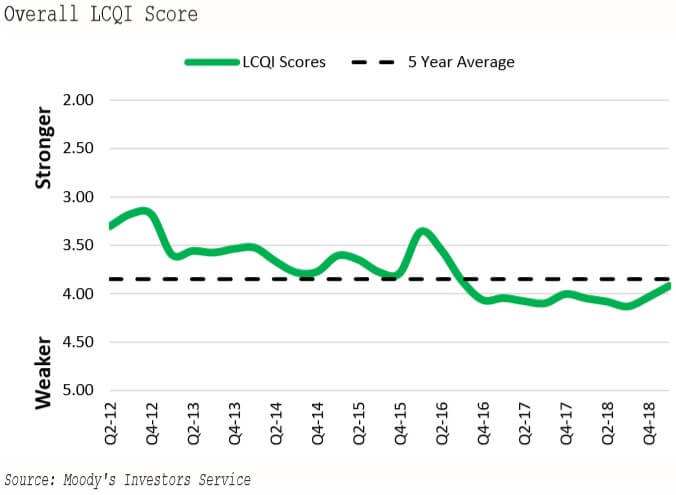

The longstanding trend of weak commercial loan covenants has begun to turn, according to Moody's Investors Service. However, “credit documentation remains extremely loose and new weaknesses continue to emerge,” Moody's said in a July report on its Loan Covenant Quality Indicator (LCQI).

Moody's attributed the change to lower rates prompting investors to turn to high-yield bonds and away from loans. Meanwhile, borrowers, especially those managed by private equity firms, are continuing to pick away at the language in covenant documentation, gradually weakening it across the market.

“There's endless demand, especially from sponsors and their counsels, to create new avenues for weaknesses,” said Derek Gluckman, vice president and senior covenant officer at Moody's.

The majority of leveraged corporate loans have been “covenant lite” for years, lacking the routinely scrutinized financial-maintenance covenants that gave investors early warning of borrowers running into credit trouble. A “death by a thousand cuts” is occurring in the documentation for so-called incurrence covenants that are tested for specific events, such as when a borrower wants to incur additional debt.

Best Gain Since 2016

The Moody's indicator has recovered from a record-worst 4.13 - on a scale of 1 (strongest covenant quality) to 5 (weakest) - in the 2018 third quarter. The LCQI was 4.03 in the fourth quarter and 3.92 in 2019's first quarter.

“The last time there was such significant improvement in loan covenant quality scores was during 2016, when the market tightened in response to stress in the oil & gas and commodities sectors,” the LCQI report said.

As further historical perspective, Gluckman noted that “in 2007, before the financial crisis, loans were probably 100 to 150 basis points better on the Moody's scale.”

Default Conditions

The Moody's analyst pointed, for example, to the conditional parameters defining covenant “carve-outs,” such as conditioning a borrower's ability to take on more debt or issue a dividend on a specific default standard.

“One thing we've seen is an elimination of the default conditions,” Gluckman said, adding that those typically haven't been “big ticket” items for investors when they are poring over loan documentation. “But they may become big ticket items once borrowers are defaulting and they're still permitted under their credit agreement to make a dividend or incur more debt, when previously they couldn't.”

Such changes can resemble “death by a thousand cuts,” he said, because a default condition may appear in 50 places in a credit agreement; if it is weakened or eliminated in 20 of them, it could end up adversely affecting loan investors.

Similar changes have been made in terms of yield, pricing and call protections. In terms of call protection, Gluckman said, there used to be a more robust infrastructure providing investors with two-year protection that shrank to 12 months and now is more likely to be six months.

“Then there was the introduction of exceptions to call protection,” he said, “so the shorter six-month call protection wouldn't even apply if the repricing was in connection with one of these accepted events, which could include a lot of different things.” He noted that a December loan deal for Energizer used such exceptions as a reason not to apply “most favored nation,” or the best available, protections on incremental debt incurrence.

Undermining Protections

“It's a continued effort by private equity sponsors and their counsels to continually undermine protections,” Gluckman said. “If they try in a hundred places to introduce language that's a bit weaker than the last time, eventually some of those changes will be incorporated into a document, and once they're in the one document they propagate across the market very rapidly.”

Gluckman noted that with elimination of call protection, even if borrowers get all the changes they wanted, there is little or no cost to calling and replacing a loan with those changes. “That's part of why we've seen this continuing downward trend, since issuers have continued to come to market to get the changes they can, when they can get them,” he said.

Some covenants have yet to be weakened, but their time may be coming. The covenant restricting access to a cumulative credit basket to make a dividend has remained untouched, Gluckman said. But as investor interest has turned to high-yield bonds, the drafts of some deals have proposed eliminating that default condition.

“If that's the next word a capital markets lawyer thinks can be struck out, when the heat comes back to the loan market, I presume they're going to try to strike that from the loan protection as well,” Gluckman said.

Heightened Awareness

Nevertheless, lenders appear to be more aware of covenants weakening than in the past. Enam Hoque, vice president and senior covenant officer at Moody's and co-author of the report, said that “the narrative has totally shifted” since 2016, when covenants simply didn't matter to investors.

“Today the discussion is all around what is going to be the effect of weakening covenants,” Hoque said.

The LCQI turnaround may in part reflect that increased awareness. Nevertheless, Gluckman said Moody's does not anticipate significant covenant improvement until real and threatened losses emerge across a wide swath of companies and industries.

“If a company is deteriorating, there is sector stress, and EBITDA is declining, as a struggling borrower there's no covenant on earth that will make money grow out of thin air,” Gluckman said.