Modeling Risk

Thursday, April 9, 2020

By Cristian deRitis

Like everyone else, I've been cycling through the five stages of grief these past few weeks, saddened by the human tragedy unfolding across the world and the loss of a way of life that already seems like a distant memory.

Every crisis is different and this one is certainly unprecedented in post-war history, given its geographic breadth. And yet I can't help but compare it to the 9/11 attacks.

I was living in Washington DC, having graduated from school just nine months prior. I learned of the news while at work as chaos broke out.

Parents rushed to their cars to retrieve their children from schools and daycare centers, only to be stuck in a massive traffic jam. I sprinted back to my apartment while jets scrambled overhead. Every delivery truck that passed was suspicious, as rumors of a dirty bomb spread.

I spent the next three days cooped up in my apartment, watching the news nonstop and preparing for the next wave of attacks that thankfully never came. Like today, the lack of information in that moment led to speculation and panic. Unlike today, that threat subsided relatively quickly, even if it took months for me to get back on an airplane and for life to get back to normal, albeit a new normal.

Today, we see the threat coming days in advance just by examining the epidemiological curves. But there is nowhere to run to, nowhere to hide.

The best course of action is to sit in isolation, breathe deeply, and try to remain calm. The best we can hope for is that no other major outbreaks occur.

By isolating ourselves and taking preventative measures today, we minimize the number of future infections. The challenge is the silence of the infection's spread - the lag of just a few days between infection and symptoms is enough for one person to spread the disease to potentially hundreds of others.

Public Health and Risk Management

In this sense, the work of our public health officials is much like the work of risk managers in the finance or insurance industries. We, too, operate with a lag, though it is often months or years between the time we make an underwriting decision and observe the outcome.

Through our actions, the outcome we hope for is that nothing happens. Bills are paid. No one loses a job. Life moves on.

No one throws a party for losses avoided or crises averted. In the best-case scenario, our managers might turn to us and say, “See I told you nothing would happen. You made me buy all that insurance and upgrade all my models and systems for nothing!” Such is the paradox of risk.

To be successful, and perhaps to stay sane, risk managers need to cultivate a sense of internal satisfaction and validation. Just think of the countless lives that epidemiologists and other public officials have saved through targeted vaccinations and disease control efforts. They are truly our unsung heroes.

Maybe Superman is really out there in space smashing up asteroids before they impact the Earth and wipe out all life. But we just know him as quiet, unassuming Clark Kent. Is Dr. Fauci all that different?

Now, maybe you aren't involved in public health risk management, where people's lives are directly on the line. Maybe you just manage the credit risk of mortgages, auto loans or small business loans. Sure, your decisions help your institution avoid financial losses. But that's small potatoes, right?

Don't sell yourself short. Those decisions can have enormous consequences on the financial health of individuals and their families. It can mean the difference between someone growing up in a stable home or being able to go to work or to employ others in a small business. Even your loan denials may make the difference between someone taking on too much debt and someone who is able to achieve economic security.

The Important Post-Pandemic Role of Risk Managers

Your skills and talents are going to be needed more than ever after the coronavirus (COVID-19) pandemic subsides. We will be looking to not only put the economy back together, but to create an economy that is more resilient, more vigilant, and better adapted to the future challenges we will face. And make no mistake: there will be future challenges.

Perhaps even more importantly than our day-to-day work, the principles of risk management can help everyone live happier, more productive and more serene lives. As a life philosophy, risk management helps us to prioritize, plan for the future and control our anxieties.

It's important to recognize that risk management does not mean risk avoidance. Bad things will still happen. The difference is how we react to the situations that are presented.

Will we remain calm and collected, as we take the playbook we've written for such occasions off the shelf? Or will we panic and allow our emotions to drive us to make precisely the wrong decisions at precisely the wrong time?

If you need any evidence that most of our friends and neighbors are not following risk management principles, simply look to the recent run on toilet paper in the face of a pandemic. Who knew so many households were operating under a “just in time” framework?

More importantly, not only were these excessive paper purchases futile, they may have inadvertently contributed to the spread of the virus, as thousands of people rushed to their local retailers. Again, the wrong decision at the wrong time.

The Value of Risk Management Principles

As risk management practitioners, our greatest societal contribution may be to simply talk to our families, friends and neighbors about risk. Perhaps we should start with the foundational principles of risk management: identify, measure, mitigate, prioritize.

The first step in any successful risk management project is to identify the potential risks. While none of us identified COVID-19 as a potential threat back in 2019, we should have been aware of our current health status and the risk that we could contract an illness at any time. We should all be taking stock of our financial health regularly and recognizing the chance of being laid off or losing the value of our wealth.

After identifying the risks, the next step is measurement. What is the likelihood of the various risks we face? What's the severity of a shock if we are unfortunate enough to experience it? Can we quantify - even in rough terms - a range of probabilities and severities?

Finally, there are the mitigation and prioritization steps. What actions can I take today to prepare for these possible outcomes? Of course, mitigation comes at a cost, so the size of our mitigation steps should be proportionate to the risk.

This is perhaps where many of us fall short, particularly if we don't apply some discipline to our analysis. We may assign too much weight to a high-severity but low-probability outcome, and not enough weight to a much more likely risk.

No, we didn't see COVID-19 coming, but some disruption due to illness or job loss is not uncommon. How much better off would we all be confronting the pandemic if we had at least three months' worth of living expenses saved up?

Unfortunately, according to the Federal Reserve, only about 40% of US families have liquid savings equivalent to at least three months of expenses. Less than 30% of families, moreover, have liquid savings equivalent to at least six months of expenses.

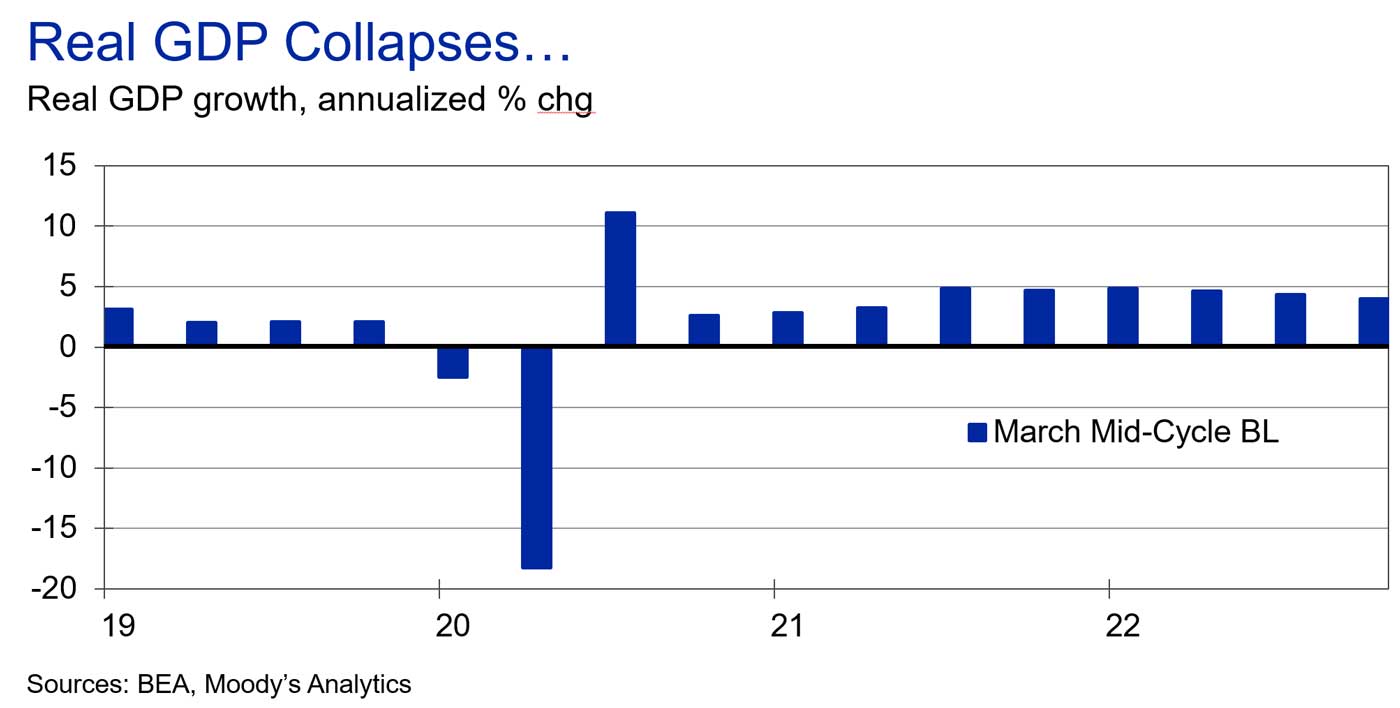

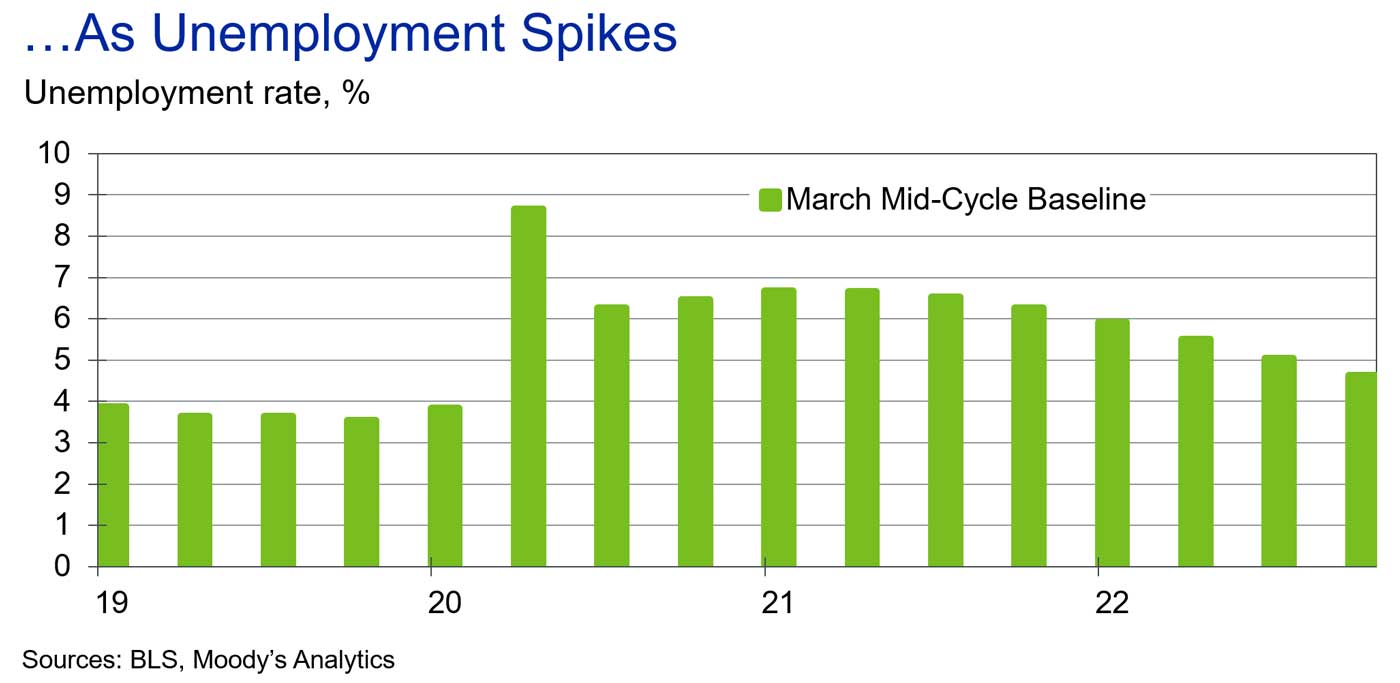

Obviously, we are living in a time of crisis and we need to take swift, direct actions now to protect public health and save our families and businesses with financial support. The latest Moody's Analytics baseline economic scenario, released March 27, calls for an unprecedented collapse in output and a sharp spike in unemployment in the months ahead (see charts, above).

If we don't act immediately, then risk management principles will be of limited value in the devastating aftermath of an economic depression. We must do whatever it takes.

Simultaneously, just as we are dealing with the current situation, we must start preparing for future risks. Spreading the gospel of risk management will help us to better confront whatever the future has in store for us, both individually and as a global community.

Cristian deRitis is the Deputy Chief Economist at Moody's Analytics. As the head of model research and development, Cris specializes in the analysis of current and future economic conditions, consumer credit markets and housing. Before joining Moody's Analytics, Cris worked for Fannie Mae. In addition to his published research, Cris is named on two U.S. patents for credit modeling techniques. He can be reached at cristian.deritis@moodys.com.

•Bylaws •Code of Conduct •Privacy Notice •Terms of Use © 2024 Global Association of Risk Professionals