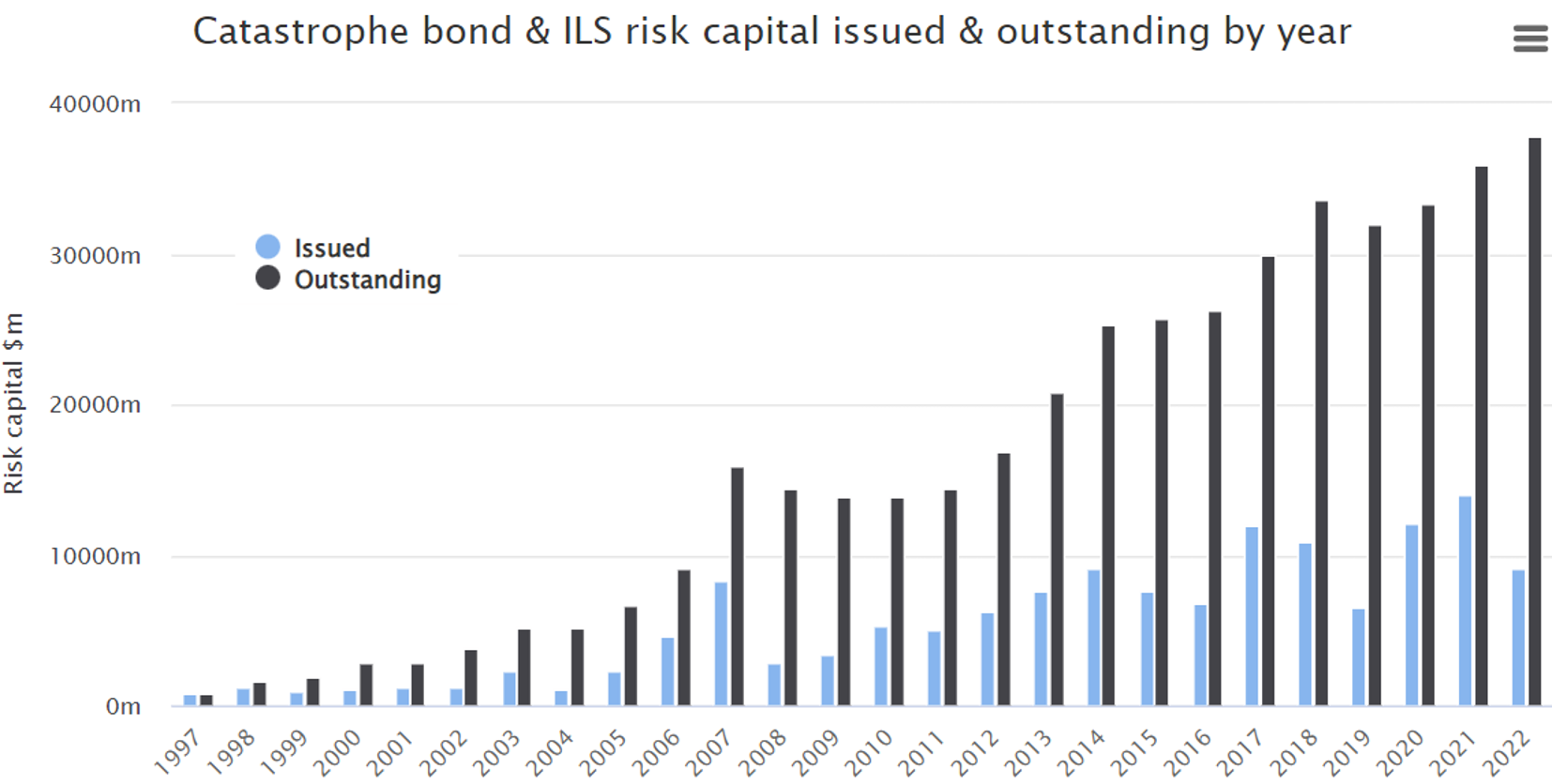

Catastrophe (cat) bond and insurance-linked securities (ILS) issuance appeared to be on its way to a record this year. That was before Hurricane Ian, a game changer that may hinder start-of-year renewals as well as the issuance of long-anticipated cyber cat bonds, still expected in 2023.

Until Ian struck in September, the market was on track to exceed 2021’s record $12.8 billion in new issuance. Jin Shah, managing director, capital markets and resilience at Moody’s Analytics company RMS, attributed the trend to relatively few catastrophic events, better returns, and the securities’ being uncorrelated with volatile financial markets.

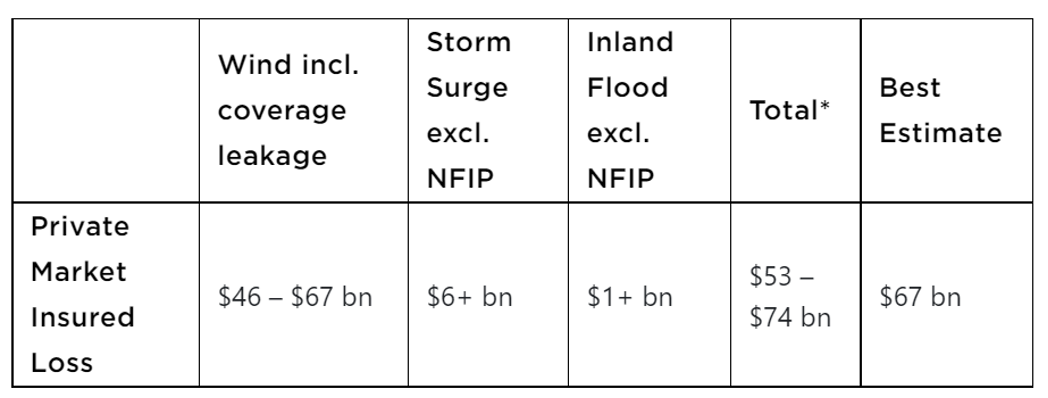

RMS in October estimated private-market insured losses from Ian between $53 billion and $74 billion. That was within the scope of RMS models’ risk distribution, Shah said, but it will have a material impact on the ILS market, including cat bonds.

“Some cat bonds are likely to default or be impaired,” he said, meaning that capital invested in those securities becomes trapped for several months or longer until claims fully develop. “Everyone is already searching for new capital,” Shah noted, “so there’s going to be even further hardening of the market, which will offer investors a greater return potential.”

Excluded from RMS’s estimate of Hurricane Ian losses (* rounded to nearest billion) is an additional $10 billion to the National Flood Insurance Program (NFIP) that could result from storm surge and inland flooding.

Market-Altering Factors

Demand for catastrophe-risk protection remains strong, stretching into 2023, said Paul Schultz, CEO of Aon Securities. “All things being equal for risk managers as they look forward into 2023, we anticipate a very active year in cat bonds.”

ILS and cat volume was $9.1 billion through mid-November 2022, according to ILS-focused information service Artemis, with a handful of deals launched since Ian.

A variety of factors in play could reshape the market. On the deal-supply side will be cedents’ willingness to pay insurance rates that have already climbed significantly this year and may ramp up further in the ILS market as losses are tallied from Ian, and more recently the smaller but still impactful Hurricane Nicole.

“If you’re a risk manager, given the reported capacity constraints in the traditional reinsurance market and the consequently higher cost of transferring risk in certain lines, it would seem prudent to be considering utilizing other sources of risk transfer capital,” Schultz said.

He added that the mark-to-market impact on outstanding cat bonds – a preliminary loss measure – is approximately $2.5 billion out of a $36 billion total. That is about 7%, roughly in line with cat bonds’ average coupon of 6.5%, indicating that Ian’s losses alone will essentially erase 2022 cat bond earnings and put a damper on the market.

Source: Artemis

Source: Artemis

Capacity Constraint

The terms reached on several cat deals launched as of mid-November, with more expected by year-end, will more clearly reveal how the market is adjusting. The biggest challenges could lie on the deal-demand side, given protection providers’ limited capacity.

Luca Albertini, CEO and founding partner at Leadenhall Capital Partners, an asset manager specializing in ILS, said that market participants attending conferences in late summer were already discussing market dislocation capacity issues. Buyers of protection were seeking several billion dollars in additional capacity, driven mainly by inflation increasing values of insured properties, Albertini said, while reinsurers and ILS investors signaled insufficient ability to provide it.

Add in losses from Ian and “trapped collateral in the capital markets,” Albertini said, “and that means our capacity in January will be down,” in turn potentially impacting renewals at the start of the year and perhaps having longer-term effects.

Limited Maneuverability

John Seo, co-founder and managing director of Fermat Capital Management, said the ILS market’s capacity woes originated more than a decade ago, when insurers reduced their use of reinsurance. Reinsurers then pursued riskier investments to bolster capital returns and transferred part of that risk to ILS investors. Rising losses from catastrophic events in recent years have left both sources of risk transfer weaker from capital and capacity standpoints.

John Seo, Fermat Capital Management

A healthier ILS market could normally have handled Hurricane Ian, a single-event loss, by mobilizing additional capital through “sidecar” private investments, issuing more ILS, or even forming a new reinsurance company. However, the industry’s significant capital challenges limited those options.

Ian “was like punching someone in the ribs who has already had several broken,” Seo said.

Recent hurricanes may be the driver of current ILS capital challenges, but the limited capacity hinders coverage of other perils such as earthquake and wildfire. It also inhibits increasing coverage of cyber risk, which has been on the ILS short list for several years.

The Cyber Gap

Even with cyber losses estimated at trillions of dollars annually, and major market participants including Swiss Re and Aon expressing support for cyber ILS, it has only appeared in scattered private transactions or been included in deals covering broader operational risk, according to Artemis.

“Cyber is promising, but risk capital in such short supply has put a damper on it,” Seo said.

Fermat Capital recently invested in Elpha Secure Technology, an insurtech start-up combining cybersecurity software with risk transfer, and has licensed models from cyber-risk analytics company CyberCube.

Still, said Schultz, investor education about cyber risk and modeling have reached a point where he feels confident about completing a cyber cat bond in 2023. He said Aon Securities has identified 12 to 16 managers who would consider underwriting cyber risk.

Long Tail and Concentration Risk

An August S&P Global Ratings report noted several disincentives for ILS investors taking on cyber risks, including the more capital-intensive nature of cyber risk compared to pure property-catastrophe insurance, “since the third-party risk implies a longer tail.”

In addition, unlike natural catastrophe risk that tends to be spread over regions and perils, the fluid nature of cyber risk suggests it can become highly concentrated in a portfolio.

“As is evident from attacks like NotPetya and WannaCry, there is significant accumulation potential due to increasing digital interconnectivity and interfaces along multiple supply chains,” the report says.

Albertini at Leadenhall agreed that there is a potential for cyber concentration risk, as well as geopolitical risk given that state actors such as Russia and China continually seek to penetrate cyber defenses. He said his team does not have the expertise to analyze those risks properly and is focusing instead on the natural catastrophe risks it understands.

Nevertheless, he added, there may be investors whose business plans do focus on cyber risk assets and their potentially attractive returns.

“If a cyber deal is going to be launched, it may be bought by investors who have raised money with also a focus on non-natural catastrophe perils,” Albertini said.

Topics: Default