If there is any good that can come from a crisis like the coronavirus, it's that it causes us to reexamine our actions and decisions. “Am I on the right road?” That's a question today that pertains to both our personal and work lives.

For the risk manager, to help determine whether the business is being run the right way, it's time to consider our existing approaches to managing and mitigating risk. What could we do differently to be better prepared to deal with a global pandemic?

“Nothing” may be a reasonable answer on the surface. Nobody saw this pandemic coming. Certainly not in terms of the specific form and timing of COVID-19. While we have experienced epidemics like SARS and MERS in recent history, they were not nearly as far-reaching as this latest coronavirus.

But suggesting that there is absolutely nothing we could have done differently isn't a satisfying answer. Can we do anything to prevent a pandemic from happening again, or at least be better prepared in the event of another?

Think Scenarios

The answer lies in scenario analysis. Surprisingly, many businesses and financial institutions have been relying on just one forecasted path (such as CECL or stress testing) for planning, revenue projections and loss forecasting. That's insufficient.

Relying on a single baseline or consensus view of how the future will unfold is certainly appealing in terms of being easy to understand and to communicate to others. After all, even with an infinite multiverse of possibilities, we only observe one reality.

But the arrival of the coronavirus and its associated economic shocks has demonstrated the folly of this single-scenario approach. Even as recently as early March, consensus forecasts were anticipating a slowing but still favorable economic outlook. Few forecasters were contemplating the possibility of a significant slowdown - let alone a recession in the near term.

Many forecasting processes and rules of thumb tend to rely on the momentum of recent trends. Most of the time that's appropriate and accurate - except when shocks happen. Identifying points where the trends reverse remains one of the most challenging aspects of economic forecasting. Not even the most sophisticated machine learning or artificial algorithms have been able to crack this nut.

We need to think differently. Rather than trying to divine the future with precision, a scenario-based approach that considers multiple upside and downside paths provides greater diversification in the outlook. Portfolio Theory 101 tells us that diversification is our best tool for managing uncertainty.

We might still focus on (or place greater weight on) a central path for ease of communication, but at the very least we should give some consideration to more extreme events. This is especially important given the nonlinearity and asymmetry of potential credit losses.

Missing to the upside generally doesn't impact loss forecasts significantly. If borrowers don't default when unemployment is at 4%, then they still won't default when unemployment is at 3%. But on the downside, a small increase in unemployment can translate into an exponential rise in the number of defaults.

Choosing Scenarios

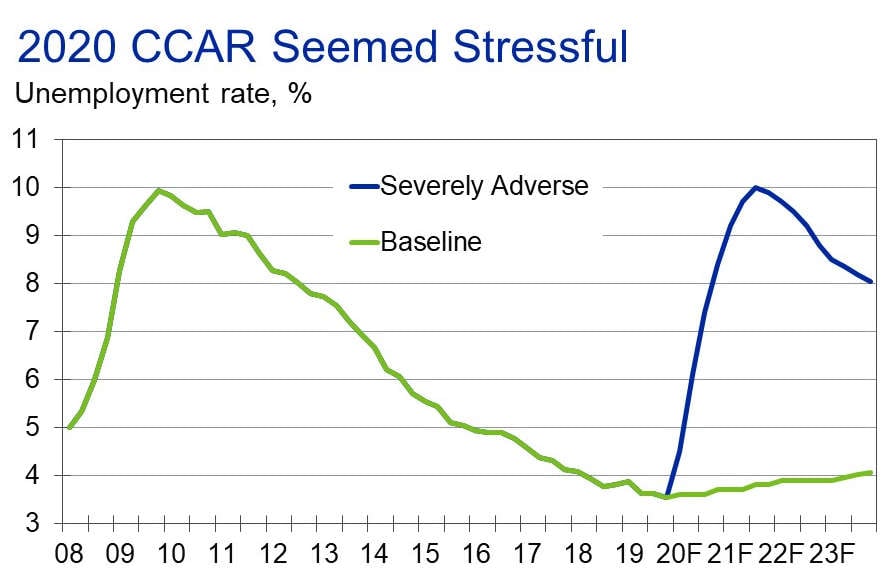

We know that multiple scenarios are a good idea, but which scenarios should we consider? If every bank or lender used the same scenarios, systemic risk might occur. That is, each individual institution might be acting prudently under the scenario provided, but they could still be blindsided by some unconsidered factor. The Fed's annual CCAR stress testing scenarios fall into this category, with all banks using the same set of baseline and severely adverse scenarios to estimate their future losses.

Chart 1: Fed Scenarios

Sources: Federal Reserve, Moody's Analytics

Of course, the advantage of a single set of scenarios is comparability across institutions. By controlling for the economic scenarios used, we can make a fair comparison of the relative risks and sensitivities of one portfolio of loans to another. This approach can help us attribute risks to industry or geographic concentrations rather than to differences in the economic assumptions.

Conversely, portfolio-specific idiosyncratic scenarios can account for the unique risks and insights that an individual institution may have. Community bankers who live and breathe their local economies may have far greater insight into what may go wrong in their region than a central banker sitting thousands of miles away in an office in Washington, D.C.

The solution to this general-versus-specific scenario conundrum is to run both types of scenarios. Of course, this presumes that institutions have the capacity to design and run scenarios quickly and efficiently. Luckily, the number of technology-enabled models and tools available for running this type of analysis is greater than ever.

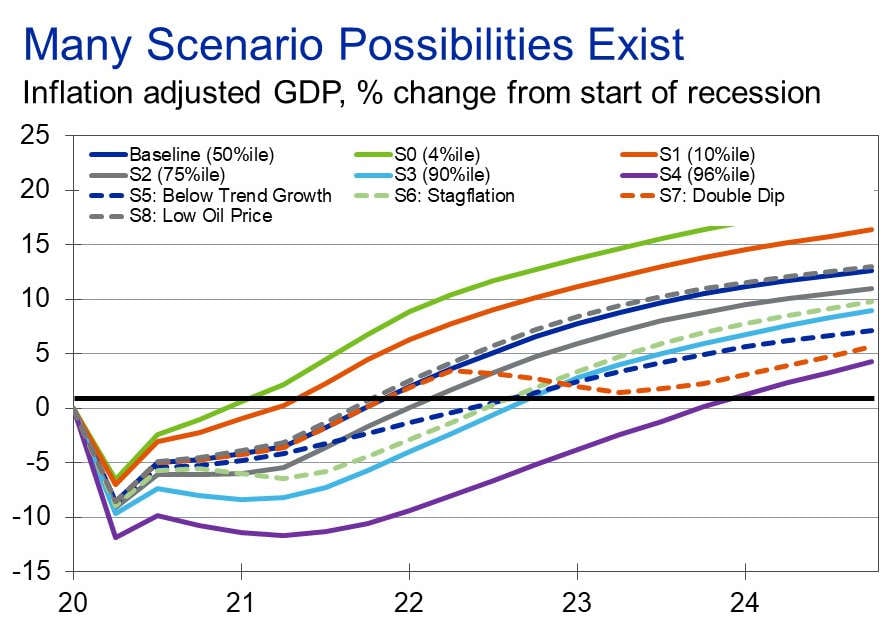

With new cloud technology, scenarios no longer need to be limited by operational considerations. Risk managers can and should avail themselves of scenarios of all types, including the statistical analysis of historical relationships of economic indicators that may be used to generate distributions of probability-based scenarios.

For example, given current conditions, what is the likelihood that unemployment will rise by 2, 5, 10 or 20% over the next year? The advantage of a probability-based scenario is that it's agnostic to the source of the shock: something bad could happen that causes unemployment to spike to 20%. Under this exercise, we simply probe our readiness regardless of the nature of the specific shock.

Chart 2: Scenario Types

Source: Moody's Analytics

Probability distributions lend themselves naturally to expected loss calculations, as well as insurance and risk transfer applications. However, the probability distribution and weights are only as good as the historical data used to construct them. As a result, they may either miss or severely under-estimate the possibility of tail events - such as a pandemic.

Thematic scenarios can fill this gap by providing projections that go beyond historic expectations. The assumption of an earthquake, flood, nuclear plant meltdown, electromagnetic pulse or other disaster may be considered to make certain real-world assumptions about the path of interest rates, house prices, unemployment or other factors.

Scenario Thinking

Of course, just “running the numbers” is not enough. We need professionals who can assemble the output into a digestible and actionable form, one which includes a coherent story or narrative. To be truly effective, scenario analysis cannot be relegated to a small group of people or boxed off into a separate risk management function.

“Scenario thinking” should ideally permeate all of our roles - both at work and at home. Regardless of our position within our organizations, we should be constantly considering the options and probabilities as we make our decisions. That goes for the account servicer, who must determine whether or not to provide payment forbearance to an individual borrower given limited resources, just as it applies to the accountant, who must consider a lifetime of potential upside and downside risks when setting an allowance.

The power of scenario thinking is not confined just to minimizing threats. Systematically considering upside and downside risks in an organized fashion can help us to appropriately assess and distinguish between risks we should avoid and those we should take, given the potential upside payoffs.

Scenario analysis won't prevent shocks from occurring in the future - nothing can. But scenarios can increase our awareness and help us to more appropriately consider and prepare for the possibilities in our version of the multiverse. Given all of the data and tools at our disposal, the only limitation to constructing scenarios is our imagination.

Cristian deRitis is the Deputy Chief Economist at Moody's Analytics. As the head of model research and development, Cris specializes in the analysis of current and future economic conditions, consumer credit markets and housing. Before joining Moody's Analytics, he worked for Fannie Mae. In addition to his published research, Cris is named on two U.S. patents for credit modeling techniques. He can be reached at cristian.deritis@moodys.com.