While regulatory attention is turning increasingly toward operational, cyber and other growing non-financial risk categories, the Federal Deposit Insurance Corp.'s 2019 Risk Review shines a spotlight on market and credit risks, including concerns related to rises in corporate debt and leveraged lending.

Although banks are well capitalized and reporting healthy profits ten years into the economic expansion, “slower growth in the broader economy is beginning to affect the banking industry. Loan growth has slowed over the past three years, particularly in real estate-related portfolios,” the FDIC said in presenting its rundown of key bank risk issues.

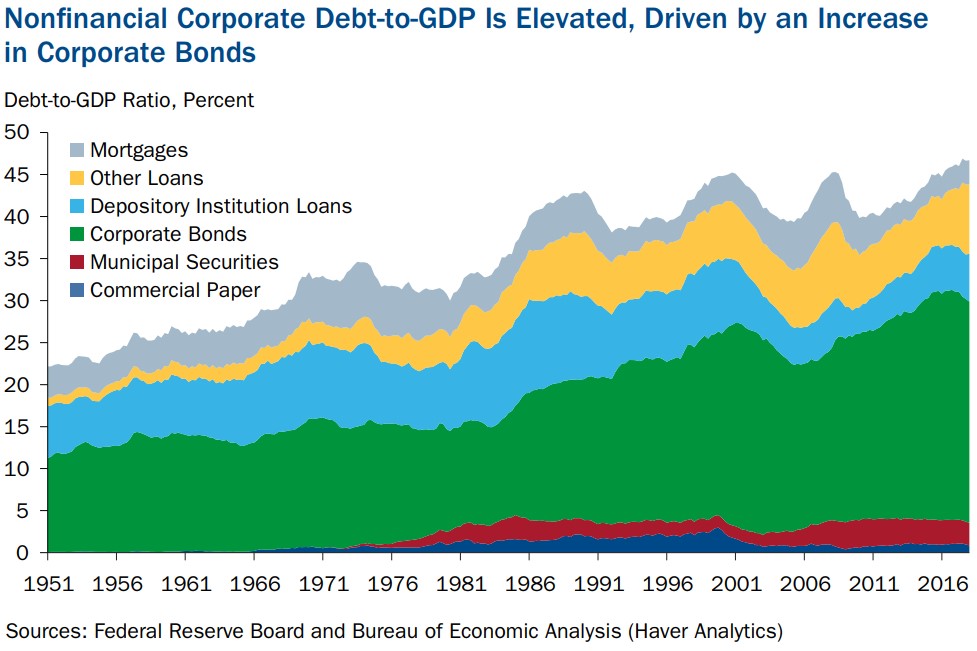

“Non-financial corporate debt levels are at all-time highs, driven by growth in corporate bonds and leveraged loans,” according to the 55-page report released on July 30.

Non-financial corporate debt hit “a record high relative to GDP,” the report said. “Corporate bonds and syndicated leveraged loans have grown far faster than other types of corporate debt, such as mortgages and traditional C&I [commercial and industrial] bank loans, with outstanding institutional leveraged loans nearly doubling since 2008.”

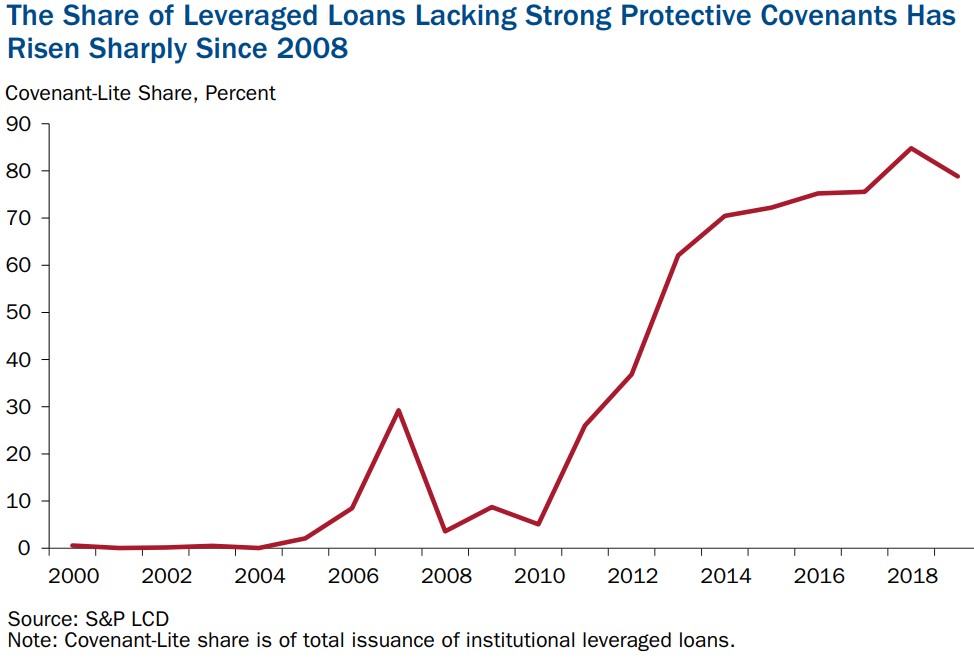

Meanwhile, the proportion of newly issued, covenant-lite institutional leveraged loans rose from less than 10% in 2010 to about 85% in 2018, before declining to 79% in 2019. That figure “remains well above the pre-2018 period,” the FDIC said. “Other aspects of leveraged loans have also become riskier. Leverage levels have risen to all-time highs, while loss-absorbing subordinated debt has largely disappeared.”

Banks and CLOs

The study included data on collateralized loan obligations, which are a source of bank exposure to the leveraged lending market and were the subject of recent economic research published by the Federal Reserve Board. (See Who Owns CLOs? Fed Research Sheds Some Light)

As of the first quarter of 2019, 16% percent ($96 billion) of U.S. CLOs were held by U.S. banks, and banks with more than $250 billion in assets accounted for 85% ($81.9 billion) of that total.

The $95 billion was “down moderately from the peak of $105 billion in 2016 but well above the $38 billion held in 2010,” the FDIC said. “Banks also are the primary source of funding for the revolving 'pro rata' portion of the loans. Many of these revolving credits are likely undrawn, but borrowers could draw on these revolving lines before default should they face distress.”

Also flagged for potential credit exposure was bank lending to nonbank financial institutions, including nonbank mortgage lenders, private equity funds and real estate investment trusts.

“Overall, loans to nonbank financial institutions account for less than 5% of total loans and leases reported by banks as of first quarter 2019, and less than 11% of all banks are engaged in this type of lending,” the report pointed out. “While the total exposure remains small, lending to nonbanks could be risky because it is relatively untested in an economic downturn. It also indirectly expands the exposure of an institution to the lending activity of the nonbank. These activities include portfolio categories that have been historically risky, such as CRE [commercial real estate].”

Room for Improvement

The FDIC noted in the report's executive summary that “examination findings since mid-2017 noted opportunities for improvement in risk management practices for CRE-concentrated institutions, particularly in the areas of board governance and oversight and portfolio stress testing.

“Despite the competitive pressures,” it added, “CRE credit quality metrics at insured institutions remain satisfactory in early 2019.”

With each of the four major CRE property types - multi-family, office, retail, and industrial - having benefited from economic growth, the FDIC called the sector outlook “positive, but guarded.”

On credit risk in general: “Competition among lenders has increased as loan growth has slowed, posing risk management challenges. Market demand for higher-yielding leveraged loan and corporate bond products has resulted in looser underwriting standards.”

Liquidity Concern

The FDIC's summary view of market risk is that “the current interest rate environment presents earnings and funding challenges to banks and could pressure liquidity at some institutions.”

“The effects of increased competition on deposit costs have not yet affected aggregate net interest margins,” the report said. “However, nearly one-third of banks have seen a decline in their net interest margin since fourth quarter 2015, generally due to an increase in funding costs but also partly because of a decline in asset yields at some banks. Many rural community banks face added deposit retention challenges associated with long-term demographic shifts and the recent downturn in the agriculture industry.”

Short-term liquidity at smaller banks has declined in recent years and could affect their “ability to manage a future downturn . . . A turn in the credit cycle could be detrimental to institutions with low levels of liquidity or high levels of wholesale funding, particularly if a sale of securities is required to meet liquidity demands or if access to certain types of funding is limited.”

Trade and Political Factors

Regarding macroeconomic developments, economic growth is seen slowing, inflation softening and housing markets slowing.

“Trade effects have weighed mostly on the transportation and agricultural sectors” that have been subject to China's tariffs, the FDIC said, adding that trade uncertainty hangs over the global economic outlook, and a slowdown in U.S. growth “is expected to be small compared with other major economies.”

“Political risks in Europe, including the as-yet uncertain terms of the United Kingdom leaving the EU (Brexit), could have broad-ranging effects on the global economy and banking system,” the report said. “While the direct impact of Brexit on the U.S. economy and banking sector may be limited, adverse financial market reactions to the terms of Brexit may pose indirect risks to U.S. markets and institutions.”

The FDIC, which in this report said it is “expanding its coverage of risks that have the potential to affect stability and public confidence in the U.S. financial system,” plans to publish its next risk review in spring 2020.