The Federal Reserve's signaling that future rate hikes are on hold is a relief to corporate borrowers who must refund debt over the next few years. But debt-refunding challenges have not gone away.

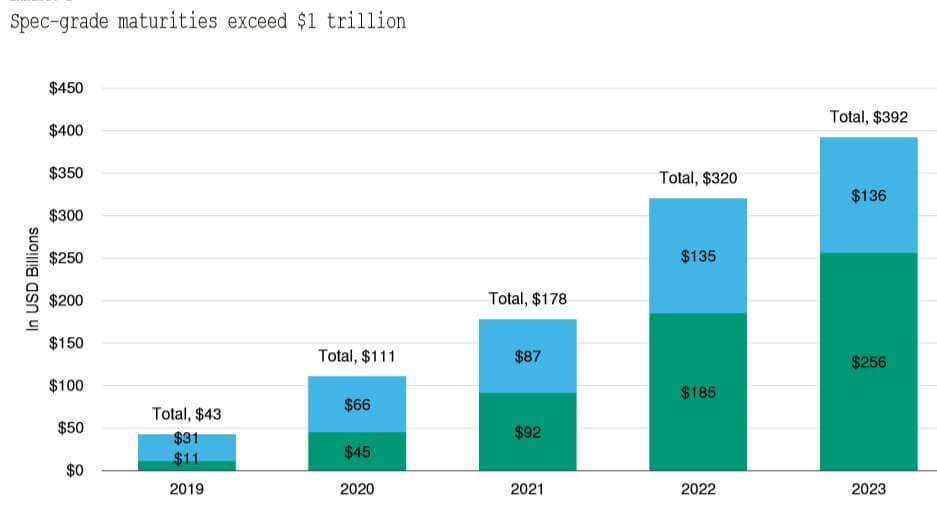

In two reports issued January 22, Moody's Investors Service noted that the volumes of speculative- and investment-grade debt maturing over the next five years have risen. Speculative grade has reached $1.044 trillion, up 6% from $988 billion last year, and down slightly from $1.063 trillion in 2017.

Maturing bank debt increased at a faster pace of 9%, compared to 2% for bonds.

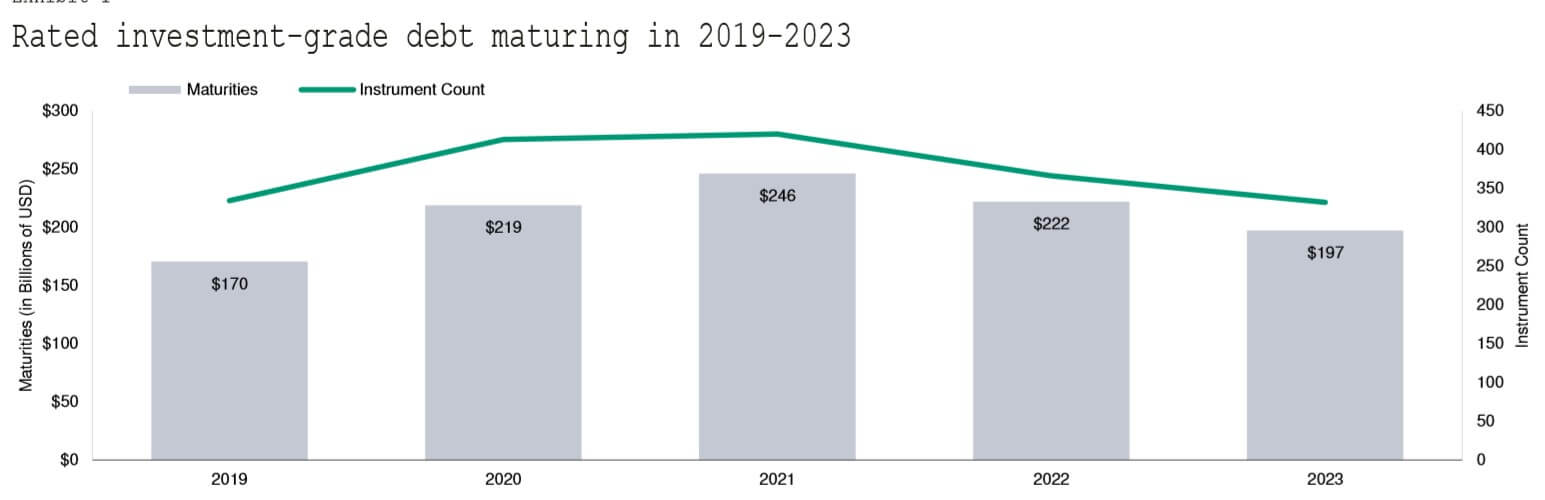

Investment-grade debt also topped $1 trillion, increasing 2% from last year, to $1.055 trillion, the highest level since Moody's began its refunding studies 11 years ago.

Those gains and other factors have increased refunding risk compared to a year ago.

“Market conditions are worse now, primarily because we've had an increase in market volatility and higher interest rates, and because there's increasing concern about an economic slowdown,” said Anastasija Johnson, senior analyst covering speculative-grade refunding risk at Moody's.

Company-Specific Indicator

Natalia Gluschuk, a Moody's analyst covering investment-grade refunding risk, said that along with those concerns, Baa-rated debt maturities, the rating agency's lowest broad investment-grade rating category, increased to 52% of overall debt from 49% a year ago, indicating greater company-specific refunding risk.

However, the lowest investment-grade rating, Baa3, where corporate issuers face the greatest risk of dropping to speculative-grade and refunding becoming more difficult, remained unchanged at 15%.

Gluschuk added that only $13 billion of Baa3 maturities, or about 1% of total investment-grade debt, carry a negative outlook or have ratings under review, compared to $26 billion last year.

In 2019, the first of the five years in which speculative-grade maturities total $1.044 trillion, companies have only $43 billion of maturities. That increases to $111 billion in 2020 and $392 billion in 2023. Nevertheless, $43 billion is the highest absolute amount Moody's has recorded in the first year of a five-year window.

Annual Figures Jump

“Compared to the total amount due, near-term refunding risk is low. However it's higher than it has been in the past,” Johnson said, adding that likely stems from issuers being unable or unwilling to refund their maturities in 2018.

U.S. speculative-grade bond issuance fell 40% in 2018 from the year before, to $163 billion, and there was no issuance at all in December, according to Dealogic. Lower issuance means the market may have difficulty digesting bonds that must be refunded.

“As a result, bond refunding risk - as measured by our Three-Year Refunding Indicator for December 2018 - is the highest since May 2009,” during the heat of the financial crisis, Moody's says.

The measure of the market's ability to absorb upcoming bond maturities through new bond issuance ended 2018 at 2.3 times, down 47% from a year earlier, and 61% below its long-term average of 6 times.

The rating agency reported February 11 that the indicator fell to 2.2 times in January, down 4% from the previous month and 51% year over year.

As of January 31, speculative-grade bond issuance was $16 billion, according to Dealogic. That's a recovery from December but well below the volume in January 2018, at $24.6 billion, and every January since 2011 - except for January 2016 when $8 billion in junk bonds were issued.

Dealogic adds that the measure does not capture companies refunding debt in the bank market instead. “Nevertheless, a combination of lower issuance, heavy maturities, climbing interest rates and widening spreads points to a more challenging refunding environment,” the report says.

Pull-Forward Effect

In addition, the relatively low level of debt maturing this year and next could be deceiving. Moody's notes that companies typically begin to address maturities well in advance, and that can be amplified by the “pull-forward effect,” when the borrowers refund several maturities in a single bank-credit agreement when the first one comes due.

“We estimate the pull-forward effect could increase near-term bank credit maturities by 74%, to $258 billion through 2021, from $145 billion,” the Moody's report says.

There is a risk that banks would be unwilling or unable to accommodate such an increase, particularly if the Federal Reserve's concerns about volatility increases and/or a slowing economy, expressed in its meeting, are realized.

Mortgage Securities

Commercial borrowers, however, are a diverse lot, and some market segments will be impacted more than others. Commercial mortgage-backed securities (CMBS), for example, will have $40.9 billion and $44.0 billion in debt maturing this year and next, respectively, according to data and analytics provider Trepp. That's much smaller than the approximately $130 billion “wall” that came due in 2016 and 2017, 10 years after the record issuance leading up to the Great Recession.

Joseph McBride, Trepp director, research and applied data, noted that rates unexpectedly increasing faster than property incomes could pose challenges for CMBS, but the market can digest what now appears likely to be a gradual increase. The severity of the last economic downturn, he said, has resulted in relatively strong CMBS underwriting overall: The loan-to-value ratio today is 60% today, compared to 70% leading up to the recession, and today's debt-service-coverage is around 1.8 to 2.0 times, compared to 1.4 times before.

In the lead-up to the recession, in some cases lenders were giving credit to commercial real estate (CRE) borrowers for future rent increases and other assumptions. That rarely happens today, McBride said, although valuations have climbed significantly, and capital is moving toward riskier projects.

“But if you're a B-piece buyer with the lowest chunks of the deal, and you see capitalization rates start to increase and net operating income and rent growth slow, then of course there will be some issues,” he said, adding that many factors today could dramatically change the economic outlook.

Interest-Only Issues

Some sectors and deal structures will be more vulnerable than others. Trepp's January report notes that loans against hotels, the property type that is most sensitive to cyclical and demand variability, “account for 31% of the maturing volume” over the next two years.

Moody's senior analyst Kevin Fagan said the rating agency views CRE valuations at peak levels today, while capitalization rates used to value the income of those properties are at record lows, with tight spreads in a rising interest-rate environment.

“We look at the effective leverage as being fairly high now,” Fagan said, adding that an increasingly important issue is the growing share of interest-only (IO) loans in CMBS deals, since the lack of amortization significantly impacts default and loss severity.

Although the Fed appears to have put the brakes on rate increases, Fagan said that should those rates continue to rise, it is unclear how CMBS will react, since the market is only 20-odd years old and has never experienced rising rates.

“If rates rise, and there's cash-flow volatility, property values have ticked down, and refi debt-service coverage is lower, borrowers can really run into issues when they refund,” Fagan said. “That's one of the main reasons we focus on IO so much.”