Policymakers are working feverishly to bring some regulatory order to cryptocurrency markets, but it remains very much a work in progress. Approaches are being debated in legislative bodies, as well as both within and between agencies like the U.S. Commodity Futures Trading Commission and Securities and Exchange Commission. China has broadly cracked down on trading and mining. The Coinbase exchange has floated the idea of creating an entirely new regulatory framework for digital assets.

Meanwhile, largely above the political fray and within the lanes of macroeconomic and systemic risk analysis, central bankers and multilateral organizations, notably the International Monetary Fund, are homing in on crypto asset growth as a potential threat to financial stability.

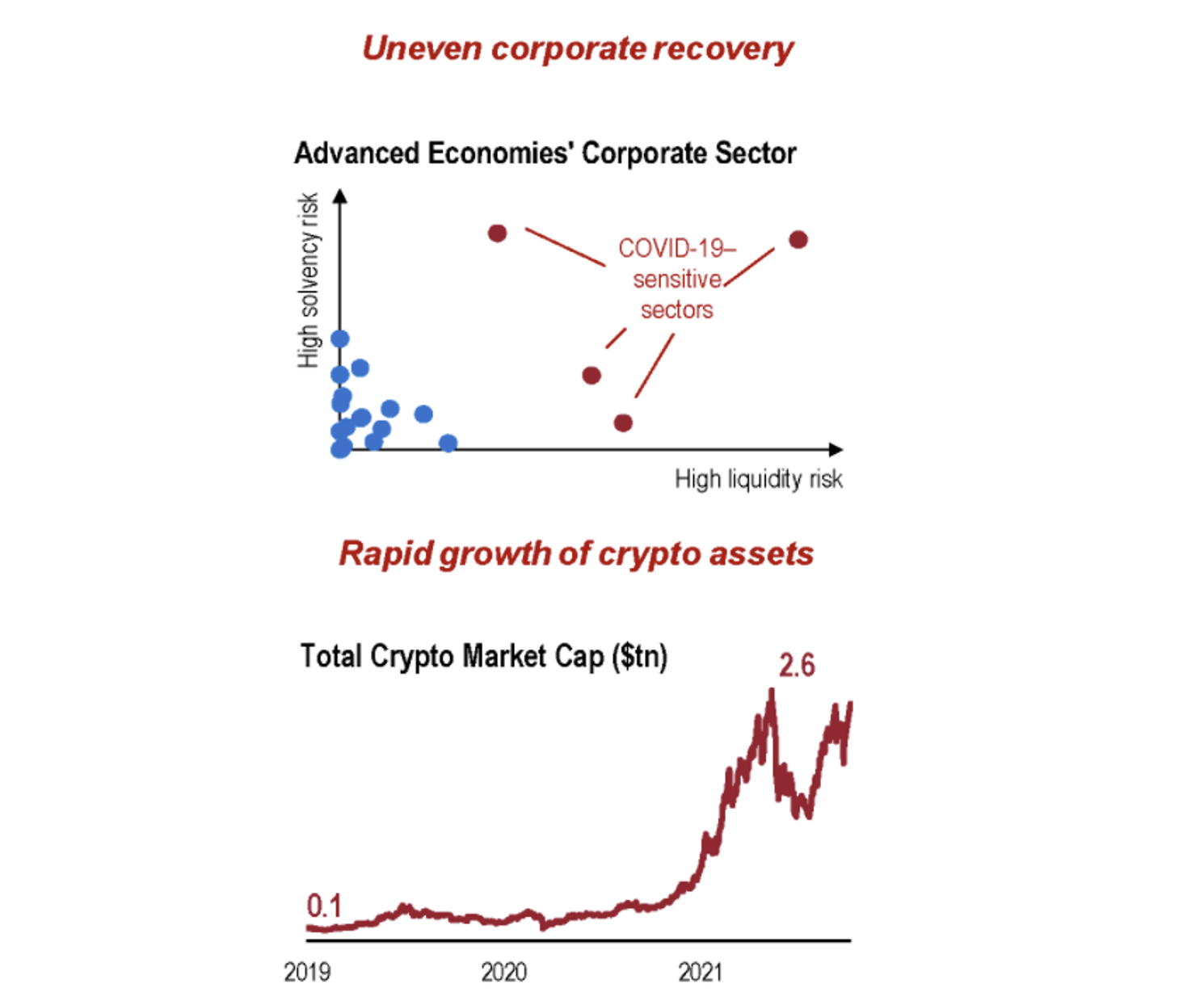

With aggregate cryptocurrency values this year surpassing $2 trillion, just a fraction of global equity and other capital market measures, regulatory certainty may not have to be an immediate necessity. But the systemic-risk scrutiny brings some pressure for action.

Despite a near tripling of that valuation this year - a 10-fold rise since early 2020 - crypto assets “currently pose limited risk” to financial stability, the Bank of England said in an October report. It added, though, that “regulation needs to develop quickly enough, both domestically and at a global level, to address the risks they could pose in the future.”

In that vein, BOE deputy governor Jon Cunliffe said, “Regulators internationally and in many jurisdictions have begun the work. It needs to be pursued as a matter of urgency.”

He described financial stability risks as currently “relatively limited, but they could grow very rapidly if, as I expect, this area continues to develop and expand at pace. How large those risks could grow will depend in no small part on the nature and on the speed of the response by regulatory and supervisory authorities.”

Stablecoins and CBDCs

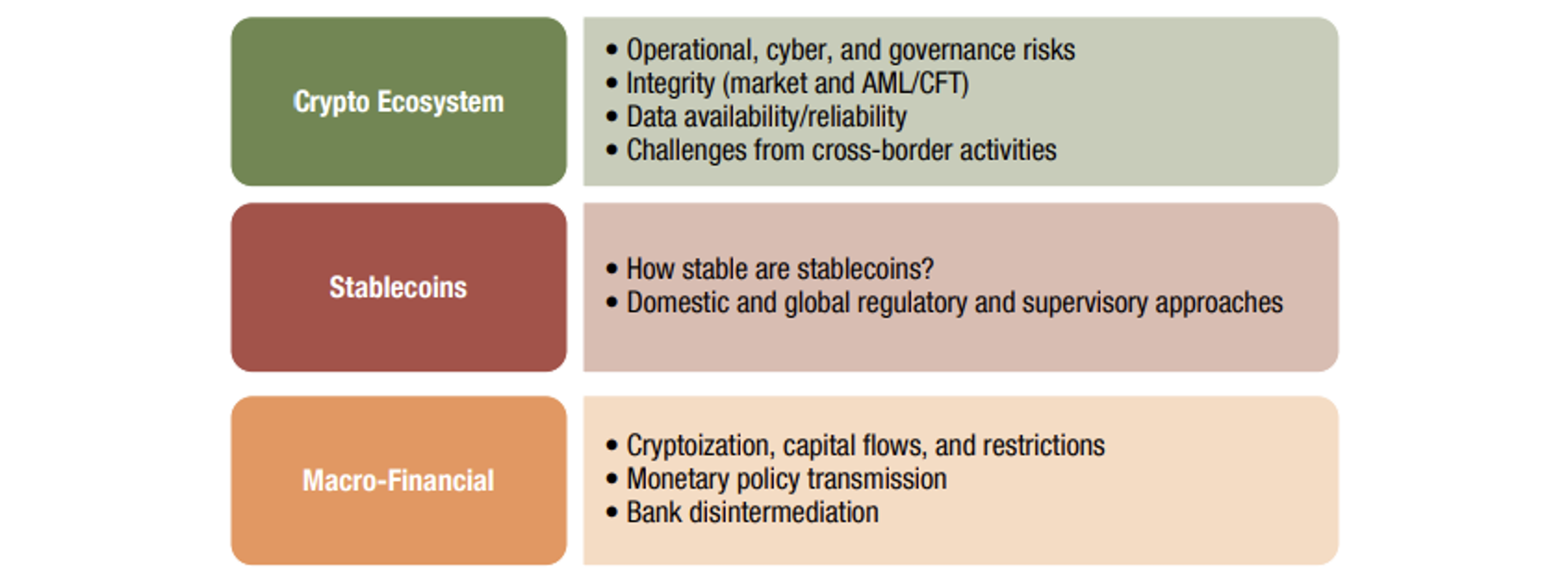

Cunliffe's remarks, in an October 13 speech to the SIBOS international banking conference, came a day after the IMF released its World Economic Outlook and Global Financial Stability Report, the latter devoting a chapter to “The Crypto Ecosystem and Financial Stability Challenges.”

Earlier in October, the IMF previewed that publication with a blog, Crypto Boom Poses New Challenges to Financial Stability, subtitled “As crypto assets take hold, regulators need to step up.”

The often dollar-pegged assets known as stablecoins were said by blog authors Dimitris Drakopoulos, Fabio Natalucci and Evan Papageorgiou to be “growing at lightning speed,” and some “could be subject to runs, with knock-on effects to the financial system.” Many exchanges and other ecosystem entities “lack strong operational, governance and risk practices,” they wrote.

The Bank for International Settlements and several of its central bank constituents published on September 30 three reports on prospects for central bank digital currencies (CBDCs), one specifically on financial stability implications such as run risks; impacts on bank deposits, funding and lending; and CBDCs amid the evolving payments landscape.

The BIS has been sharpening its own technology edge through various Innovation Hub projects, and it has encouraged dialogue about how Facebook, Google and other Big Tech companies may pose systemic risks and be subject to banking supervision and other forms of regulatory oversight. (See How to Regulate Big Tech? The BIS Has Some Ideas.) On another matter of cross-sector importance, the Financial Stability Board in an October 19 report began laying out steps toward "greater harmonization of regulatory reporting of cyber incidents" because of their threat to the financial system.

On October 6, the Committee on Payments and Market Infrastructures (CPMI) and International Organization of Securities Commissions (IOSCO) issued preliminary guidance and a call for comments on the applicability of the Principles for Financial Market Infrastructures (PFMI) to “systemically important stablecoin arrangements.” Cunliffe of the Bank of England said the consultation document “is part of an ongoing commitment by the international regulatory community to ensure the principle of 'same risk, same regulation,' to identify potential risks and to help develop appropriate oversight to safeguard financial stability.”

In an October 18 speech in Madrid, Federal Reserve governor and Financial Stability Board chair Randal K. Quarles cited an October 7 FSB report on regulation, supervision and oversight of global stablecoin arrangements. “Digital assets may not be current threats to global financial stability,” Quarles said. “Yet as we've learned from some forms of nonbank financial intermediation, those products, services and institutions that fall between the regulatory cracks one day can become systemic problems the next. The goal of our work is to guard against new risks that emerge from innovation without stifling this same innovation.”

In Washington, D.C., the Biden administration is embarking on an “aggressive effort to make sure we understand and address the whole range of risks that we see in the cryptocurrency space,” senior National Security Council official Peter Harrell told a Wall Street Journal forum. “An update on the report on stablecoins being developed by the President's Working Group on Financial Markets” was on the agenda of an October 21 executive session of the Treasury Department-led Financial Stability Oversight Council.

Crash Scenario

Jon Cunliffe raised the possibility of history repeating: “A massive collapse in crypto asset prices, similar to what we have seen in tech stocks and subprime, is certainly a plausible scenario. In such a price correction scenario, the first question that arises is the degree of interconnectedness between crypto and the conventional financial sector.”

The Bank of England deputy governor for financial stability discussed vulnerabilities across three categories: unbacked crypto assets, including bitcoin and thousands of other virtual currencies lacking underlying intrinsic value; backed crypto assets for payment, also known as stablecoins; and decentralized finance (DeFi), the disintermediated credit, savings and other services that climbed from less than $10 billion early last year to some $110 billion this September.

Pondering the effects of a massive price correction in unbacked cryptocurrencies, Cunliffe concluded that retail investor losses are currently unlikely “to be large enough to be a financial stability risk. The picture is less clear for financial institutions.” Although investment-portfolio and bank exposures are still limited, he spoke of the rapidly spreading interest in these assets, with leverage coming into play and shocks potentially being transmitted through financial-system interconnectedness.

“At sufficient scale,” Cunliffe said, “destabilizing market corrections . . . can lead a damaging and general loss of confidence in the financial system. Taking together the volatility of unbacked and largely unregulated crypto assets, their nascent but fast-growing integration into the financial sector and the appearance on the scene of leveraged players, my conclusion is that while a severe price correction would not cause financial stability problems now, all else equal, the current trajectory implies that this may not be the case for very long.”

“Foundation for Regulation”

Cunliffe said he believes the CPMI-IOSCO guidance “will provide the foundation for regulation to bring systemic stablecoins within the regulatory perimeter” and prompt some structural changes in existing programs.

Those standards “do not address all of the potential financial stability risks from stablecoins used for payments at systemic scale,” he added. “There is also the possible impact on the banking system” if deposits shift - which could also result from CBDC introductions.

“DeFi is still in its early infancy,” the central banker said, “but its rapid growth means that regulators, domestically and internationally, need to think seriously now about the risks of a broad range of financial services being effected through DeFi platforms, and how to ensure risks are managed in the DeFi world to the same standards as they are managed in traditional finance.”

“Financial Stability Headwinds”

The IMF global financial stability assessment centers on the three Cs of COVID, climate and crypto, according to Tobias Adrian, financial counsellor and director of the fund's Monetary and Capital Markets Department. In a press briefing during the IMF and World Bank annual meetings, Adrian and department deputy director Fabio Natalucci highlighted pandemic-related “financial stability headwinds,” increasing debt levels and stretched asset valuations; climate change as an existential threat, with climate finance as an essential solution; and crypto as a booming and innovative but volatile development posing policy challenges that the IMF is working with 190 countries to address.

“These are powerful technologies” that can bring about positive change in payment efficiency, financial inclusion and capital market access, Adrian said. There is no one-size-fits-all approach to regulation, he added, and he warned against countries' adopting bitcoin as a national currency because its volatility could have “macroeconomic consequences.”

Adrian mentioned, as did the report, that crypto assets' correlation with other asset classes has increased during periods of market stress, reducing their diversification rationale. “The diversification benefit,” said the report, “could also decline over time if there is continued involvement of institutional holders that are affected by common factors.”

Adrian wrote in the stability report's foreword that “the volume of crypto asset transactions has reached macro critical levels in some emerging markets, often as high as those of domestic equities. A sound regulatory framework for crypto assets, and decentralized finance markets more generally, must be a priority on the global policy agenda.

“This is particularly pressing for stablecoins, for which some business models have been subject to the risk of sudden and severe liquidity pressures. A regulatory level playing field is a key priority.”

Drilling down into the ecosystem challenges, the IMF report found, “At a global level, financial stability risks appear contained for now, but the macro-criticality of crypto assets, and in particular stablecoins, can be significantly higher for some emerging market and developing economies where adoption has progressed fast.”

Areas of risk identified as emerging, but now limited, include the rapid run-up of crypto market capitalization, loss of confidence in the assets, banking system exposure, DeFi, and “cryptoization” of payments and settlements.

Losses from operational, cyber and governance risks “have not had a significant impact on financial stability, globally or domestically,” the IMF said. “However, as crypto assets grow, the macro-criticality of such risks is likely to increase. In addition, the crypto ecosystem remains exposed to concentration risks, given its large reliance on a few entities (for example, Binance handles more than half of trading volumes, and Tether has issued more than half the supply of stablecoins)."