While signaling increased concern about leveraged lending as a corporate-credit - and potential financial-stability - risk, senior regulators have lacked a complete picture of the exposure. Researchers at the Federal Reserve Board have filled in some blanks with what is said to be the first breakdown of who invests in U.S. collateralized loan obligations, which account for about half of U.S. leveraged loans outstanding.

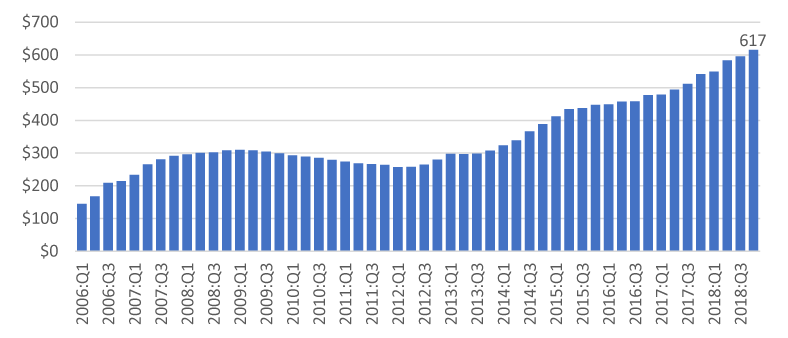

The bottom-line finding of a July 19 FEDS Notes article by Emily Liu and Tim Schmidt-Eisenlohr of the Fed's Division of International Finance: U.S. CLOs have grown dramatically in the post-crisis years, to $617 billion in the fourth quarter of 2018. Based on percentage shares from the year before, gleaned from Treasury International Capital (TIC) data, $540 billion of the total was held by U.S. investors, including $285 billion by institutional investors and $95 billion by depository institutions.

The institutional-owner breakdown was, in rounded percentages of domestic holdings of Cayman Islands-issued CLO securities: insurance companies, 24%; mutual funds, 18%; and pension funds, 11%. Depository institutions were just under 18%; other financial organizations including bank holding companies 10%; nonfinancial organizations including households 10%; and funds or other investment vehicles 9%.

“Our calculations based on the TIC data suggest that at end-2018 around $457 billion (74%) of U.S. CLO securities were issued out of the Cayman Islands, and that of these Cayman issues, $393 billion (86%) were held by U.S. investors at year-end 2018,” the economists explain. “We estimate that U.S. investors held an additional $147 billion of domestically-issued U.S. CLOs, for a total of $540 billion held by U.S. investors, or 88% of total U.S. CLOs outstanding.

“TIC data further suggest that foreigners held about $12 billion of domestically-issued U.S. CLOs, and we estimate that foreigners held $64 billion of Cayman-issued CLOs. In total, we estimate that only $76 billion (12%) of U.S. CLOs are held by foreign investors.”

Systemic or Economic Implications

The FEDS Notes analysis follows regulatory acknowledgements of concern about leveraged lending as a contributor to growing corporate indebtedness, and in turn a raising of critical voices in Congress. Leveraged loan growth has been cited in reports by the Bank for International Settlements, the U.S. Treasury's Office of Financial Research, and the U.S. regulatory agencies' Shared National Credit Program. (See The Next Time Bomb: All Eyes on Debt)

Federal Reserve Board chair Jerome Powell and vice chair for supervision Randal Quarles have said that leveraged lending is on their radar, but, when pressed, stopped short of agreeing with the likes of Democratic Senators Sherrod Brown of Ohio and Elizabeth Warren of Massachusetts that it is an imminent systemic threat.

A House Financial Services Committee memorandum for a June 4 hearing on “the systemic risk of leveraged lending” quoted Jerome Powell as saying that “the world would benefit greatly from more information on who is bearing the ultimate risk associated with CLOs.

U.S. CLOs Outstanding ($ billions)

“We know that the U.S. CLO market spans the globe, involving foreign banks and asset managers,” the Fed chief said in a May 20 speech. “But right now, we mainly know where the CLOs are not - only $90 billion of the roughly $700 billion in total CLOs are held by the largest U.S. banks. That is certainly good news for domestic banks, but in a downturn institutions anywhere could find themselves under pressure, especially those with inadequate loss-absorbing capacity or runnable short-term financing.”

Powell concluded in that address, to a Federal Reserve Bank of Atlanta conference, that “business debt does not appear to present notable risks to financial stability. The debt-to-GDP ratio has moved up at a steady pace, in line with previous expansions and neither fueled by nor fueling an asset bubble. Moreover, banks and other financial institutions have sizable loss-absorbing buffers.”

The House committee memorandum also mentioned a comment by former Fed chair Janet Yellen: “What I would worry about is if the economy encounters a downturn, we could see a good deal of corporate distress. If corporations are in distress, they fire workers and cut back on investment spending. And I think that's something that could make the next recession a deeper recession.”

More Loans 'Covenant-Lite'

In the opening of their “Who Owns U.S. CLO Securities?” note, Liu and Schmidt-Eisenlohr point out that the information they set out to compile is “essential for quantifying the full exposures of investors to the leveraged loan market, as indirect holdings through CLOs represent a growing share of the total.”

They also observe that “the percentage of so-called 'covenant-lite' loans in the leveraged loan market has grown substantially over time. Covenant-lite loans have no financial maintenance covenants, making them more like high-yield bonds.”

Particularly popular with institutional investors are AAA-rated CLO tranches, which, the authors note, have never defaulted, even during the crisis. “The sub-investment grade (mezzanine) and equity tranches are generally held by more speculative investors, such as hedge funds and the CLO managers themselves,” the paper says.

The TIC system - the researchers' principal data source along with the Securities Industry and Financial Markets Association (SIFMA) - does not capture information on foreign holdings of Cayman-issued CLOs, but “news reports suggest that Japanese banks hold as much as $60 billion in AAA-rated tranches of U.S. and European CLOs,” the Fed paper says. “While we do not know how much of these holdings are of U.S. CLOs, the TIC liabilities survey confirms that at least some domestically-issued CLO securities are indeed held by investors in Japan. Other foreign holders of domestically-issued CLO securities include investors in European financial centers.”

The European CLO market is much smaller than that of the U.S., at $99 billion as of the 2018 fourth quarter. “While demand for these securities appears to be dominated by European and Asian investors,” according to the Fed note, “the TIC data suggest that U.S. investors also hold small amounts of these securities, roughly $5 billion at year-end 2017.”