Smaller banks may get three more years to comply with the new Current Expected Credit Loss (CECL) accounting standard, but other banks still will have to adopt it next year, even as more of them estimate double-digit increases in loan-loss reserves.

Meanwhile, the Financial Accounting Standards Board, which issued the credit-loss standard in 2016, is under fire from trade associations that support legislation calling for a delay in CECL implementation and a study of its impact, and from other critical voices.

William Isaac, a former Federal Deposit Insurance Corp. chairman, and Thomas Vartanian, a George Mason University law professor and executive director of its Financial Regulation and Technology Institute, wrote in a July 23 Washington Times article that “CECL needs to be reconsidered in depth.”

They recalled, “A similar rush by FASB in the face of unanswered concerns resultaed in disastrous financial consequences in 2008,” when the standards board redefined mark-to-market accounting in the face of warnings from the banking industry. That resulted in “massive write-downs of loans by bank and non-bank lenders alike. Accounting or paper losses of $500 billion in U.S. banks triggered a global financial crisis that required a decade to work its way through the economy - a lost decade that brought irreparable harm to millions of people.”

Isaac and Vartanian stated that after Congress held hearings in 2009 and demanded that FASB and the Securities and Exchange Commission amend how credit losses for securities are recorded, “FASB reluctantly agreed, and it is no coincidence that the start of the current and longest bull market in history began at that point.”

A Q&A from FASB

Although long critical of CECL, which becomes effective January 1 for calendar-year-reporting companies, the biggest U.S. banks appear to have largely reconciled themselves to developing sophisticated systems to comply with the standard. They must recognize on day one the credit losses expected over the life of a loan.

On July 17, FASB proposed delaying the effective dates for four major standards, including a three-year CECL delay for smaller reporting companies as well as private companies and other non-SEC filers. Jonathan Prejean, a managing director at Deloitte, noted that on the same day FASB issued a Q&A addressing CECL concerns, also seemingly aimed at smaller banking institutions and emphasizing that they can use judgment in the methods to make their loan-loss estimates.

“You're still going to have to support adjustments to your forward-looking information, why you're making the adjustments and so on,” Prejean said. “But you don't have to have a forecasting model. Larger institutions are already going down the path to using some type of quantitative macro forecast, and they're comfortable with that.”

Questions of Judgment

Systems to generate such macro forecasts typically require significant resources to develop and run, so FASB's clarification may come as a relief to smaller lenders, if not other segments of the industry. Michael Gullette, senior vice president, accounting and tax at the American Bankers Association, said the Q&A “ignores the practical realities coming from auditors, examiners, and analysts that 'judgment' and 'qualitative adjustments' will largely eliminate the need to provide quantitative support for CECL.”

Gullette said new auditing standards “emphasize skepticism,” and a Big Four accounting firm that works with large and small banks told the ABA that “no longer is 'expert credit judgment' sufficient.”

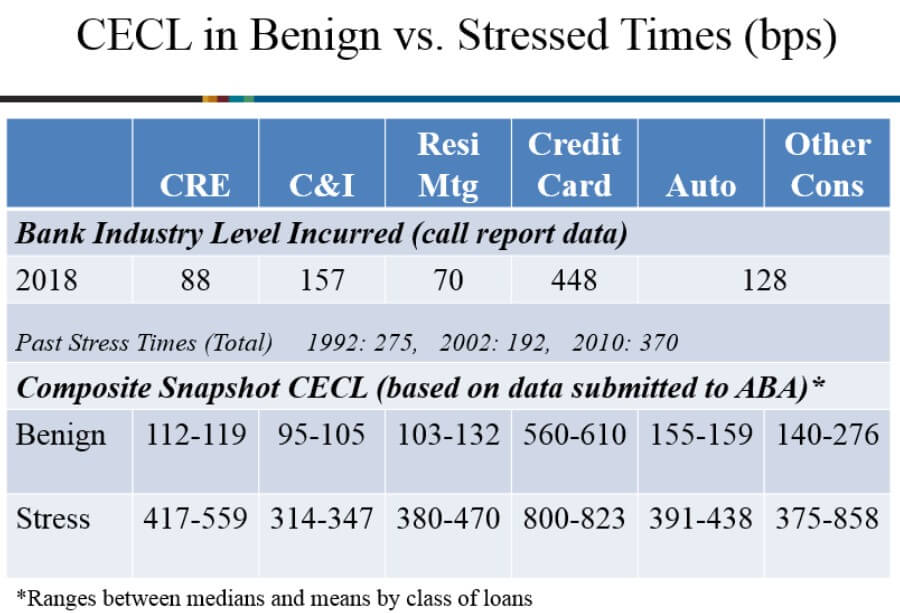

He added that in a rare example of guidance on CECL, FASB had said that the Weighted Average Remaining Maturity (WARM) method, using an average annual charge-off rate to estimate credit losses, may be acceptable. However, current aggregated WARM estimates for commercial and industrial loans indicate one to three basis points of loss, but estimates from banks are 95 to 105 basis points (see ABA table below).

“There has to be some kind of quantitative support that gets a bank from 3 to 100,” Gullette said. “No auditor will say, 'Just add 97 basis points for credit judgment.'”

Lenders' Estimates

Among the sizable lenders that have estimated the impact of CECL, Discover Financial Services said recently that it could increase loan-loss reserves by 55% to 65%, depending on the shape of its portfolio when the standard takes effect. Synchrony Financial reported that its second-quarter allowance for loan losses would have been 50% to 60% higher under CECL.

The new standard is expected to have a bigger impact on banks with large credit card portfolios, because the open-ended nature of those credits makes it difficult to estimate future losses.

Earlier this year, Citigroup and JPMorgan Chase & Co. estimated smaller, though double-digit, increases in allowances. But Wells Fargo & Co. saw its reserves decreasing by as much as $1 billion.

Analytical Drawbacks

Critics worry that CECL will result in banks having lower reserves when the economy enters a downturn, then having to increase them significantly precisely when businesses need the capital.

Franklin Templeton and Capital Group have submitted letters to FASB expressing concerns about CECL reducing investors' ability to analyze banks' credit risk and impacting the cost of capital for businesses. “Stop and study” bills introduced in the House and Senate call for quantitative studies on CECL's effects on bank capital and the economy as a whole.

In July 17 statement about the CECL delay for smaller banks, Rob Nichols, American Bankers Association president and CEO, said FASB's vote to delay CECL for certain smaller banks is “proof that the required efforts to implement this costly standard are far greater than the board has previously led bankers to believe.”

“The delay should apply to banks of all sizes, and should be used to conduct a rigorous quantitative impact study to properly assess the effect this new standard will have on their ability to serve their customers and the broader economy, particularly during an economic downturn,” Nichols said.

An Independent Community Bankers of America statement supported the delay and reiterated the group's support for the proposed legislation. “ICBA has worked with FASB officials since 2011 to achieve several substantive improvements to CECL and will continue to press for a more flexible CECL environment for the nation's community banks,” the association said.