Assessing Today’s Outlook on Model Risk Management

October 12, 2022

The Risk Snapshot Series highlights key insights from GARP’s quarterly survey of Financial Risk Managers (FRM®) about critical risk issues global risk managers and their organizations are navigating.

Model risk management has come under increased pressure in recent years. The growing use and complexity of models have coincided with heightened regulatory demands related to FRTB, CECL/IFRS-9, and climate-related stress tests. Large, unexpected shocks such as the COVID-19 pandemic, the Russian invasion of Ukraine, and the rapid rise of global inflation have further strained the predictive models of financial institutions and created a range of challenges for risk managers related to model risk management.

To better understand how such events have affected model risk management within firms, GARP surveyed Financial Risk Managers (FRMs) across the globe for their current outlook. The survey asked participants to report on several important issues, including model culture, model performance, model development and validation, model risk management, and future model risk challenges.

Key Insight #1 – Favorable View of Model Performance in Key Recent Events

Respondents generally viewed model performance positively across the major risk domains during recent challenging global risk events, including the COVID-19 pandemic, the Russian invasion of Ukraine, and the 2022 inflation spikes. Participants were asked how well their firm’s risk models performed in each case and responses were gathered for credit, market, operational, liquidity, and non-financial risk. Across all events and risk domains, roughly 45% of respondents rated the performance positively (selecting either “somewhat well” or “very well”) versus roughly 15% who rated the performance negatively (selecting either “somewhat poorly” or “very poorly”). Relative to the performance ratings for COVID-19 and the 2022 inflation spikes, model performance for the Russian invasion had a slightly higher percentage of positive ratings and slightly lower percentage of negative ratings.

Key Insight #2 – Increasing Pace of Model Development and Validation

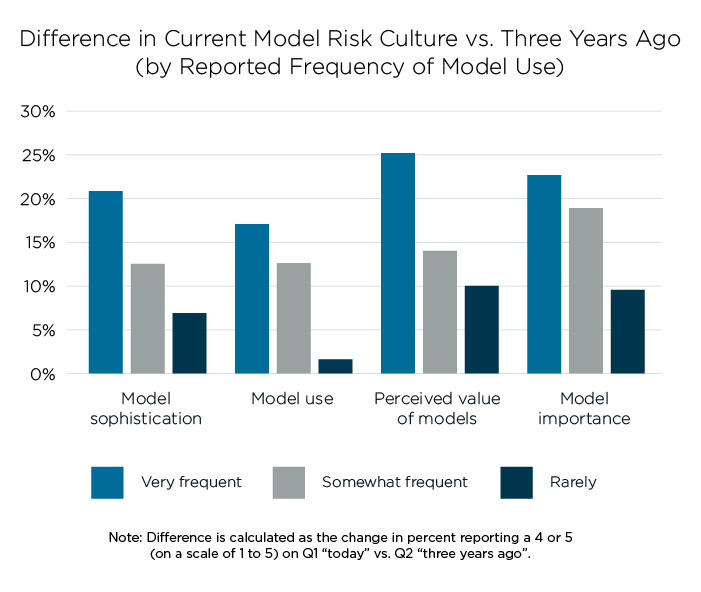

When asked to describe their firm’s current model risk culture as well as the culture that existed three years ago, respondents indicated a meaningful increase in the importance, perceived value, usage, and complexity of models. These increases were evident regardless of the respondents’ reported frequency of model use but were most pronounced among heavy model users.

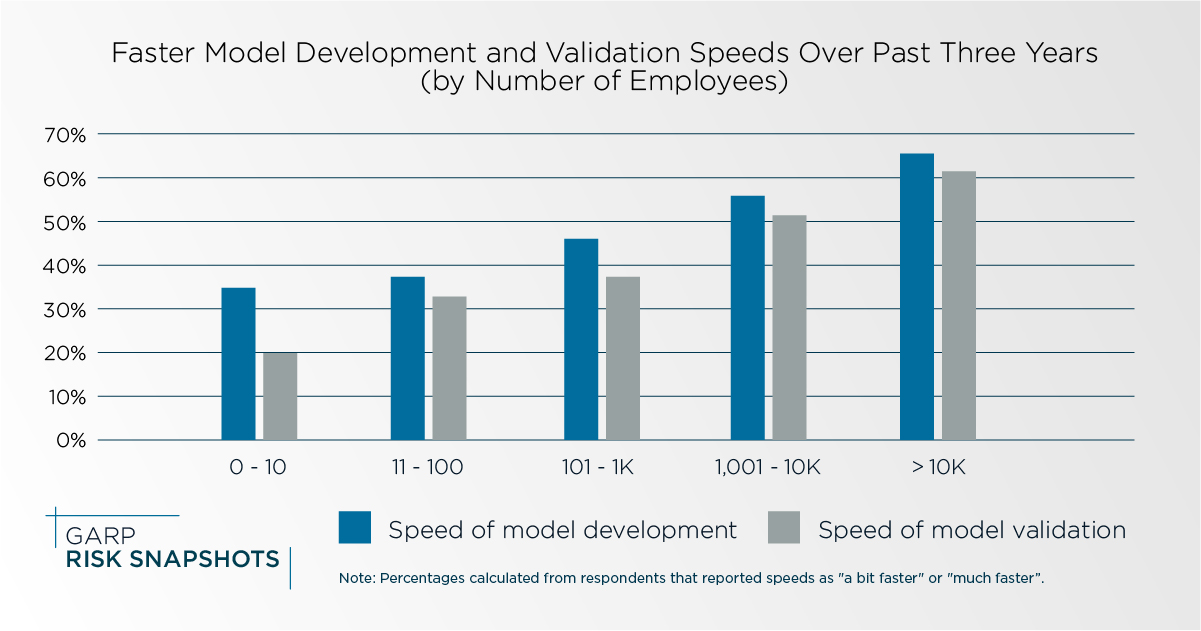

Respondents reported that the speed of model development and model validation had increased over the past three years. These increases were evident regardless of firm size but rose as firm size increased.

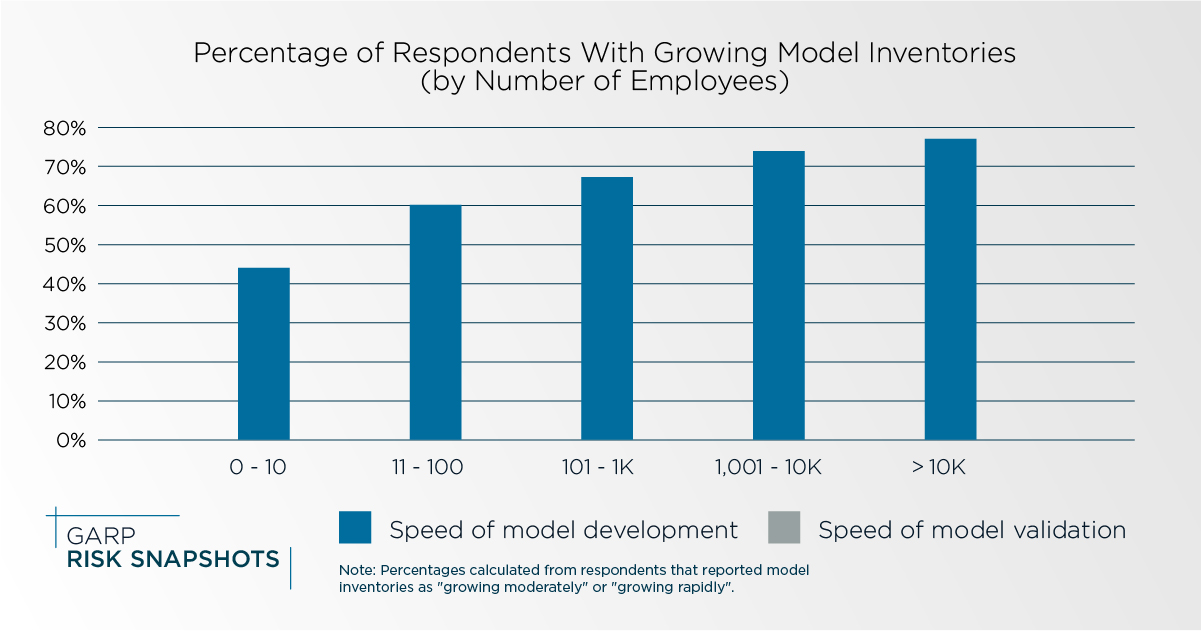

One measure of the increased use of models — model inventories — was reported up between 40% and 80%, with greater growth at larger firms.

Key Insight #3 – Weaker Validation of Third-Party Models

The vast majority of survey respondents (93%) reported that their firm uses models developed by vendors or other third parties; more than half (54%) indicated third-party model use was “somewhat” or “very” frequent. However, over one-third (36%) indicated that their third-party models are not validated to the same level of in-house models.

Key Insight #4 – Finding Qualified Talent Identified as Top Challenge Going Forward

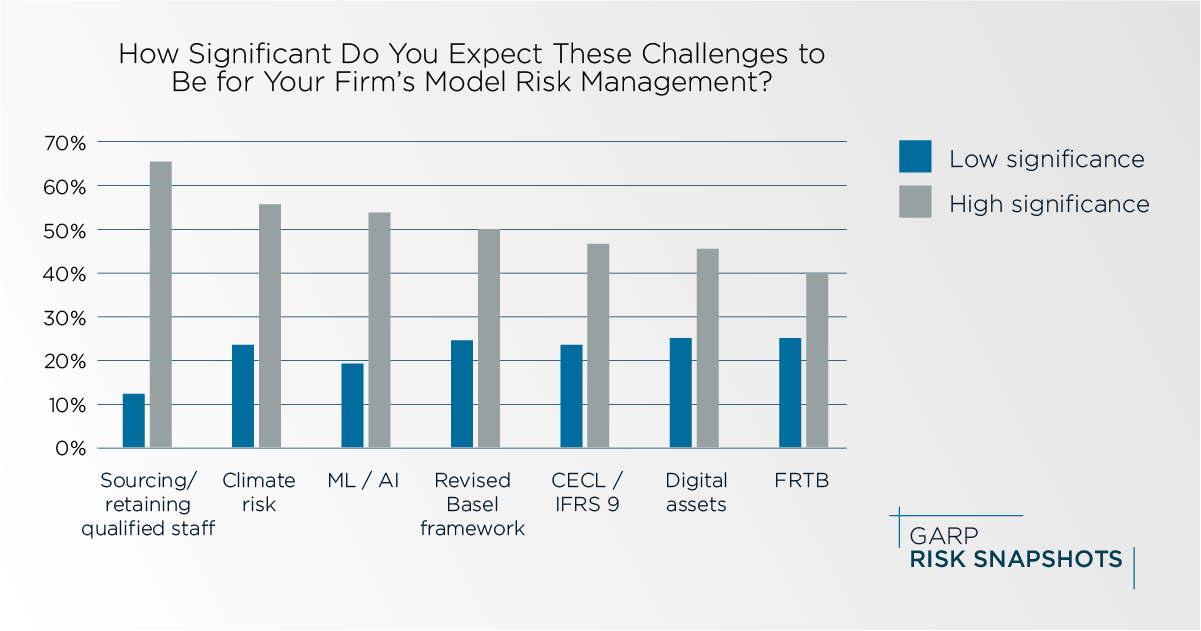

Survey respondents were asked how significant they viewed potential model risk challenges for firms in the future. Across several areas of regulatory transition, new domains (climate risk and digital assets), and new technology (AI/ML), respondents viewed significant challenges ahead for model risk management. Unsurprisingly, finding qualified model risk managers was viewed as the most significant challenge; over 70% of respondents “very familiar” with their firm’s model risk management rated this challenge of high significance. In addition, firms also reported that their model risk management teams have already been growing; 41% reported their teams have increased “somewhat” or “significantly” over the last 3 years, while only 11% reported their teams have decreased over the same period. Growth was particularly strong at larger firms. It is evident, therefore, that the need for qualified model risk managers will continue for some time.

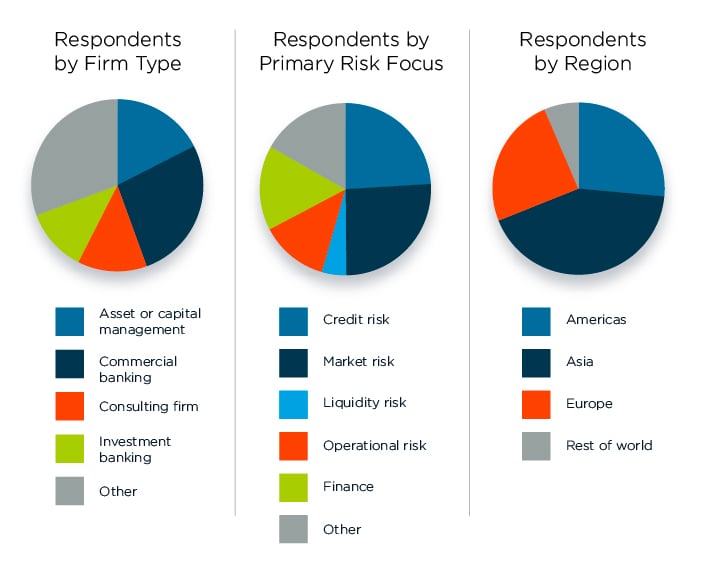

Survey Demographics

Over 1,200 FRMs participated in this survey representing a broad swath of risk managers across the globe, financial services firms, and risk disciplines, as shown in the respondent breakdowns by region, firm type, and primary risk area in the charts below.

In addition, roughly two-thirds of respondents work at large firms (greater than 1000 employees) and more than 70% have more than five years of risk management experience.

Want to read more?

Download the full report now!