- FRM

- SCR

- Risk & AI

- Membership

- Insights & Events

- About Us

With the London Interbank Offered Rate (LIBOR) used as a key benchmark in risk management models, mortgages, corporate bonds, and interest rate and currency swaps, there is concern the LIBOR cessation and move to alternative risk-free rates (RFRs) to limit market manipulation will create disruption at top financial firms. To gauge how risk managers perceive the transition to a post-LIBOR world, GARP surveyed nearly 600 Certified Financial Risk Managers (FRM®) across the globe for their immediate outlook.

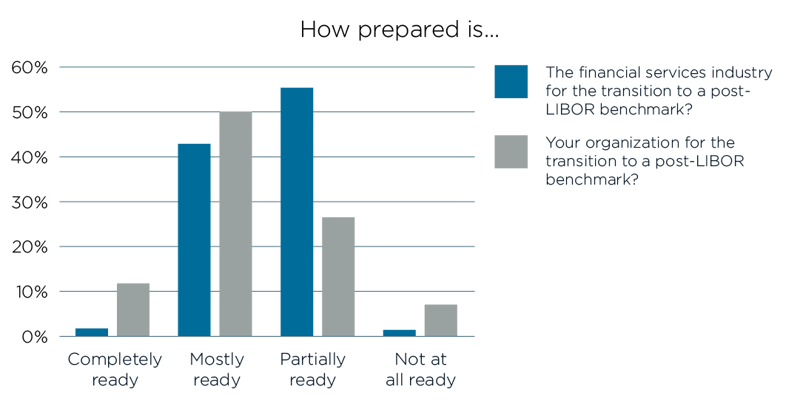

Fewer than 50% of respondents believe the financial services industry overall is “completely” or “mostly” ready for the transition to a post-LIBOR benchmark.

Although respondents were overall more positive about the readiness of their own firms, only around 10% of FRMs believe their firm is “completely” ready for a post-LIBOR benchmark.

Respondents from government/regulators (75%) and consulting firms (71%) were most sanguine about their company’s preparedness for the LIBOR transition, while those from insurance (58%) and accounting/auditing (50%) were least optimistic.

Overall, respondents reported that less than half of the relevant people in their organization understand the mechanism for setting the new RFR most relevant to their firm. Almost one-third of respondents, moreover, reported that the mechanism is understood by 25% or less of key employees.

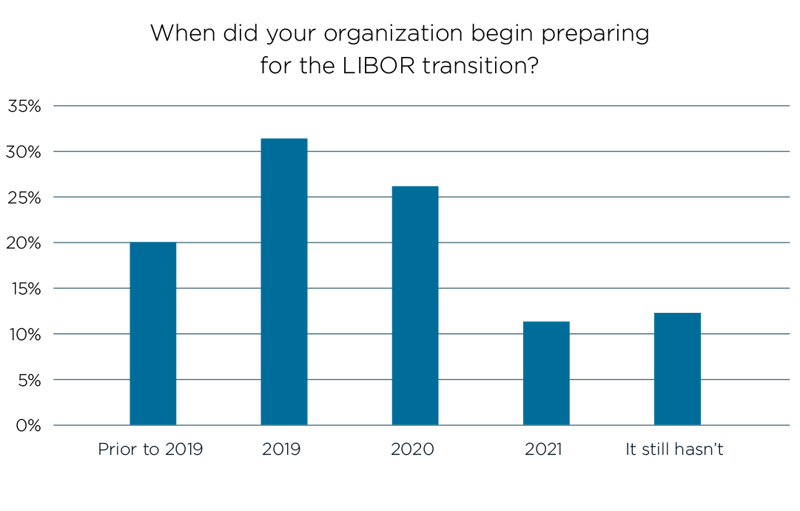

While many respondents say their firms began preparing for the LIBOR transition in 2020 or before, almost 25% did not begin until this year, or have not begun at all. Only 20% started to get ready for the transition prior to 2019.

This “late start” was reported most at asset or capital management firms (37%) and least at commercial banking firms (15%). Firm size also seemed to play a role, as a greater number of larger firms were reported to have started preparing earlier for the transition relative to smaller ones.

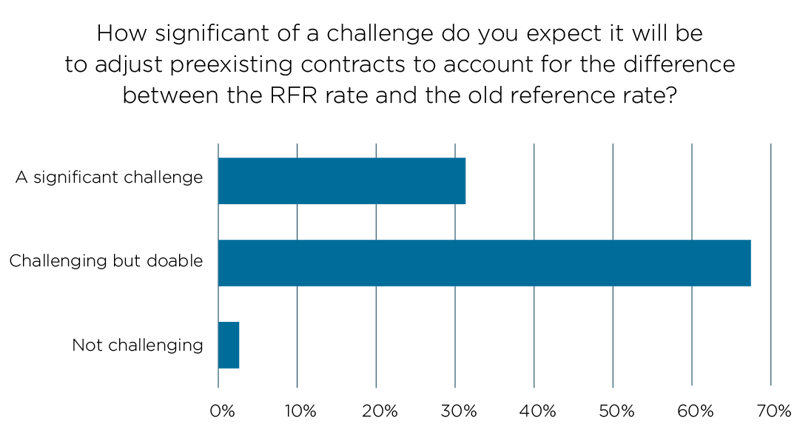

Though most respondents expressed confidence that adjusting preexisting contracts to account for the transition to new RFR could be done successfully, 30% thought it would present a “significant challenge.”

Over 33% of respondents identified the lack of a robust term-structure as a significant short coming of the new RFR, while around 60% found the lack of historical data to be its most pressing issue.

Nearly 70% of respondents think there are still some term-structure issues that need to be worked out before LIBOR replacement rates can be deemed satisfactory from a term structure perspective.

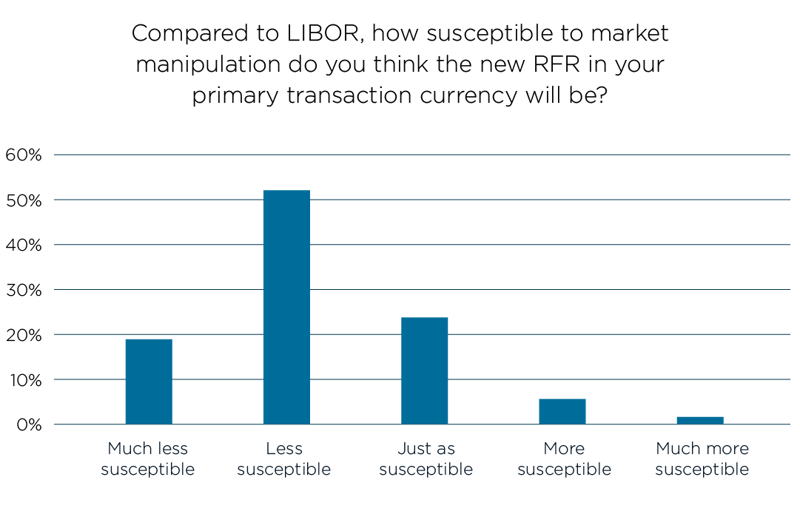

As concern over market manipulation was one of the drivers to replace LIBOR, it is important to note that, while some remain skeptical, slightly over 70% of respondents believe the new RFRs will be less susceptible to market manipulation than LIBOR.

•Bylaws •Code of Conduct •Privacy Notice •Terms of Use © 2024 Global Association of Risk Professionals