- FRM

- SCR

- Risk & AI

- Membership

- Insights & Events

- About Us

The Russian invasion of Ukraine and the resulting sanctions imposed on Russia have impacted organizations in significant ways and created a range of challenges for financial risk professionals. To better understand how risk managers and their firms have been — and expect to be — impacted by the conflict and sanctions, GARP surveyed over 850 Financial Risk Managers (FRM®) across the globe for their current outlook. The survey asked participants to report on several important issues, including the impact of the invasion relative to major areas of risk, evaluation of firm preparedness, the risk outlook, and key lessons learned.

The survey specifically captured the perspective from risk managers at firms that have a range of direct and indirect exposure to Russia and Ukraine. Roughly 25% reported that their firm has significant or moderate direct and indirect exposure to Russia and had existing operations in Russia prior to the invasion, while roughly 15% reported that their firm has significant or moderate direct and indirect exposure to Ukraine and had existing operations in Ukraine prior to the invasion. Many of these firms had exposure to both Russia and Ukraine.

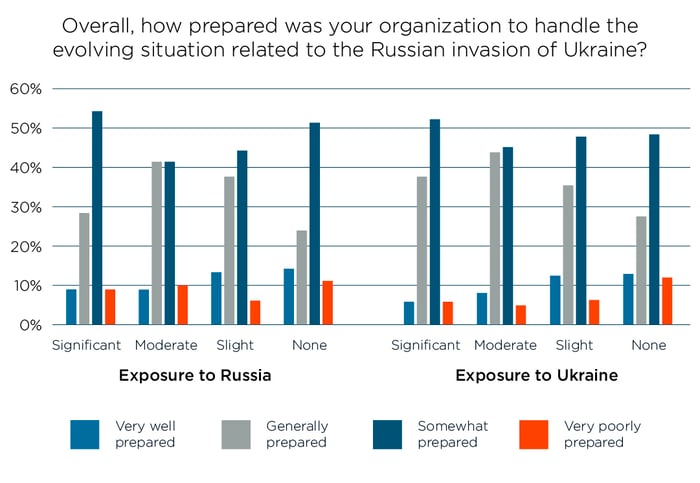

Respondents indicated that firms were generally not very well prepared for the evolving situation related to the Russian invasion of Ukraine. Most respondents revealed that, while their firms had considered the possible conflict, they were not expecting the situation to evolve as it has. Respondents from European firms indicated an overall lower level of preparedness than respondents from either Asia or the Americas. A general lack of preparedness was also reported amongst firms with moderate to significant exposure to Russia and Ukraine.

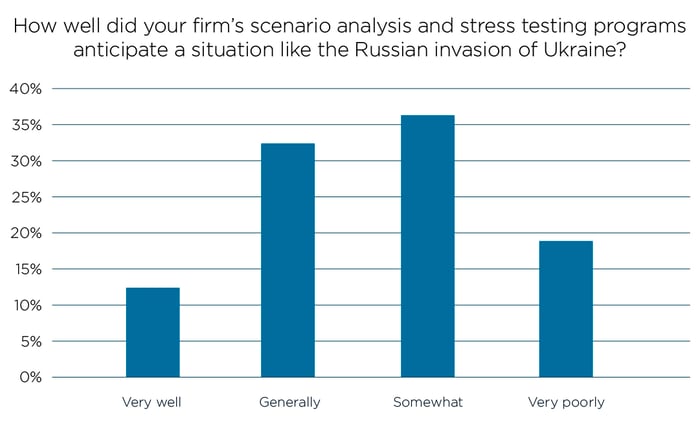

It’s not surprising that few firms appear to have been very well prepared for the conflict, given that most respondents indicated that their firm’s scenario and stress testing analysis only “somewhat” or “very poorly” anticipated a situation like the Russian invasion of Ukraine.

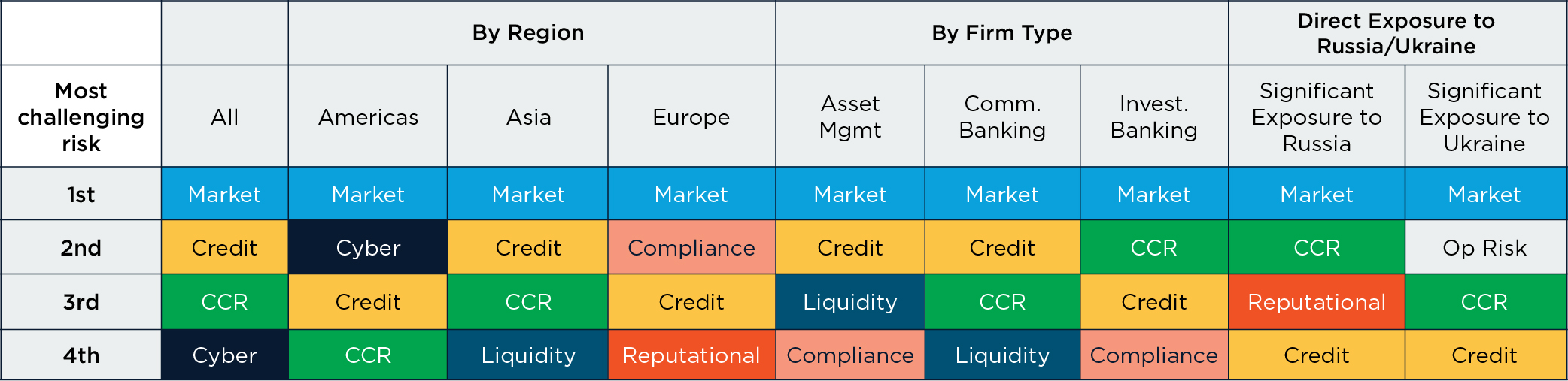

Market risk has been the most challenging risk to manage across all regions, company types, and levels of exposure to either Russia or Ukraine, but the next three most challenging risks varied. Credit risk and counterparty credit risk were also consistently challenging domains across most subgroups, but high rankings of other risk domains by particular respondent subgroups are interesting:

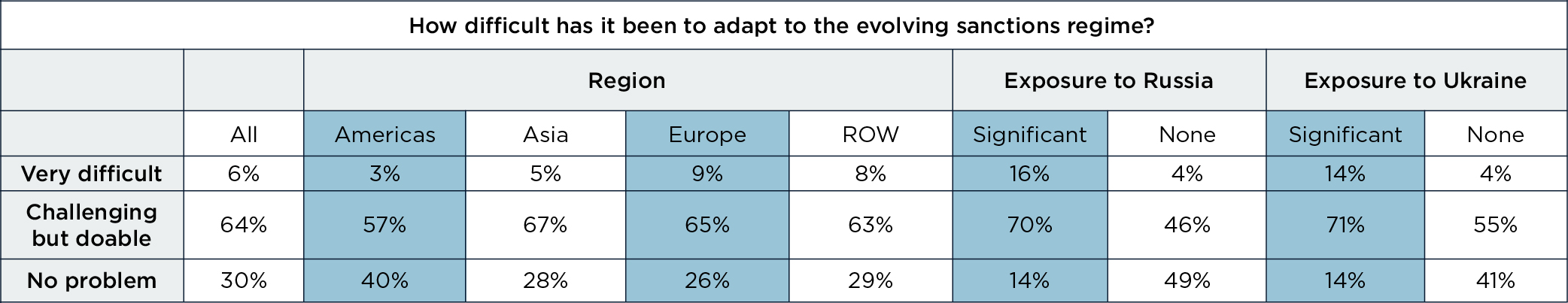

Almost two-thirds of respondents indicated that adapting to the evolving sanctions regime has been challenging but doable. Respondents from European firms and firms with significant exposure to either Russia or Ukraine indicated a slightly higher level of difficulty in adapting.

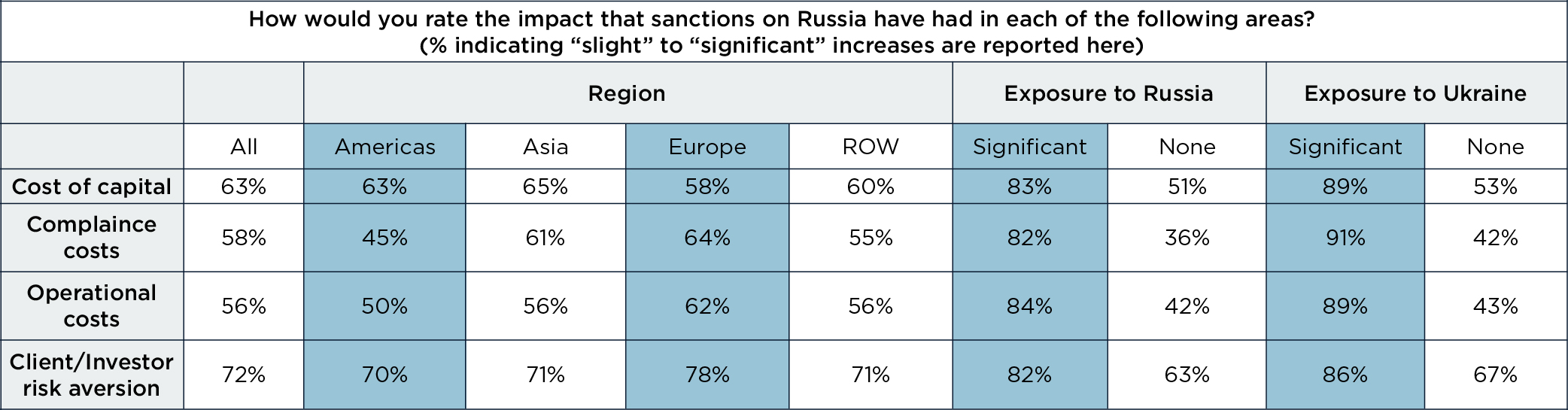

Most respondents indicated that sanctions have resulted in increases in their firm’s cost of capital, compliance costs, operational costs, and levels of client and investor risk aversion, with the rise in risk aversion being noted by almost three-quarters of respondents. For European firms and firms with exposure to Russia and Ukraine, these impacts were even more pronounced.

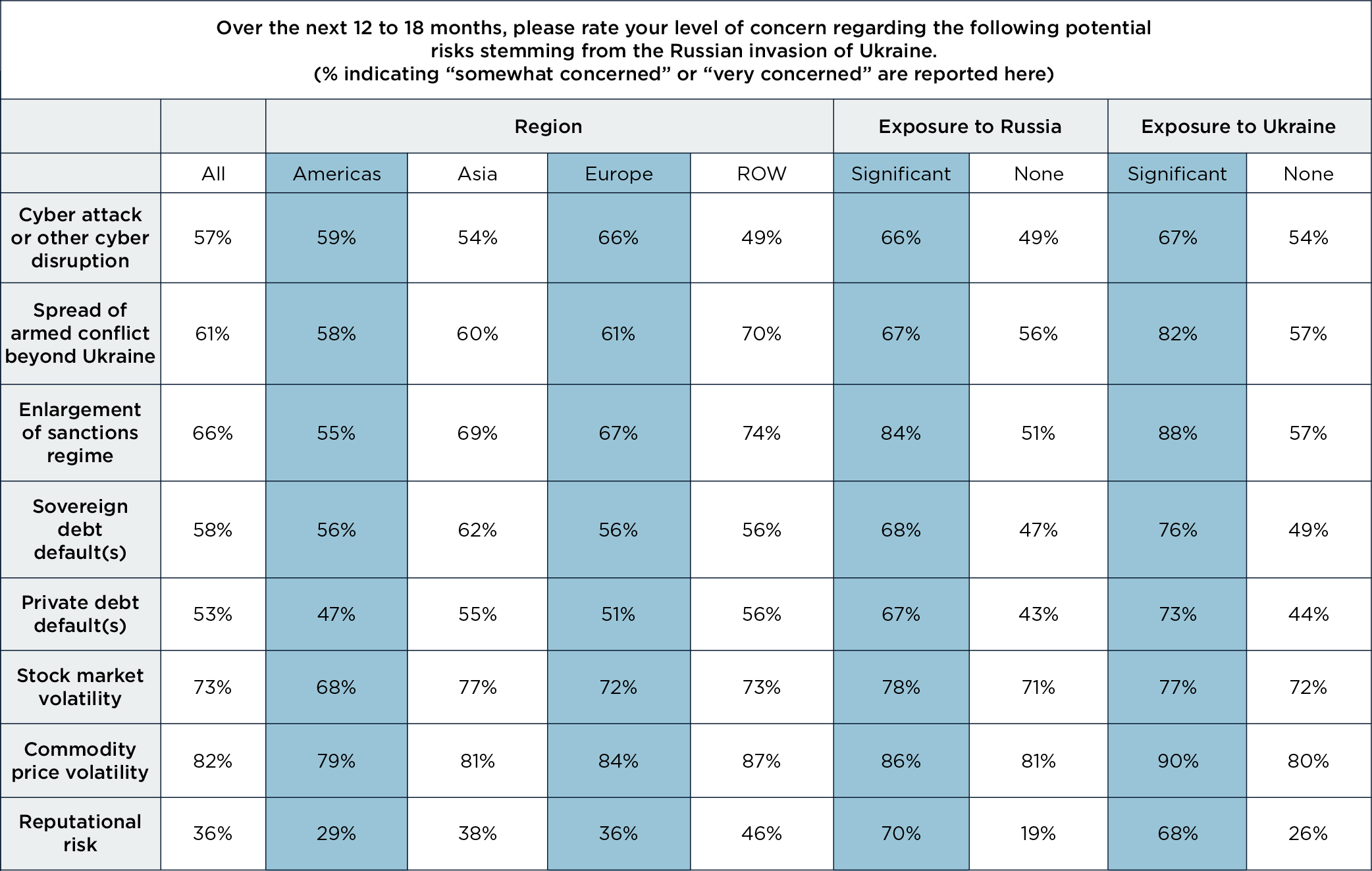

Looking out over the next 12 to 18 months, respondents overall indicated that commodity price volatility and stock market volatility were their biggest concerns followed by an enlargement of the sanctions’ regime. While concerns over commodity price volatility and stock market volatility were high across both geographic and exposure subgroups, concerns about an enlargement of the sanctions’ regime were more dependent on firm exposure to Russia or Ukraine. Sovereign debt default also appeared to be a significant concern for respondents whose firms had significant exposure to Russia or Ukraine.

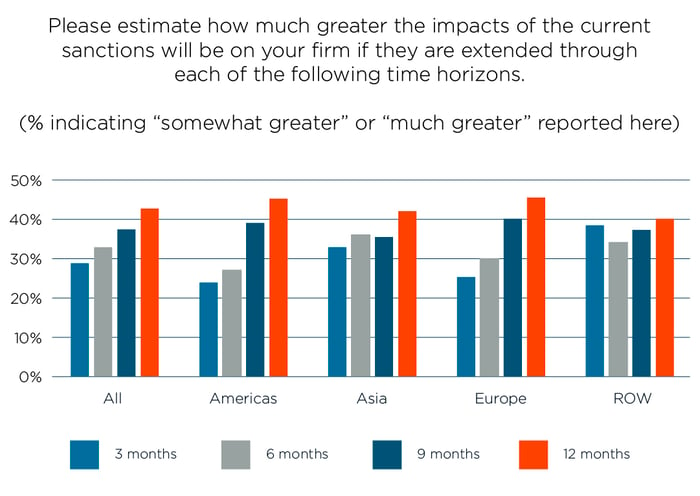

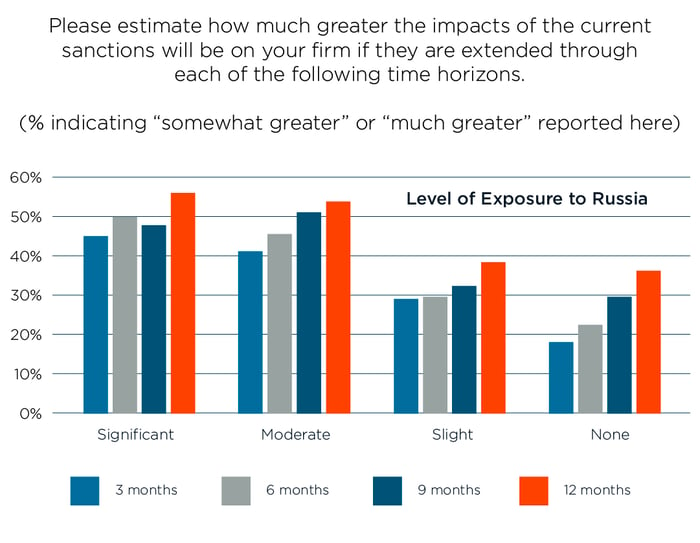

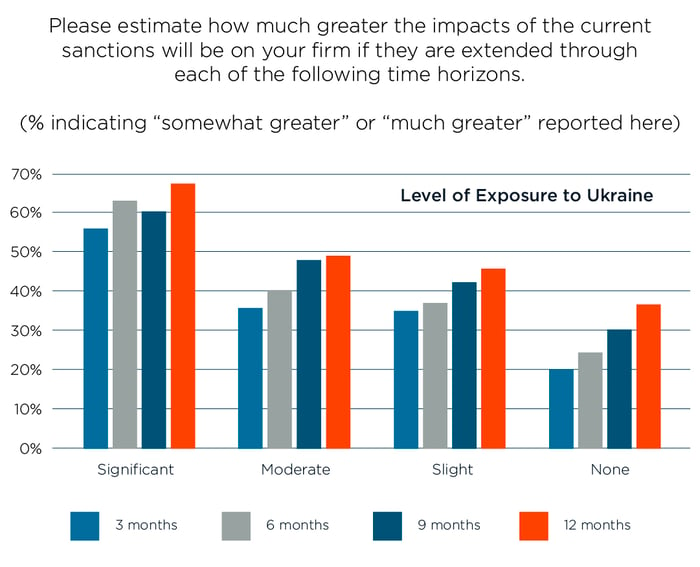

Respondents indicated that the impacts of current sanctions would increase meaningfully with time, as over 40% said that the impacts would be “somewhat greater” or “much greater” if the sanctions were extended for 12 months. Concerns about the impact of longer-term extensions of the current sanctions’ regime appeared meaningfully higher for firms with significant exposure to Russia or Ukraine.

Respondents were asked to provide their perspective on the most important risk management lessons learned so far from Russia’s invasion of Ukraine.

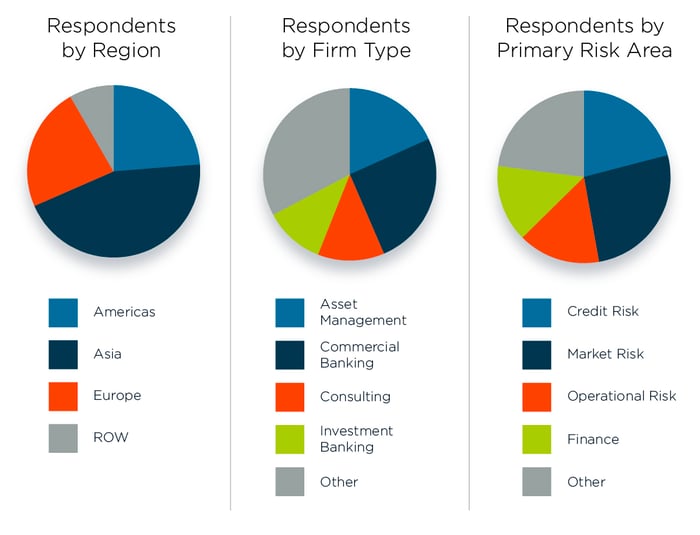

Over 850 FRMs participated in this survey representing a broad swath of risk managers across the globe, financial services firms and risk disciplines, as shown in the respondent breakdowns by region, firm type, and primary risk area in the charts below.

In addition, roughly two-thirds of respondents work at large firms (greater than 1000 employees) and roughly two-thirds have more than five years of risk management experience.

•Bylaws •Code of Conduct •Privacy Notice •Terms of Use © 2024 Global Association of Risk Professionals