For risk modelers at lending institutions, climate change represents an enormous challenge. Until now, stress testing has focused on acute short- and medium-term recession risk and has avoided questions of long-term strategic risk management. Climate change is a slow-moving train wreck that has been happening, very gradually, across the span of most bank databases.

The evolution of climate risk management has been driven, in part, by recent regulatory actions. In June 2017, the Task Force on Climate-related Financial Disclosures published its final report, recommending that companies report the possible impact of climate change in their financial filings. In recent months, especially in Europe, those recommendations have started to be implemented.

Moreover, this April, the Prudential Regulatory Authority released new guidance for UK banks and insurance companies, and we've seen evidence that other European regulators are asking big banks to prepare for questions on the impact of a warming planet.

Designing a data-oriented response to this challenge, as opposed to the alchemy of management overlay, will require a considerable amount of lateral thinking by quants. An obvious first step in this process is to develop macroeconomic scenarios that encapsulate the impact of climate on economic activity. Here the story is mainly about migration, of both people and capital, and transition costs as economies adapt to the new normal.

If worst-case temperature paths occur in coming decades, economic activity will move from coastal areas inland - from places that are currently hot to colder locales, from islands to continents, from low lying areas to the highlands and from south to north. While areas like Siberia and Northern Canada will become more hospitable with a warmer planet, locations like the Maldives, Singapore and even India will become far less so.

These shifts will cause the long-term growth path to bend slightly higher for economies such as Canada's and slightly lower for those like Singapore's. Given the duration of risk exposure for banks making loans in these locations, though, it is difficult to imagine these altered growth paths having much of an impact on aggregate credit risk. At the national level, the changes due to climate will be glacial relative to the sharp stresses normally considered in the stress testing community.

Extreme Weather: Economic Effects

Things get a bit more interesting when we dig deeper into more granular economic data.

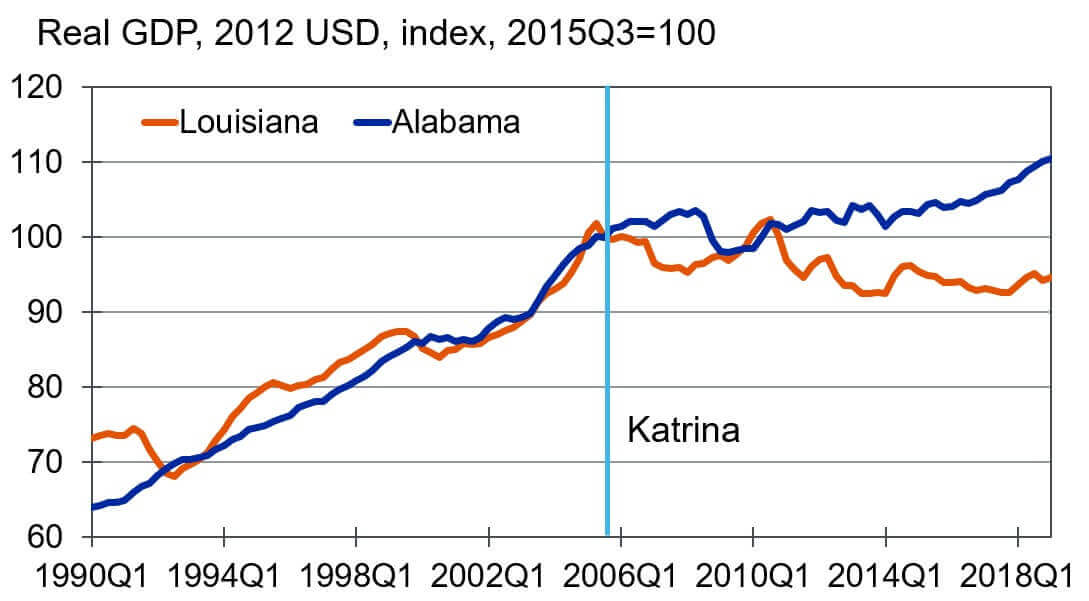

Climate change will cause an increase in extreme weather, so exploring the impact of past events that were known to cause economic dislocation may prove instructive. Chart 1 shows the real gross state product for Louisiana and Alabama, indexed to 100 in 2005 (Q3), the date of the disastrous Hurricane Katrina.

Chart 1: Regional Impact of Hurricane Katrina

While the two states shared a similar growth trend prior to the hurricane, a sizeable wedge has opened between them in the years since. In comparing these two southern states of roughly equal population, Louisiana has the longer coastline, with Alabama largely shielded from Gulf hurricanes by the Florida panhandle. New Orleans, the city most affected by Katrina, has a significantly larger population than Mobile, the only coastal city in Alabama, with more activity taking place in larger inland cities like Birmingham and Montgomery.

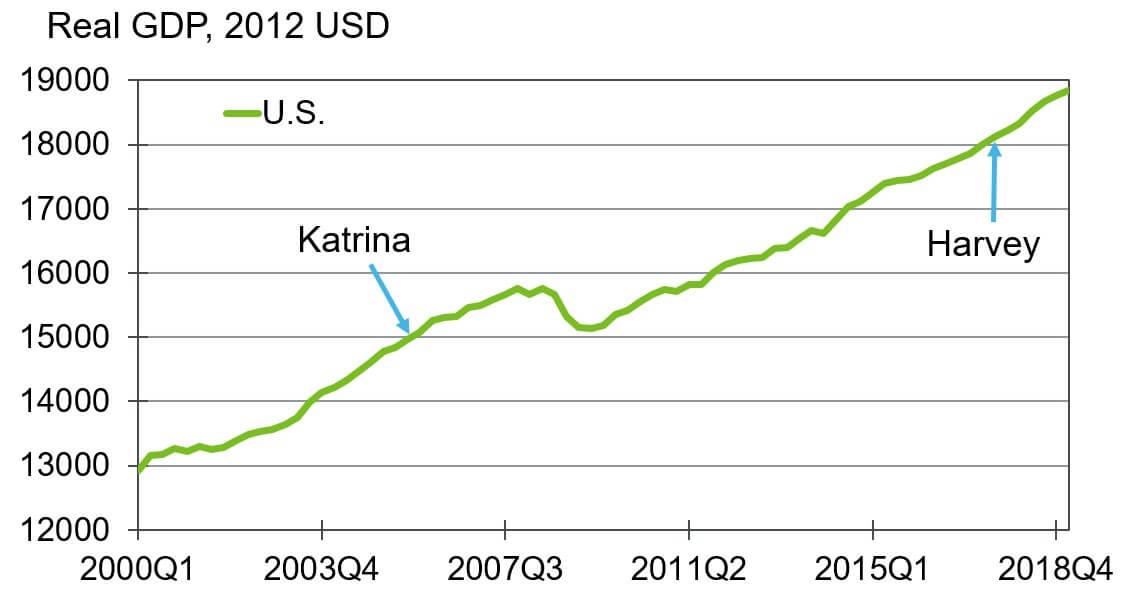

In the U.S. GDP data, you find no evidence of any economic impact from Katrina. It seems that the devastating hurricane caused activity to migrate away from the Delta - Louisiana suffered, but the rest of the country grew slightly faster to compensate. From a stress testing perspective, this means that detailed regional-level economic scenarios are necessary if the impact of climate change is to be correctly rendered.

Chart 2: The Effects of Natural Disasters on GDP

The other critical point is that The Big Easy is and was far more dependent on tourism than anywhere in Alabama. Businesses that are location dependent, like hotels and cement plants, will be especially harmed by an increased risk from natural disasters. Entities that can easily move away from affected areas, like online retailers, will simply do so, and their solvency will be largely unaffected by the changed circumstances.

The Importance of Data Gathering

This line of thinking introduces a new set of drivers into classic probability of default models for commercial loans. If a bank has an outstanding loan with a business located in a climate-sensitive area, they will need to assess the ability of the business to move its operations, when it becomes necessary, to higher ground. That said, I looked at commercial loan default rates for banks based in New Orleans and found that Katrina had precisely zero impact, even on short-term portfolio dynamics.

However, while the relationship between climate change and credit risk is difficult to isolate among a multitude of other factors, banks should aim to gather as much data as possible about the climate risks present in regions and industries in which they operate. As evidence of climate change builds and threats materialize, this data will be invaluable in creating a framework for making future credit decisions.

Tony Hughes is a managing director of economic research and credit analytics at Moody's Analytics. His work over the past 15 years has spanned the world of financial risk modeling, from corporate and retail exposures to deposits and revenues. He has also engaged in forecasting of asset prices and general macroeconomic analysis.