One of the most important attributes of a good risk manager is the ability to see what others do not see: to be able to peer around corners, search for the unexpected and act as ballast for new ideas - even unpopular ones. One of the worst things a risk manager can do is fall victim to a new risk category called “ostrich risk.”

Ostrich risk can be defined as the willful and/or reckless refusal to accept clear evidence of a risk issue, and instead bury your head in the sand. This risk is tightly coupled to behavioral fallacies such as “group-think” and “confirmation bias, ” and results in organizational lack of awareness, unpreparedness and a loss of resiliency. In large organizations where consensus is the desired outcome and traditional approaches tend to outflank new ideas, this is a real problem.

Today's Buried Risk: Non-Performing Assets

Contrary to common belief, ostriches don't bury their heads in the sand (as the saying goes). Rather, they dig holes in the dirt to bury their eggs. That is, they hide something important for the purpose of safety, even if that safety is only a few inches deep.

The analogy seems apt in today's environment, where institutional asset managers seek to bury non-performing assets (NPAs) by way of payment extensions, interest deferrals, payment capitalization and other methods of forbearance. These are, to be sure, temporary and necessary actions; however, forbearance is not a viable long-term plan - nor is loading-up already highly-leveraged businesses with additional debt.

Although aggressive central bank efforts have created a temporary floor underneath financial asset prices, these monetary actions will not forestall debt default that is conditional on the re-employment of millions of people. Monetary policy may be able to create money out of thin air, but not employment.

Risk managers, asset-quality and loan review teams need to immediately align themselves, and seek out solutions to avert looming defaults and liquidations. This means collaboratively working with struggling credit counterparties in ways that - heretofore - might have seemed unusual and unorthodox. (Bridging temporary lack of cash flow with new hybrid-debt and equity investments is just one example.) But this can't be done in a silo: it requires organizational support.

In today's environment, everyone is a “work-out” manager, and everyone has a social, moral and business obligation to help find viable solutions. This will necessitate elevating new policies ideas and proposed solutions (even if unpopular) to senior decision makers, as well as educating staff on agreed-upon planned actions.

Labor Crisis: Re-employment is Critical to Minimize Credit Losses

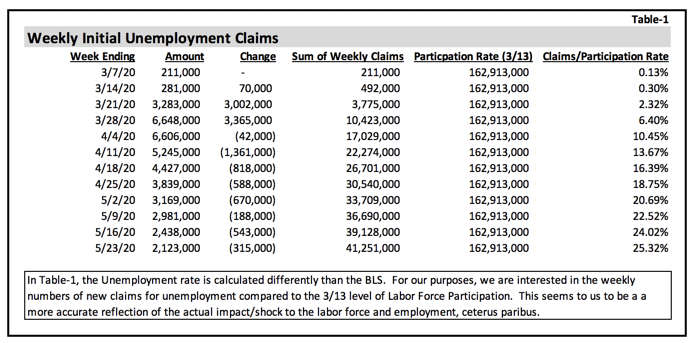

As of this writing, the officially reported unemployment rate stands at 14.7%. The April 2020 Bureau of Labor Statistics (BLS) report indicated a loss of 20.5 million jobs in April. However, it's important to keep in mind the total job losses and claims for unemployment since the COVID-19 crisis began (see Table 1).

Table 1: Initial Unemployment Claims in the U.S. - Since the Start of the Pandemic

Since the beginning of the COVID-19 pandemic, claims for unemployment have totaled 41.3 million. While most media tend to report the U-3 unemployment rate, many observers prefer the U-6 rate - which includes those “marginally attached” to the labor force. The U-6 rate, as of April, stood at 22.8%. If the U-3 represents “speed,” it's helpful to think of U-6 as acceleration.

In Table 1, we take a slightly different view in order to illustrate the “shock” to the labor market. We merely sum the weekly new initial unemployment claims and compare this to the pre-COVID-19 labor force participation rate, which seems a fair reflection of the actual damage to labor.

Using this method, the overall “labor disruption rate” is 25.32%, a level significantly higher than both the U-3 and U-6. Combined, this trifurcate of numbers paints a grim and increasingly dire picture of the U.S. labor market and, therefore, overall economic health.

This level of labor market disruption portends a collapse in aggregate demand, which historically precedes a credit crisis. To be prepared, risk managers must begin to facilitate much-needed conversations with senior leadership, third-parties and internal business partners.

Risk managers, moreover, must seek the adoption of new organizational methods and ideas for today's unusual and exigent circumstances. As things stands today, many organizations are already “behind the curve.”

Constructively working with viable SMEs is the only way to re-employ the millions of lost jobs, and ultimately reduce credit loss. The least productive outcome would be a rash of bankruptcies and SME liquidations due to lack of proper strategies to handle the coming surge in NPAs.

Solutions Needed, Risk Managers Must Respond

Risk managers who have a solid understanding of portfolio credit risk should immediately understand the implications of the unprecedented shock to labor on expected credit losses, reserves for bad debts and capital.

With most of the available data points flashing red, many institutional asset managers, banks, insurers and structured credit specialists continue to display elements of ostrich risk - via, e.g., erroneously conflating the Fed-induced induced rebound in financial asset prices with a broader rebound in employment and a “V-shaped” economic recovery. This is unrealistic and an error in judgment.

A recent report from the Society for Human Resource Management indicates that more than 40% of small businesses have had to close due to the pandemic, with 62% reporting a decline in revenues. The University of Chicago's Becker Friedman Institute, meanwhile, predicts that 42% of those hitting the unemployment roll will become permanent.

What's more, a new survey of more than 8,000 small business operators, conducted by Facebook, states that more than 28% of SMEs will suffer cash flow problems in the next few months - with 11% expecting to fail within the next three-months. Without immediate solutions, 52% expect to be out of business within six-months.

Risk managers and senior leadership must immediately improve their awareness of the scale, scope and impact of the coming surge in NPAs, and assist their firms in the identification and development of appropriate risk management and loss mitigation strategies. To date, insufficient discussion has taken place on viable strategies to identify, measure, manage and control the emerging credit risk challenges.

Parting Thoughts

The solutions to our economic malaise should be coming from the private sector and fiscal side of the national balance sheet, not simply from Jerome Powell's monetary playbook. As a community of risk professionals, it's up to us to restore market confidence, discipline and price discovery.

We cannot afford to bury our head in the sand and wait for the next government bailout. Without a viable organizational strategy for restoring SME health, the record increase in unemployment will have a catastrophic effect - not only on retail credit risk but also on main-street businesses.

Risk managers must advocate for improved measures to identify troubled (but viable) SMEs and work constructively to create meaningful recovery plans with these firms. This will not only help improve the labor conditions but also assist in moving the economy toward the path of reconstruction.

To forestall what otherwise will not just be a pandemic-induced financial crisis but also a labor and social disaster of Mephistophelian proportions, we must lift our heads out of the sand. Progressive and innovative actions are needed help our SME community.

Thomas Day is the Chief Credit Officer of Themis Capital Management Group. He is an engaged investor in distressed assets, and is highly interested and actively involved in digital smart-contracts that represent debt obligations. He is a leader of several business start-ups, and sits on the board of directors of two different organizations. He can be reached at tday@themis-capgroup.com and www.linkedin.com/in/thomaseday.