The second-to-last batch of participants in the uncleared, over-the-counter (OTC) derivatives market is scheduled to begin complying with new initial margin rules by September 2020, with the rest to follow a year later. While the ground is well tread, the organizations face complicated preparations and potential delays that could disrupt their use of the derivatives and potentially their hedging strategies.

Market participants with the greatest volume of notional uncleared OTC derivatives exposure, averaging $3 trillion or more, had to start complying with new initial margin rules in 2016. Each subsequent year, groups of users with ever smaller volumes have been added. Those with notional averages of $50 billion and above must be prepared to post initial margin (IM) starting September 1, 2020, and those with $8 billion and above a year later.

“Timing is the biggest issue,” said Dominick Falco, head of BNY Mellon's segregation product.

In part, that's because several complicated pieces must be in place before the deadlines. If they are not, counterparties may no longer engage in non-cleared derivatives trading.

“From a risk manager perspective, their organizations may face a loss of liquidity, because counterparties may no longer be able to deal with them,” Falco explained.

Size Calculation

In fact, a critical step is drawing near. Users of uncleared OTC derivatives - including corporate pension funds even though their parents are exempt from the requirements - must determine whether their average aggregate notional amount (AANA) exceeds $50 billion a day over a 90-day observation period. That determination must be made annually. If that is the case this spring, during the AANA calculation period between March and May, they will have to be ready by September 1.

However, given preparations required to post initial margin, Falco said, they would be wise to make that determination as soon as possible, if they haven't already done so. They will have to engage service providers, and that can take time.

“Any organization that has determined themselves to be well over the $50 billion threshold should probably have already started to engage the various service providers,” Falco said, adding, “Even those on the cusp should try to get as much information as possible, so they're not caught off-guard early next year.”

Avoiding Delays

The risk of acting later is that service providers, such as BNY Mellon and other custodians that will house the collateral as well as third parties to do initial-margin calculations and other key functions, will likely be dealing with onboarding backlogs as deadlines approach. Falco said that BNY Mellon, one of the biggest custodians, has sought since early on to tailor services to enable derivatives users to comply with the new rules. It estimates that 150 to 200 organizations must comply with the requirements next year, and approximately a third of those have already chosen their custodians, one of the first major steps.

“The custodian they choose may in some cases determine to a large extent the types of agreements they'll need to use with counterparties,” Falco said.

Although the custodian is primarily responsible for holding margin assets that are posted against bilateral trades, BNY Mellon notes in an informational brochure other important services the custodian or another third party could provide:

- Managing IM required on non-cleared trades.

- Issuing and responding to margin calls.

- Instructing the movement of collateral to and from counterparties.

- Resolving collateral disputes.

- Providing analytics on the optimal securities to post as margin.

- Monitoring securities posted for eligibility requirements.

- Transforming cash or ineligible securities into acceptable collateral.

- Providing ongoing portfolio monitoring, maintenance and reporting.

Segregation Model

Next, users of uncleared OTC derivatives must choose a segregation model.

In the triparty model, the fund agrees to collateral schedules with each counterparty but allows its custodian to select and administer the collateral on its behalf. The third-party model is more hands-on, and the derivative user more actively manages its margin assets.

BNY Mellon notes that the tri-party option tends to be more suitable for portfolio managers running multiple funds with complex allocation requirements.

“It's important clients make that determination as quickly as possible, since the set up time for each is a bit different, and they will differ from custodian to custodian,” Falco said.

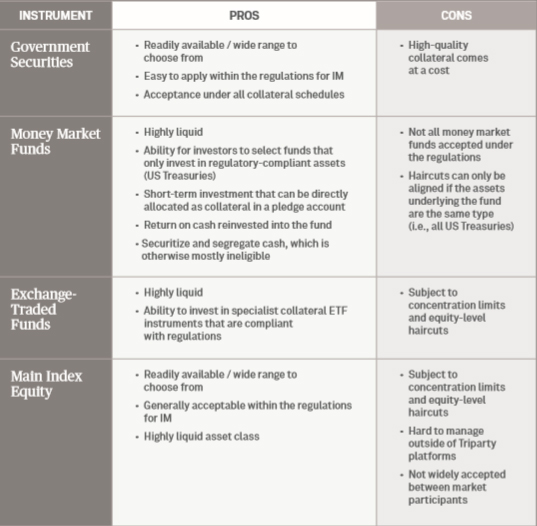

Then the organization must negotiate collateral schedules with each of its counterparties that specify the types of collateral each is willing to accept. Organizations may already be familiar with variation margin, and while it is generally posted in cash, initial margin typically must take the form of highly rated fixed-income securities, although sometimes major equities or equity indices are permissible. BNY Mellon says firms often put additional restrictions on the types of securities that can be used for initial margin.

Alignment with Risk Policies

“Risk managers are going to want to understand those types of collateral and ensure that the collateral their organization is receiving is in line with the firm's risk policies,” Falco said, adding, “The eligible collateral schedules can take a long time to negotiate among counterparties.”

A slew of legal documentation must be agreed upon and executed. That includes a custody agreement if the organization is tapping a new custodian; an account control agreement (ACA) to establish a segregation account with the counterparty and custodian; eligible collateral schedules (ECS) stating the assets to be posted to counterparties, and applicable haircuts and concentration limits; and a security agreement to provide the custodian with security for supporting the collateral provider in a tri-party agreement.

Organizations that are certain their notional OTC-derivative averages are below $50 billion but above $8 billion shouldn't breathe too big a sigh of relief about an extra year to comply. BNY Mellon estimates upwards of 550 such organizations fall into this category. With the 2020 deadline an immediate priority for service providers, and the number of organizations in the September 2021 group being much larger, it is wise to start sooner rather than later.

“We're saying [2020's] 150 firms should really already be preparing, so think about the impact following year, when there will be more than three times that number,” Falco said.