One of the key factors behind the 2007-08 global financial crisis was an overreliance on external ratings. Could we be heading down a similar road after the expected January 2025 implementation of Basel III?

The Basel Committee on Banking Supervision (BCBS) is now working out the final kinks in its international regulatory framework. The credit risk component of the final version of Basel III will aim to reduce the variability of banks’ calculations of risk-weighted assets (RWA). But it also incentivizes banks to adopt the standardized approach (SA) for credit risk measurement (in lieu of internal ratings-based models), and SA models rely heavily on external ratings.

Basel III's so-called “output floor," which puts a limit on the amount of capital benefit a bank can obtain from its use of internal models (relative to the SA), is one of its most controversial elements. The BCBS describes this restriction as follows: “Banks’ calculations of RWAs generated by internal models cannot, in aggregate, fall below 72.5% of the risk-weighted assets computed by the standardized approaches. This limits the benefit a bank can gain from using internal models to 27.5%.”

It’s important to note that 72.5% is the “fully-loaded” floor, but this level will only be reached after a transition period. Still, this seems ironic, because putting too much trust in external ratings is something the new Basel rules were expected to prevent.

In short, banks under Basel III will have less opportunity to put full trust in their internal models, and those that rely on SA models will be forced to use prescribed procedures for the RWA calculation – including input floors.

The External Ratings Problem

If you’re curious about how the phasing in of the new, external-ratings-reliant set of Basel III rules could impact RWA, the BCBS has you covered. Through its Basel Framework page, one can virtually “time travel” into the future to see how risk weights will be impacted for bank using the SA technique.

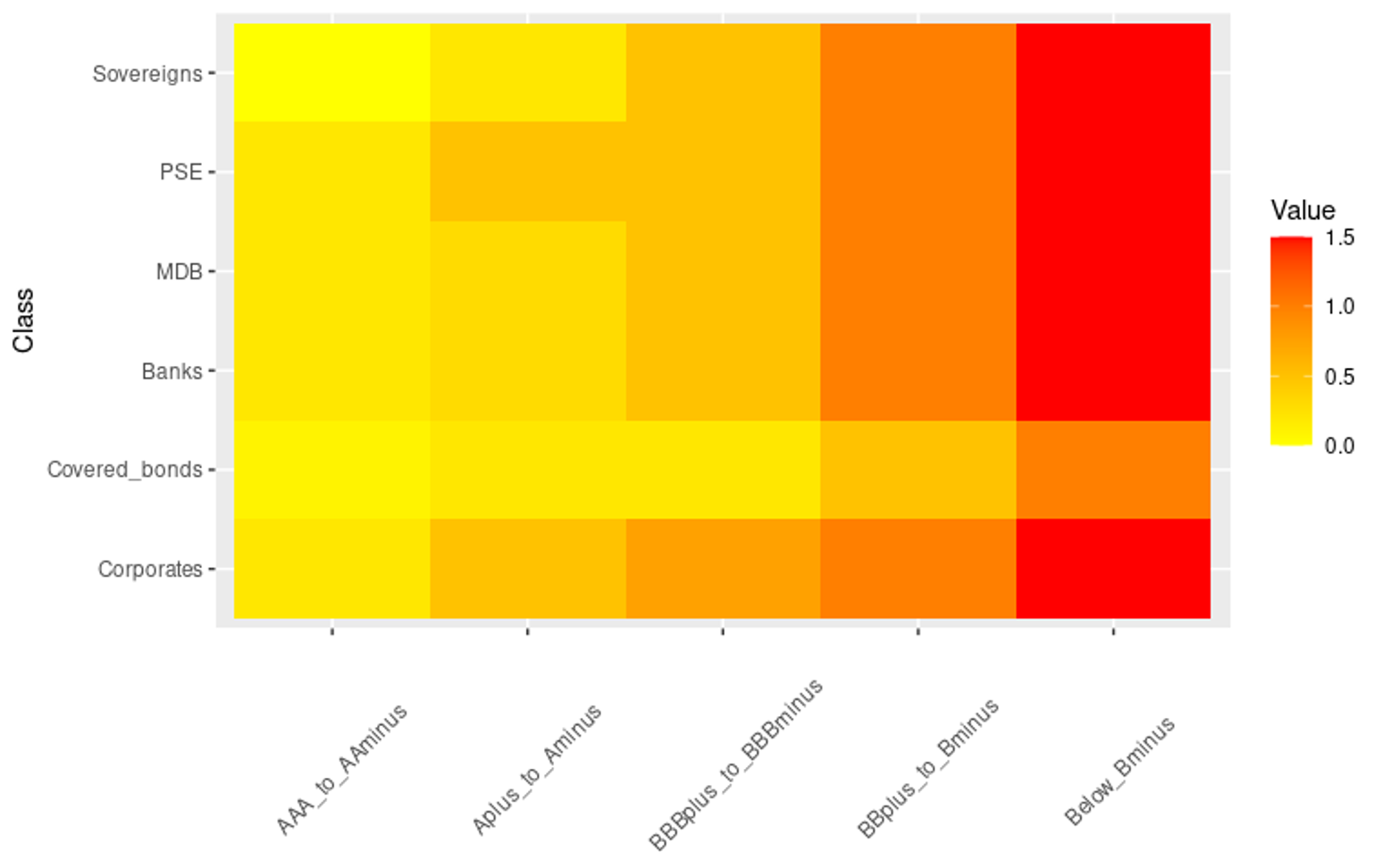

When traveling, for example, to January 1, 2025, and focusing on the CRE20 section of Basel III, one can view the standardized approach for individual exposures. As depicted in figure 1 (below), the RWA weights for different exposure classes will be exclusively driven by the external rating.

Figure 1: Basel III’s RWA Weights for the Standardized Approach (January 2025)

The color map is straightforward: bad ratings lead to a higher capital requirement than good ratings. Indeed, the RWA weight monotonously increases through deteriorating ratings.

When looking vertically at the heatmap, one recognizes that sovereigns and covered bonds have relatively low RWA weights for the same rating, while public sector entities and corporates have relatively high RWA weights.

The Turner Review: Forewarnings on External Ratings

Basel III’s heavy emphasis on external ratings is remarkable, because if these ratings go astray, all banks will be wrong in the same direction.

After the GFC, many reports came out analyzing the causes of crisis, which culminated in the September 2008 default of Lehman Brothers. Authored by the UK’s Financial Services Authority in March 2009, “The Turner Review” was one of the most influential postmortem reports on the GFC.

Marco Folpmers

Reducing the reliance on external ratings, especially for structured products (i.e., repackaged credit risk), was one of the key recommendations of that report – which also advocated for improving the quantity and quality of bank capital.

Swings in external ratings will have a procyclical impact, since all banks are affected by these variations in the same way. Ratings downgrades, moreover, will have a collective and simultaneous impact on banks’ capital requirements, potentially leading to a credit crunch and yet another economic crisis.

While there is general consensus that an overreliance on external ratings exacerbated the GFC, both the Turner Review and the European Banking Authority acknowledge that, when used properly, external ratings can be a useful tool in risk measurement.

Due Diligence Risk Mitigants: Helpful or Ineffective?

The architects of the final Basel III rules have, of course, foreseen the RWA difficulties connected to the heavy use of external ratings, and mitigants are therefore in place. One way that Basel II attempts to reduce the risk of RWA calculations is by requiring banks to perform due diligence on the external ratings.

The due diligence requirements state that when a bank uses external ratings, it should assess whether the risk weight that is applied is “appropriate and prudent.” For smaller banks, this will require less effort, because the sophistication of the due diligence should be proportionate to the size and complexity of a bank’s activities.

However, it remains hard to see how this due diligence can effectively reduce the risk of overreliance on external ratings and procyclicality.

First, on principle, the aim of Basel III is to reduce RWA variability. This is the top goal of the finalization of Basel III. This means that collective rating procedures will be favored over a bank’s internal ratings. Since this is the overarching theme of Basel III, the risks connected to external ratings overreliance are hard to mitigate.

Second, due diligence procedures only take place ex post, after the external rating has been accepted, in principle; the onus will therefore be on the side of those who want to prove the external rating wrong. Since future default rates are stochastic, with much uncertainty (usually), rejecting a null hypothesis can be difficult in practice.

Third, confirmation bias is likely to arise. It is, in fact, much easier to see the appropriateness of a suggested rating than to reject it.

Fourth, given their relative lack of complexity, smaller banks can make do with less sophisticated approaches to the due diligence for external ratings. But how, exactly, can these smaller institutions check the external ratings in a simple way?

The only way to perform this task correctly is to set up a shadow rating system, but that would only add more layers of complexity. Honestly, this can’t be done in a simple and qualitative manner. On the one hand, small- and medium-sized banks should be able to rely on external ratings and perform their due diligence simply; on the other hand, overreliance on external ratings should be prevented and challenger rating systems should be built.

Parting Thoughts

Proponents of Basel III may argue that since the output floor requirements do not apply to some IRB banks, the emphasis on the use of external ratings for RWA calculations will be less impactful than some are predicting.

Even if this turns out to be true, many banks that use the SA will be immediately impacted by the RWA change in Basel III. Smaller banks may become particularly overreliant on external ratings, since they are subject to the less stringent (“proportional”) due diligence requirements.

One additional point to consider is that Basel III, once finalized, will force banks to rethink not only how their portfolios generate value but also how they can meet their capital requirements. After performing critical assessments of their capital requirements, portfolios and business composition, banks may need to consider, among other things, their credit risk measurement approach.

Some banks that are now using IRB models may see the logic in transitioning to the standardized approach that has been embraced by Basel III. Of course, the more banks that switch from IRB to SA, the greater the threat is that we will eventually see a dangerous overreliance on external ratings.

Dr. Marco Folpmers (FRM) is a partner for Financial Risk Management at Deloitte the Netherlands.

Topics: Default