On the heels of its launch late last year of total return swaps trading, EquiLend has gone live with a collateral trading service, with workflows supporting trade negotiation, execution and management of lifecycle events such as substitutions and transaction rolls.

Rolled out following a working group effort dating back to July 2019, the new service comes at a time of increasing attention to collateral management and growing demand for technology solutions, also reflected in offerings and announcements by others in the field, both individually and in various partnership groupings.

The 2008 financial crisis and related volatility in repurchase agreement (repos) and other opaque securities-financing markets highlighted the importance of collateral and the need for transparency. Some regulatory requirements have been eased in light of the coronavirus crisis, but that will delay only temporarily the need for compliance by an increasingly broad swath of market participants.

“Collateral has become very dear to banks, and they've had to become very efficient managing it and their balance sheets,” said Audrey Blater, senior research analyst at Aite Group.

“This notion that the buy side is going to have to post and receive initial margin and think about collateral efficiency has really pushed collateral management from the back office to a pre-trade process,” Blater added.

Growth in Initial Margin

Uncleared margin rules (UMR) from the Basel Committee on Banking Supervision (BCBS) and International Organization of Securities Commissions (IOSCO), which impact over-the-counter (OTC) derivatives, began to take effect in September 2016 for the first cohort of financial firms, in the so-called phase 1, with notional derivative exposures of more than $3 trillion. Each year since then, progressively smaller and more numerous groupings of financial institutions have had to comply, increasing the demand for securities used as collateral.

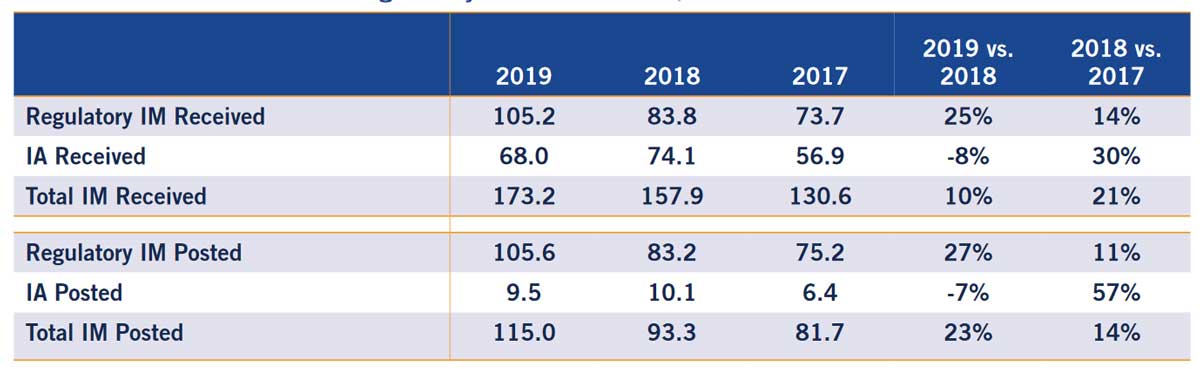

The International Swaps and Derivatives Association (ISDA) annual margin survey, released April 14, showed that the 20 largest market participants had collected $173.2 billion in initial margin (IM) at year-end 2019, up 10% from a year earlier.

Phase 1 Firms Regulatory IM and IA

(US$ billions)

The ISDA report said that $105.2 billion of the total was collected from “counterparties currently in scope of the regulatory IM requirements. A further $68 billion of IM was collected from counterparties and/or for transactions that are not in scope of the margin rules (independent amount [IA]), including legacy transactions. In addition to these amounts, phase-one firms reported that they collected $44.0 billion of IM for their inter-affiliate derivatives transactions at year-end 2019.”

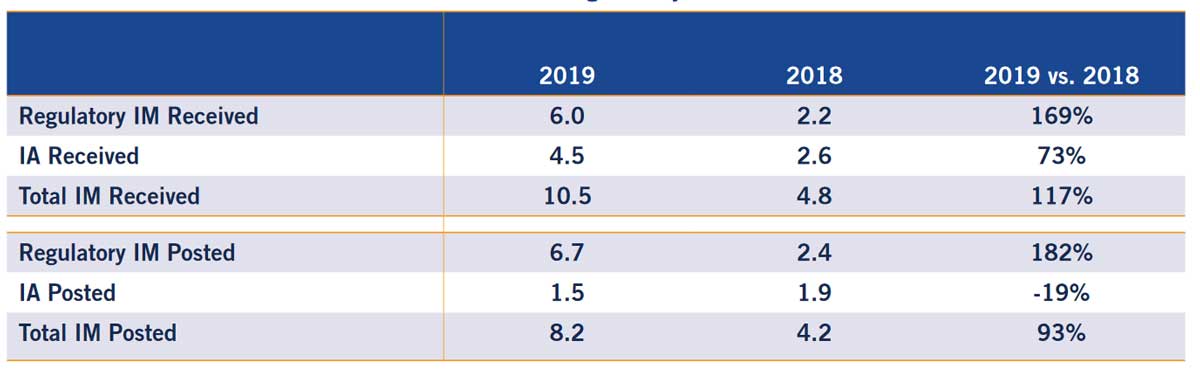

Seven smaller phase 2 and phase 3 firms surveyed by ISDA reported much smaller volumes of collected and posted IM, but those figures increased dramatically year-over-year by, respectively, 169% and 182%.

In an April 3 announcement, BCBS and IOSCO delayed implementation for phases 5 and 6. Institutions with more than $750 billion derivatives exposure were given a one-year extension, to September 2021, while those with more than $8 billion have until the following September. Those two, final phases will impact upwards of 1,200 organizations, including many pension funds and asset managers that have never had to post margin.

Europe's SFTR

Another major impetus for collateral efficiency, according to Aite's Blater, is Europe's Securities Financing Transactions Regulation (SFTR). It imposes significant securities-finance reporting obligations, including on repo and securities-lending transactions that require posting collateral.

“Because there are so many fields that have to be reported, it's driving electronification of those markets. So people are picking up the phone less and electronically trading repo and securities lending, and it's also automating the post-trade process,” Blater said.

Such transparency has brought collateral into pre-trade analysis. Blater noted that a firm may want to lend out high-quality liquid assets, or instead may consider which type of synthetic representation of financing, whether repos, total return swaps or something else, is the most efficient use of its collateral.

Phase 2 and Phase 3 Firms Regulatory IM and IA

(US$ billions)

“These are all transactions people can increasingly analyze on a dashboard to make efficient decisions about,” she said, adding that while SFTR directly impacts European financial firms, their counterparties in the U.S. and other jurisdictions typically must also comply with the reporting requirements.

SFTR is proceeding on schedule, although the European Securities and Markets Authority (ESMA) has given some relief due to the pandemic. For banks and broker-dealers that were supposed to begin reporting on April 13, ESMA requested relevant authorities “not to prioritize their supervisory actions” until July 13.

Following the original schedule, trade repositories must register by July 13, so that central counterparty clearing houses (CCPs) and central securities depositories (CSDs) can begin reporting. Buy-side firms must begin reporting October 13, and nonfinancial counterparties three months after that.

A Bid to Transform

EquiLend is continuing its expansion from the foundational Next Generation Trading (NGT) securities finance platform in the early 2000s. (See EquiLend Brings Automated Trading to Total Return Swaps)

“In the same way NGT revolutionized securities finance trading, and Swaptimization brought unparalleled liquidity and efficiency to the swaps industry, we believe EquiLend Collateral Trading is set to transform collateral trading and management,” CEO Brian Lamb said in February. He described the collateral market as “in desperate need for efficiency and automation.”

With the collateral trading service comes “the ability to manage substitution and trade lifecycle events after day one, and keep both parties in line by following the trade online,” facilitating adjustments to trade baskets, said Paul Lynch, global head of products at New York-based EquiLend.

Lynch said that investment banks and broker-dealers typically house significant volumes of “low-grade” collateral, including lower-rated debt and equities. At certain times, however, they may want to trade it for higher-grade collateral to meet client needs or regulatory capital requirements, or for balance-sheet efficiency.

Agent lenders representing beneficial owners of higher-grade collateral assets, such as pension funds, are often willing to make those trades for appropriate margin.

“This market is actively traded on a daily basis,” Lynch said, with daily volume estimated between $400 billion and $500 billion. EquiLend says its new platform supports those types of “collateral upgrade and downgrade trades.”

AcadiaSoft Partners Up

Complying with the UMR requires calculating margin using a model such as the SIMM (Standard Initial Margin Model (SIMM), developed and licensed by ISDA. The largest banks may have the resources internally to perform the SIMM calculation. AcadiaSoft has offered its Initial Margin Exposure Manager (IMEM) for this purpose since 2016, becoming what Fred Dassori, head of strategic development, described as “the industry standard in this space.”

In February, AcadiaSoft announced a partnership with treasury-management and portfolio-finance solutions provider Hazeltree to include SIMM calculations in the Hazeltree Collateral Manager. Dassori said the main input to the SIMM calculation is the common risk interchange format (CRIF) file, comprising a firm's UMR-eligible trades and the risk sensitivity of those trades. Firms complying with UMR in the final stages may lack the time and resources necessary to generate the file.

“By partnering with Hazeltree, we're able to offer the buy-side community a state-of-the-art integrated solution that both helps our clients meet their UMR obligations and takes another step toward standardization across the industry,” Dassori said in the announcement.

Also in February, Massachusetts-headquartered AcadiaSoft announced a joint initial margin analytics service with Clarus Financial Technology. More recently came an agreement with Cassini Systems, a provider of pre- and post-trade analytics for participants in the uncleared derivatives market. It enables Cassini clients to use the firm's analytics to determine the best trade execution as well as forecast and optimize their portfolios, and their Cassini-generated, end-of-day CRIF files will be sent automatically to AcadiaSoft's IMEM for reconciliation.

Cassini founder and CEO Liam Huxley said that with the integrated workflow, clients benefit from front-to-back margin optimization and operational automation.

“In these times of extreme market volatility and enormous margin swings, it's particularly vital for market participants to not only ensure they meet the challenges of [UMR] but also understand and manage the true cost of every transaction, from pre-trade all the way to post-trade operations,” Huxley said.

DTCC's SFTR Signings

On the SFTR front, Depository Trust & Clearing Corp. (DTCC) said that as of mid-February, 138 client firms along with 30 partnering vendors had signed on to the Global Trade Repository (GTR) service to meet SFTR regulatory obligations.

At the time, with an anticipated two months until broker-dealers' SFTR implementation and eight months for the buy side's, “broker-dealers have made good progress in their readiness for SFTR implementation, and our goal is to help support asset managers as they look to do the same. We're ready to assist them as they prepare for this new mandate,” said Val Wotton, DTCC managing director, product development and strategy, Repository and Derivatives Services.

EquiLend along with IHS Markit, Pirum Systems, and FIS joined the DTCC program early in 2018. Catena Technologies, Compliance Solutions Strategies and Finastra and others have since followed. The February statement also lists buy-side clients including Citadel, Franklin Templeton, Nordea Investment Management and Pimco. Global banks such as Barclays, JPMorgan and Societe Generale came on board last year.

DTCC notes that it opened industry-wide user-acceptance testing (UAT) for SFTR last October. Additional phases since included user acceptance testing with final XML schemas and validation rules.

“Each broker-dealer should assess how the scope of SFTR will uniquely affect them, which may include changes to liquidity and collateral, reporting requirements, breaks, disclosures, and automation and multilateral trading facility use,” Wotton said. “Preparation for compliance will also include the mandatory selection of a trade repository for reporting purposes.”

A Partnership Dissolves

Effective March 10, per a January announcement, the DTCC-Euroclear GlobalCollateral joint venture, bringing together the Margin Transit Utility (MTU) and Collateral Management Utility (CMU), was dissolved and the products separated.

DTCC stated that it was “very pleased with industry receptiveness” to MTU and CMU for managing cross-border collateral movement, and the decision was reached as “we regularly assess the most efficient way to deliver the highest-quality services to support clients.”

“DTCC will integrate MTU into its Institutional Trade Processing (ITP) business to provide more holistic support for firms, and Euroclear will become the sole owner of the GlobalCollateral entity offering the CMU,” the statement said, while DTCC and Euroclear were to “maintain a strong working relationship.”

New CloudMargin Recruit

CloudMargin, a six-year-old, London-based fintech venture that developed the first “cloud native” collateral management workflow tool, has appointed David G. White as chief commercial officer, a newly created position reporting to CEO Stuart Connolly.

From 2016 to 2019, White was head of sales for the triResolve business line of TriOptima, formerly part of ICAP and now a unit of CME Group. Previously, he was product marketing executive at TriOptima and consultant and manager at DCG, The Derivatives Consulting Group, later known as Sapient Global Markets, specializing in OTC derivatives projects on behalf of tier 1 investment bank clients.

Connolly, who was group CEO of TriOptima before joining CloudMargin in June 2019, said he had a “great working relationship” with White, adding, “This is an important new role for us as we continue to grow, and David will hit the ground running, thanks to his deep domain and technical expertise, understanding of our product, and strong working ties with our outstanding partners - such as AcadiaSoft - as well as many in our client universe.

“In these times of stress across our industry and the world, I know that David's leadership, empathy, calm demeanor and compassionate professionalism will be a welcome addition to our team.”

White said that he is “hugely excited to join a fast-growing company in an important and evolving market. With continued regulatory change, and a desire across the industry to drive new levels of efficiency, CloudMargin is well positioned to capitalize on the significant opportunity that exists and continue to carve out its place as a key market provider.”