage points in 2020, particularly if the U.S. and China uphold existing tariffs or impose new ones.

Obstacles to foreign direct investment (FDI) are on the rise. These include lower expected returns, uncertainty about economic policy in major economies, and ongoing and emerging geopolitical tensions. As a result, FDI remains lower than it was before the 2008-2009 crisis and has declined the last three years.

A superpower economic confrontation - at least philosophically - was on display at Davos between European Central Bank president Christine Lagarde and U.S. Treasury Secretary Steven Mnuchin. Lagarde advocated for green technology investments, while Mnuchin argued that such strategies were unworkable and that access to cheap energy was more important, the Financial Times reported. Lagarde called for taxes and regulation to push companies in the direction of anticipating a low-carbon future. Mnuchin insisted that “there's no way we can possibly model what these [climate] risks are over the next 30 years with a level of certainty.”

Private and Public Debt

The WEF sees rising corporate debt as a key vulnerability in the global financial system, while across G-20 economies, public debt is expected to reach 90% of GDP in 2019 - the highest on record - and rise to 95% in 2024.

“Financial market stress and strained public finances are creating uncertainty as to whether conventional monetary and fiscal policy instruments, which have worked to boost growth in the past, could be as effective in the future,” the report says.

The forum observes that while interest rate cuts made by central banks have helped boost growth, they have also fostered higher debt and riskier rent-seeking, which affect financial market stability. It also sees the role and reach of monetary policies challenged by factors such as technological change, climate change and rising inequality.

Higher debt along with economic stagnation helps to explain why “fiscal crises” are the top-rated risk for businesses globally over the next 10 years, according to a WEF executive opinion survey. Weak public finances have two worrying implications: They jeopardize the leverage that governments have to address a recession; and they could aggravate already troubling social tensions.

Compounding the economic fragility are trends such as the intensity of climate change and its economic costs - in 2018, there was $165 billion in worldwide economic stress and damage from natural disasters; sizable populations still without internet access; the lack of a global, technological governance framework and related expansion of cyber insecurity; and the rise of geopolitical uncertainty and conflict as many stakeholders shift from cooperative goals to competitive positions.

WEF president Brende concludes, “There is still scope for stakeholders to address these risks, but the window of opportunity is closing. Coordinated multi-stakeholder action is needed quickly to mitigate against worst outcomes and build resiliency across communities and businesses.”

Katherine Heires is a freelance business journalist and founder of MediaKat llc