Are we on the verge of another housing bubble, rife with spiraling prices?

As we transition to a higher interest rate, low-growth world, risk managers and bank regulators are rightly concerned about the possibility that house prices could fall precipitously in the next few years, exposing lenders and investors to elevated credit losses.

How should portfolio managers prepare themselves for this possibility? Just as importantly, how should risk modelers construct models that provide the most realistic view of expected credit losses for both stress testing and loss-accounting purposes?

It’s unfair to compare the current situation with the subprime mortgage crisis of the late 2000s, because today’s mortgage-lending standards are stronger and because homeowners are now in better financial shape. However, there are certainly enough troubling signs to concern both portfolio managers and risk modelers.

In a minute, we’ll examine where the housing market is headed, and the steps risk modelers may need to take to prepare for a potentially steep decline. First, though, we need to consider recent history.

A Long, Strange Trip

The recent performance of housing markets has been unprecedented. House-price appreciation soared in markets across the globe over the past two years thanks to a confluence of factors. Aggressive government-support programs and reduced interest rates spurred demand, while supply chains and labor constraints crimped the pace of new home construction.

In the United States, house prices rose by over 40% nationally from the start of 2020 to the end of 2022, flying in the face of prognostications for a sharp downturn.

Early in the COVID-19 pandemic, forced shutdowns made it difficult for buyers to visit homes, while restrictions at government offices made it hard to complete transactions. The disruptions, however, proved to be temporary.

As the real estate industry quickly found technological solutions to pandemic challenges and as mortgage rates dropped to record lows, the housing markets were off and running. Increased demand met limited supply, pushing prices up to record levels.

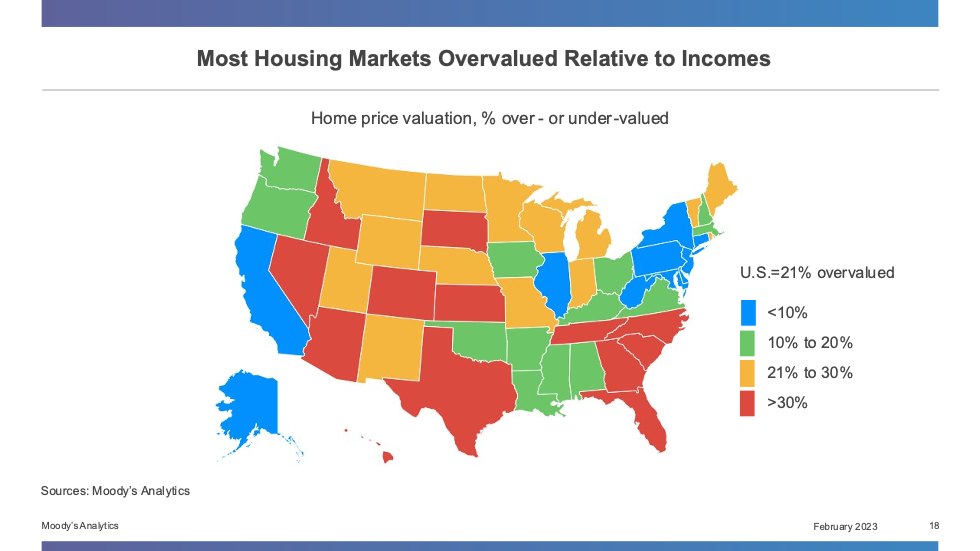

Figure 1: The Overvaluation Problem

In the U.S., the pace of growth even exceeded that of the early 2000s housing boom, with home prices growing faster than incomes in nearly 80% of housing markets, according to the Moody’s Analytics Home Price Valuation Index.

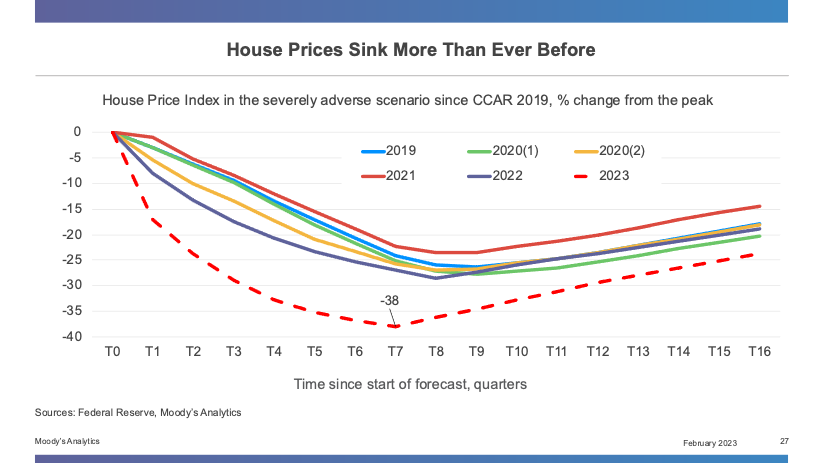

The frenzy has not gone unnoticed by central bankers, with the Federal Reserve including an unprecedented -38% peak-to-trough decline in its latest bank stress-testing exercise. Regulators around the world are similarly concerned about the integrity of their own financial systems, given rapid house-price increases in countries such as China, England, Canada and Australia.

Figure 2: HPI – Moving in the Wrong Direction

This Time is Somewhat Different

While overvaluation is even more extensive than in the early 2000s, there are mitigating factors to suggest that the outcome – a plunge in prices and a spike in foreclosures – could be different this time.

First, the financial position of homeowners is much stronger today due to larger down payments and the adoption of stronger mortgage-lending standards since the late 2000s housing bust. Homeowners have significant equity cushions in their homes today and have locked in record low interest rates, making it less likely that they will miss payments and fall into foreclosure. Without a significant increase in defaults, it is doubtful that prices will fall precipitously.

Cristian deRitis

Second, today’s demographics are more supportive of greater housing demand relative to the late 2000s, when new home construction exceeded household formations by a wide margin. In contrast, there is more demand than supply today, with an estimated deficit of nearly 1.5 million housing units.

Of course, the risk of a sharp decline in prices cannot be discounted completely. Should the economy experience a deep recession, with the unemployment rate rising to 6% or more in the U.S., shortfalls in income may leave households with no other option but to default on their mortgages.

Modeling Choices Drive Loss Forecasts

Given the competing forces in the economy, risk modelers are challenged to develop quantitative models that can provide the most accurate, forward-looking loss forecasts possible, conditional on a range of assumptions regarding house price declines and the broader economy.

As with any modeling exercise, modelers first need to consider the theoretical basis for borrower behavior before starting to run regressions blindly. For example, what would cause a borrower to fail to make payments on their mortgage and risk losing their home to foreclosure?

The literature advances two theories. The ruthless default paradigm suggests that borrowers will be likely to default when the discounted present value of the property securing their loan falls below the value of their mortgage. In short, a borrower with negative equity in their home will choose to default on their loan, rather than continuing to pay on a money-losing investment.

While empirical evidence supports the idea that negative equity is a necessary condition for a borrower to default, it is not sufficient. Historically, many borrowers have been observed to continue to pay diligently on loans that are seemingly against their own financial interests.

Alternatively, the trigger event hypothesis posits that borrowers are not so ruthless when they consider the additional costs of defaulting, including restrictions on accessing credit in the future. Furthermore, homeowners may have a poor estimate of what their properties are actually worth at any given time – and many owners have overly optimistic expectations about their own home’s value.

Rather than strategically tracking their equity position month to month, borrowers may be expected to continue making payments on their mortgages until an event such as job loss, divorce or illness causes an income shortfall that prevents them from making a payment. At that point, the borrower will assess their equity value to see if a default is necessary or if, in contrast, it would be possible sell their home and pay back their lender.

With these insights, mortgage risk modelers should consider model specifications that can incorporate aspects of both hypotheses. Economic driver variables related to changes in unemployment or income can capture the likelihood of a trigger event, while measures of home price appreciation can be used to assess each borrower’s equity position.

Careful consideration needs to be paid to variable transformations in models as well. For example, a model that is sensitive only to year-by-year changes in a house price index rather than borrower equity could end up significantly overstating default risk. Case in point: a borrower with a 50% equity cushion may be no more likely to default with a 30% decline in prices than a 20% price decline. In this example, a model that only considered changes in home prices may exaggerate the impact of the larger price decline.

Parting Thoughts

The next couple of years will undoubtedly challenge conventional wisdom related to the economy and credit performance. Risk models will likely be exposed to an economic environment that hasn’t been experienced before – marked by high interest rates, tight labor markets and stubbornly-high inflation rates.

Regulators and business managers will undoubtedly be asking questions that risk managers need to be prepared to answer. While previous experience is helpful for estimating the range of potential outcomes, care will be needed to put history in the proper context and to evaluate the current situation for both exacerbating or mitigating factors.

Models may be stretched to their limits in terms of historical extrapolation, requiring risk professionals to rely on simulations and scenario analysis to provide ranges in their forecasts – rather than narrow, explicit projections.

For some countries and submarkets, the loss experience in real estate may exceed that of the late 2000s, while for others it will be much better, given changes in underwriting, demographics and risk management practices. Careful consideration of alternative scenarios and risk-model design will be critical to making reasonable and supportable estimates in the face of uncertainty.

Cristian deRitis is the Deputy Chief Economist at Moody's Analytics. As the head of model research and development, he specializes in the analysis of current and future economic conditions, consumer credit markets and housing. Before joining Moody's Analytics, he worked for Fannie Mae. In addition to his published research, Cristian is named on two U.S. patents for credit modeling techniques. He can be reached at cristian.deritis@moodys.com.

Topics: Modeling