An often-repeated refrain on the topic of boardroom diversity is that it requires a trade-off: sacrificing quality to satisfy quotas.

It doesn't have to be - and shouldn't be - that way.

Take, for example, James Lam, recently named board chair of $1.3 billion, employee-owned waste management company Recology. A veteran risk professional, Lam joined the board in April as the San Francisco-based firm was facing, among other risk and governance issues, a Department of Justice investigation into public corruption allegations against former employees.

Lam immediately set about rebuilding the board and encountered the kind of problem most companies would love to have when recruiting independent directors: plenty of qualified candidates, including those from diverse backgrounds.

The search, by word-of-mouth and working his own wide-ranging board director network, took about six weeks, said Lam, who is president of James Lam & Associates, chaired the board risk committee of E*TRADE before it was acquired by Morgan Stanley last year, and was chief risk officer for GE Capital Markets Services and Fidelity Investments in the 1990s.

Lam revealed he identified and reached out to 10 “strong” candidates for three open seats, mainly focused on skill sets but with “diversity as an attribute.” Eight had diverse backgrounds in terms of gender, race, ethnicity and sexual orientation, offering “a diversity of views, life experiences, skills and perspectives.” Two women, both from underrepresented groups, were among the three selected to fill out the seven-member board.

“I wasn't looking for diversity as my primary driver, but rather at what the company needs now and into the future,” Lam explained.

What he found: “There's no shortage” of “highly qualified” candidates, including those representing a diversity of backgrounds and who are “board-ready today.”

Historically Male

The boardroom is one of the last male-dominated corporate bastions, but a recent spate of diversity directives has thrust this aspect of board recruitment into the open.

The old boys are being outed, so to speak, and being held more accountable in the name of representation and stakeholder management. Forget about tokenism. Transparency surrounding board selection and composition has become top-of-mind in a world where environmental, social and governance (ESG) issues are in the spotlight.

“Breaking up the old boys' network is a good thing,” heralded Robert Iommazzo, co-founder, managing partner and head of the global Finance & Risk practice of executive search firm SEBA International.

“The focus on adding more diversity to boardrooms has significantly changed board searches, putting the onus on companies to think out of the box about whom they recruit, what they recruit for, and how they support new board members,” Russell Reynolds Associates' Jenna Fisher was quoted as saying in a May 28 Wall Street Journal article. Fisher leads the firm's Corporate Officers Sector and has hundreds of chief financial officer and board searches under her belt.

Legal and Market Pressure

It's no wonder boardroom diversity is a cause du jour. Companies are under pressure on multiple fronts.

In 2018, California became the first state to enact legal board diversity requirements. A May 2020 Harvard Law School Forum on Corporate Governance article listed 11 other states, among them Colorado, Washington, Massachusetts, Illinois and New York, that had enacted or were considering board diversity legislation or resolutions. A bill in Oregon was introduced early this year.

The measures run the gamut from requiring representation by gender or nonbinary identity as well as from underrepresented groups (think race, ethnicity and sexual orientation), to demanding board demographic disclosures and reporting.

Research cited by BoardReady in December 2020 said that since the first of two California diversity laws went into effect in 2018, requiring representation of women, “the percentage of public companies with all-male boards in California has dropped from 30% to 3%,” and “there was a 66.5% increase in the number of board seats held by women.”

Investment management and shareholder advisory firms are increasingly backing diversity initiatives as a prerequisite for doing certain kinds of business or in proxy voting related to nominating and governance committees. Among them: Goldman Sachs, BlackRock, State Street Global Advisors, Fidelity Investments, Vanguard and Institutional Shareholder Services.

Additionally, in August, a Nasdaq proposal setting criteria to be met for public listing was approved by the Securities and Exchange Commission, with agency chair Gary Gensler stating, “These rules reflect calls from investors for greater transparency about the people who lead public companies, and a broad cross-section of commenters supported the proposed board diversity disclosure rule.”

Momentum to Continue

Mark McCareins, a Northwestern University Kellogg School of Management business law professor, “predicts that scrutiny over board diversity from a range of stakeholders will only increase over time,” according to a June KelloggInsight article.

“Because there's such a patchwork of inconsistent state statutes - and because many of these statutes are looking at different kinds of diversity - it's very hard, from a compliance standpoint, to figure out a one-size-fits-all answer,” McCareins noted.

“Not all of these new legal requirements come with teeth,” he commented. And for companies, something as straightforward as bylaws “could stand in their way” of complying.

“Right Thing to Do”

Dealing with diversity, equity and inclusion, known as DEI, is not just about compliance. It is “both a good thing to do and the right thing to do,” asserted Matthew Feldman, retired chief executive officer and past chief risk officer of the Federal Home Loan Bank of Chicago, who is one of the new Recology directors.

“But it's also risk management,” he added.

“A good, strategic risk officer helps the organization understand the implications of demographic trends,” he elaborated. “It's a very significant dimension that needs to be thought of, and not just thought of as programs or initiatives, but as highly strategic.”

“From a board governance perspective, diversity is the ultimate risk management strategy,” Lam maintained. “One of the key principles of risk management is that any concentration is a risk.”

When it comes to board governance and oversight, “You want to be able to eliminate blind spots, challenge management and see the forest for the trees,” he recommended. “If you have a homogeneous board, it's harder to do.”

Talent Pipeline

Russell Reynolds' Fisher told the Wall Street Journal that companies need to broaden their search boundaries, given “the relatively smaller number of diversity candidates that hold the C-level titles that have historically been recruited in board searches.”

“Not only do those highly sought-after candidates receive several board recruitment inquiries every week, but many already sit on multiple boards and aren't interested in joining more,” Fisher noted. “Given the skills-based nature of board searches, companies adding diversity as a key consideration are seeking well qualified talent in other roles beyond those traditionally seen on a board.”

As a sign of the times, Harvard Business School is offering a new, four-month executive education course, Accelerating Board Diversity, advertised as helping to prepare senior executives from underrepresented minorities for board service.

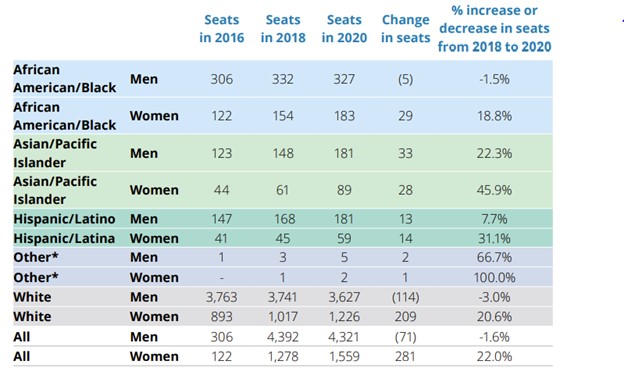

The sixth edition Board Diversity Census from Deloitte and the Alliance for Board Diversity found that between 2018 and 2020, Fortune 500 board seats occupied by women and minorities rose from 34% to 38.3%, while those held by men fell from 77.5% to 73.5%.

Still, race and ethnicity disparities were stark as of 2020: 82.5% white, 8.7% African American/Black, 4.1% Hispanic/Latino(a), 4.6% Asian/Pacific Islander, and 0.1% other.

Companies clearly have their work cut out for them and risk facing reputational and other consequences if they don't do better.

“From a pragmatic perspective,” Iommazzo pointed out, “demographics have shifted, and corporations don't want to alienate a customer base. They want to make sure the organization is representative of the communities they serve, at a minimum.”

Measuring Results

There are, indeed, indications that board diversity is good for business and the bottom line.

Carlyle Group offered this on its website: “Over the past three full years, the average earnings growth of [its] portfolio companies with two or more diverse board members has been nearly 12% per year greater than the average of companies that lack diversity,” with “each diverse board member associated with a 5% increase in annualized earnings growth.”

“If you have a highly diverse and well-skilled board, it's the best of both worlds,” claimed Clifford Rossi, principal of Chesapeake Risk Advisors; professor-of-the-practice and executive-in-residence at the University of Maryland's Robert H. Smith School of Business; and chief risk officer for Citigroup's Consumer Lending Division during the 2008 financial crisis. But he cautioned: “You have to have the right people on board to protect shareholders.”

In an email to GARP Risk Intelligence reflecting on three days of Recology board meetings in July, Feldman wrote, “The team that James has assembled is diverse, not just in backgrounds and genders, but in experiences, thus demonstrating that with the right focus, a slate of excellent diverse candidates can rapidly be assembled, vetted, selected and on-boarded.”

Board diversity is “not a quota issue,” Lam insisted. “It's really an effective governance issue.”

L.A. Winokur is a veteran business journalist based in the San Francisco Bay Area.