Banks originating and participating in leveraged loans should ensure that risk management processes keep pace with changes in that market, the Federal Reserve Board, Office of the Comptroller of the Currency and Federal Deposit Insurance Corp. said in a joint shared national credit (SNC) program review.

“Risks associated with leveraged lending activities are building, in contrast to the portfolio overall,” the report said.

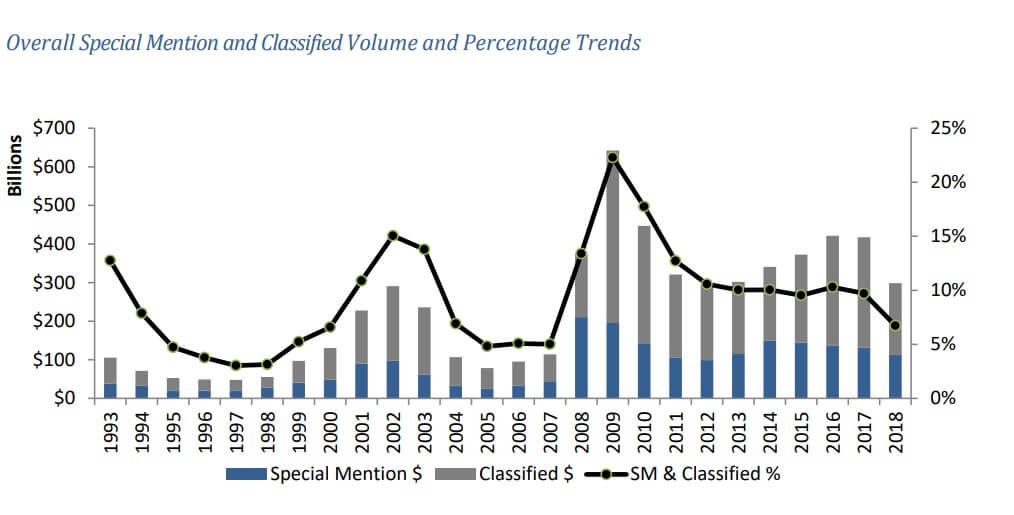

Loans and commitments qualifying for the review aggregate to more than $100 million or more, are shared multiple unaffiliated federally-supervised institutions, and therefore represent complex transactions. The SNC 2018 review, released January 25, covers $4.4 trillion in commitments to more than 5,000 borrowers, and leveraged lending stood out as the primary contributor to those categorized as “special mention” (73%) and “classified” (86%).

Investors outside the banking industry held 62% of loans in those two categories, which totaled $295 billion, considerably more than did U.S. banks (20%) and foreign banking organizations (18%).

Leveraged loans accounted for (in rounded percentages): 73% of special mention commitments, 87% percent of substandard commitments, 45% of doubtful commitments, and 76% of nonaccrual loans.

“Leveraged loans with supervisory ratings below 'pass' typically reflect borrowers with higher than average leverage levels and weaker repayment capabilities,” the report noted. “The SNC review found that many leveraged loan transactions possess weakened transaction structures and increased reliance upon revenue growth or anticipated cost savings and synergies to support borrower repayment capacity.”

Other Regulatory Voices

The SNC caution flag on exposure to highly indebted borrowers echoes concerns raised last fall by Todd Vermilyea, the Federal Reserve's head of risk surveillance and data, and an analysis in the September quarterly review of the Bank for International Settlements.

In the latter, BIS economist Tirupam Goel said that high-yield bond and leveraged-loan-based finance had doubled since the Great Financial Crisis (GFC) and behaved procyclically.

“The market for financing highly leveraged transactions flourished in the United States in the 1980s before collapsing during the recession of the early 1990s,” Goel wrote. “It again grew rapidly in the mid-2000s before stalling during the GFC. Leveraged loan volumes have been particularly procyclical - rising faster than high-yield bonds in the run-up to the GFC and during the subsequent period of extraordinary monetary accommodation.”

As for potential systemic consequences, Goel said, “The relative illiquidity of leveraged loan markets could exacerbate the resulting price impact. Moreover, given that mutual funds are a major buyer, mark-to-market losses could spur fund redemptions, induce fire sales and further depress prices. These dynamics may affect not only investors holding these loans, but also the broader economy by blocking the flow of funds to the leveraged credit market.”

Vermilyea, at an October conference as reported by Bloomberg, said the Fed was alert to “material loosening of terms and weaknesses in risk management.” He also highlighted such concerns as growth in “covenant-lite” loans and in “collateral stripping,” in which borrowers move collateral out of reach of creditors.

Possible “Material Downturn”

The U.S. agencies in the SNC report said they “remain focused on assessing the impact of these layered risks. A material downturn in the economy could result in a significant increase in classified exposures and higher losses. Banks engaged in originating and participating in leveraged loans should ensure that risk management processes keep pace with changes in the leverage lending market and ensure that their risk management processes and limits fully consider the potential direct and indirect risks associated with these loans.”

Despite improvements in risk management and underwriting practices since 2013, “bank risk management needs to continually evolve as market conditions change and risk layering practices emerge.

“The agencies expect lenders to understand and reasonably support the borrowers' ability to achieve revenue growth or anticipated cost savings and synergies when underwriting and risk rating these credit facilities,” the report continued. “Lenders should ensure that planned and permissible incremental facility use is fully incorporated into measures that control origination and participation activities . . . Agent banks and investors should also ensure that stress testing models account for market changes as recovery rates may differ from historical experience. In addition, banks should consider how the potential risks from a downturn in the leveraged lending market may affect other customers and borrowers.”

GARP editor-in-chief Jeffrey Kutler contributed to this article.