CECL and IFRS 9, a pair of next-generation accounting standards, were supposed to provide a solution to credit loss estimation problems that became apparent during the global financial crisis (GFC). However, the COVID-19 pandemic created loss-projection issues, and raised questions about the feasibility and effectiveness of standards that rely on forward-looking forecasts that are “reasonable and supportable.”

In the wake of the GFC, national and international accounting boards were concerned that financial statements failed to reflect the build-up in credit risk that had occurred in the leadup to the crisis. IFRS 9 and CECL were subsequently introduced – both of which required lenders to use expected future losses as the basis for loan loss-reserve calculations.

IFRS 9, which applies primarily to publicly-listed credit businesses outside of the U.S., was first implemented in January 2018. CECL, which applies to U.S. credit companies (e.g., banks/savings institutions/credit unions/holding companies), initially went live in Q1 2020. Now that we have some field experience with the new methods, are they fit for purpose?

CECL and IFRS 9 were designed to make financial statements more informative for investors by requiring lenders to reserve losses on the basis of reasonable and supportable forecasts. In addition, the use of downside scenarios was encouraged, reflecting the fact that recession-era credit losses often far exceed those observed during a marginal slowdown. These forecasts replaced the incurred loss framework that only recognized potential losses when they were confronted at the coalface.

But the pandemic yielded surprising credit-loss results that raised questions about the efficacy of the CECL and IFRS 9 methodologies. What does it take, for example, for a forecast to be considered reasonable? Moreover, how do unfolding events affect the horizon over which predictions can be supported?

Unexpected Loss Results Amid a Lockdown

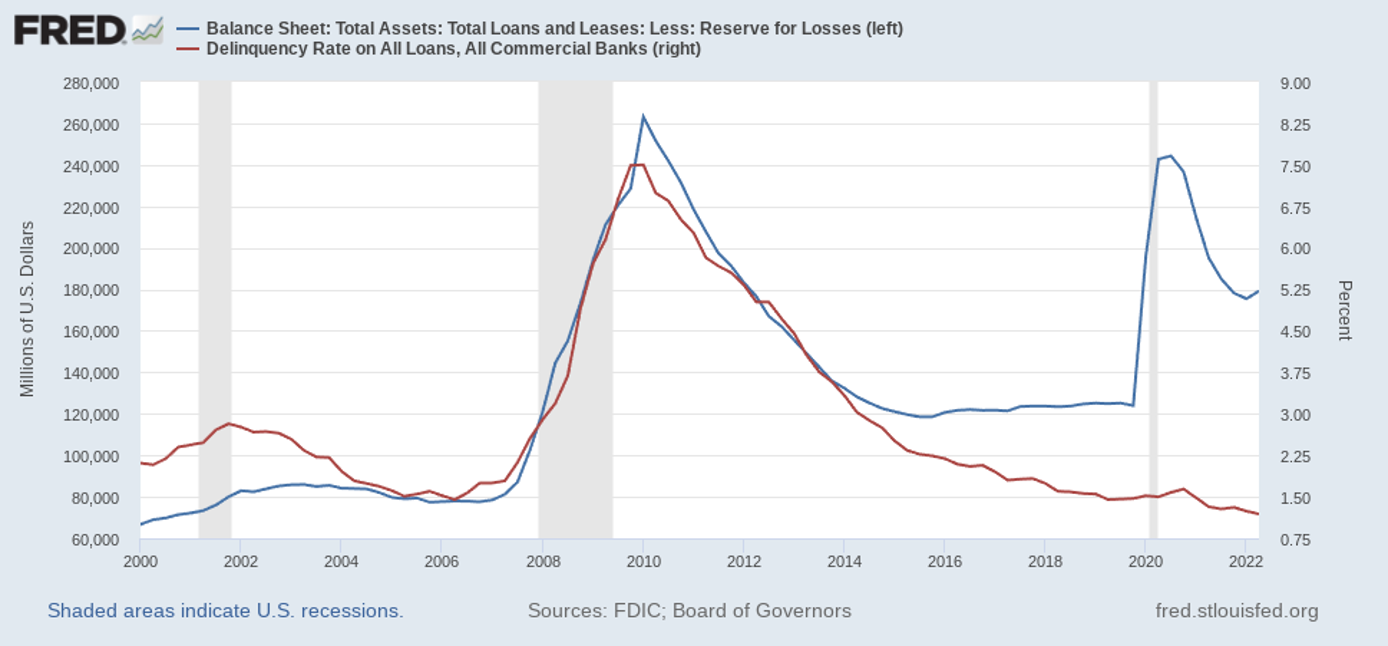

To recap, delinquencies and credit losses for U.S. commercial banks barely budged during 2020, and have since fallen to record low levels. This was despite a sharp recession triggered by the wave of lockdowns that occurred across the country and around the world. I use the U.S. as an example because of data availability and because, in my view, CECL is a more extreme protocol than IFRS 9, allowing ease of exposition.

Pandemic Impact: Reserves Leapt, Delinquencies Trended Down

At the start of 2020, the felicitous outcome depicted in the above chart seemed far from likely. In a recent article, accounting experts Ariana S. Pinello and Lee Puschover explored the financial statements of 25 large and midsize U.S. banks from the early months of the pandemic. They identified a number of features they described as “unexpected consequences” of the new (CECL-based) accounting rules.

In Q1 2020, CECL was barely up and running when the pandemic reached North American shores; late in the quarter, the WHO declared a global pandemic. Unemployment was rising and 2019-era models were predicting an implausibly rapid rise in credit losses.

At this precise time, we knew with some certainty that economic activity would be disrupted, that many would lose their jobs and that household income would be curtailed. A recession was a certainty, but its depth and duration were unknown.

It was also reasonable to surmise that there would be some sort of government support for businesses and households, since this was being discussed widely at the time. What’s more, we knew, or were at least very confident, that banks had not been lending recklessly in the months leading up to the pandemic.

But we had no experience of the behavior of loan portfolios under lockdown conditions. Indeed, we had not experienced a recession with a clearly identifiable starting point for many decades.

Recessions often completely spare large swathes of borrowers, but we had no way of knowing if a pandemic recession would be benign or malignant. Conservatively, large loss estimates were warranted – but, given the circumstances, we had little idea of what would actually happen to borrowers as the pandemic unfolded.

The Infeasibility of Loss Projections During a Pandemic

Put simply, the horizon for reasonable and supportable forecasts at the end of Q1 2020 was zero.

In Q2, economic signals were generally favorable, financial markets recovered, government assistance was passed and economic fears subsided. Pinello and Puschover pointed out that many banks increased their reserves in Q2, surmising that this was counterintuitive given the generally improving economic outlook.

Tony Hughes

They make a strong point: by this stage, the credit models backing loss calculations had been sidelined and banks were relying exclusively on subjective overlays. One suspects, therefore, that there was a strategic element in the construction of the loss-estimation numbers, as well as a large pinch of rank conservatism.

However, at the time, there was no clear signal for the future direction of the economy, and no evidence of any impact the pandemic could have on credit performance. The reasonable and supportable forecast horizon, therefore, was still zero.

Defining CECL/IFRS 9 Requirements

So, what makes a forecast both “reasonable” and “supportable”? When building quantitative models, we would normally determine “reasonableness” by checking out-of-sample forecast performance across a holdout sample. We would “support” the model by demonstrating that forecast accuracy is better than that produced by other methods.

The terms become very fuzzy, though, when we introduce purely qualitative approaches.

Suppose I had predicted a tiny total bump in credit losses back in March 2020 and based my IFRS 9 reserves on such a forecast. Would my auditor have signed off on the numbers? No way! At the time, my forecast would have been declared to be unreasonable – but it actually would have turned out to be extremely accurate.

The problem with the type of purely qualitative forecast that we saw during the pandemic is that if there is no track record of past forecast accuracy, and no way to ensure that the approach taken is consistent, there’s simply no basis on which to support the forecast.

Here’s an axiom to cover this situation: If you can’t build a valid quantitative model (e.g., in the aftermath of a never-before-seen extreme event), the reasonable and supportable forecast horizon, always and everywhere, is zero.

In short, loan loss estimates, especially for CECL, were unhinged during the pandemic. Consequently, those who were concerned with a ramp-up in earnings volatility prior to the introduction of the new methods have been fully vindicated.

The key remaining question is whether loss reserves can be reliably built prior to the onset of a recession. In the case of the COVID-19 crisis, given its wholly unexpected nature, this was obviously not possible.

Parting Thoughts: Persisting Problems

Are investors now better informed about expected credit losses?

Under the incurred-loss methodology, with default rates effectively flat amid the pandemic, reserves would have been stable, just like actual losses. The old method – while unquestionably reactive – held the advantage of being simple, consistent and grounded in actual observations of borrower performance.

Under the new methods, reserves reflect the sentiments and needs of managers and various executive committees. Especially under the CECL protocol, reported earnings have fallen significantly, then rebounded, then fallen again, though bank health has been basically solid throughout the pandemic.

The headline numbers are so noisy and the methods used by different banks so idiosyncratic that it’s difficult to compare peers or to identify changes in the make-up of rival portfolios. This may change as the system beds down, but the subjectivity we witnessed in the early days of the recession is likely to be a lingering problem for CECL and IFRS 9.

Tony Hughes is an expert risk modeler. He has more than 20 years of experience as a senior risk professional in North America, Europe and Australia, specializing in model risk management, model build/validation and quantitative climate risk solutions.

Topics: Default