Modeling Risk

Friday, September 3, 2021

By Cristian deRitis

The financial services landscape may eventually be altered, significantly, by digital assets like cryptocurrencies and central bank digital currencies (CBDCs). Banks must therefore be prepared, not only for the risks these innovative instruments pose but also for potential opportunities.

Before addressing these key issues, it's helpful to first consider what we can learn from the history of alternative currencies.

I'm a bit of an “economic tourist.” You can learn a lot about a country and its economy from your encounters with vendors at local markets, including the local specialties and whether haggling over prices is encouraged or discouraged. (Pro tip: outside of the U.S., it's often encouraged.)

One experience from my paternal home region is particularly relevant to today's interest in digital currencies such as Bitcoin or USD Coin. Understanding the history of alternative currencies can help risk managers and modelers to comprehend both the risks and opportunities behind the emergence of these digital substitutes.

Seeking SIMEC

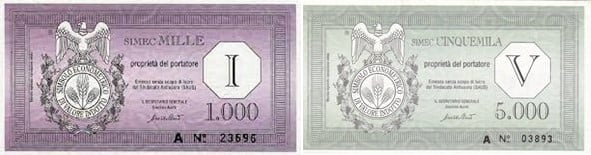

Back in 2000, just as the European Central Bank was getting ready to debut its new “euro” banknotes, the “SIMEC” - an alternative to the Italian lira - was released in the hilltop town of Guardiagrele in Italy's Abruzzo region.

The SIMEC, an acronym that translates as "econometric symbol of inducted value," was developed by Giacinto Auriti, a retired law professor who posited that central banks rob families of purchasing power when they put new money into circulation through the banking system.

Figure 1: SIMEC Notes - The Short-Lived Italian Currency Alternative

By issuing a “people's currency” outside of the central bank's (Bank of Italy) monopoly, Auriti hoped that prices would become more stable and predictable over time. Similar arguments are made today by advocates of cryptocurrency, who suggest that fiat money is subject to manipulation that inevitably leads to inflation.

To encourage adoption of this new money, Auriti struck a deal with 40 local shopkeepers, wherein he would exchange any SIMECs they collected at a rate of 2-to-1 (i.e., 2 Italian lire for every 1 SIMEC). This led to a spending boom, as individuals could receive an instant 50% discount on their purchases simply by exchanging their lire for SIMECs before making their purchases.

The system worked - until it didn't. Not long after printing up his first batch of SIMEC notes, the professor ran into both legal and financial trouble. At the same time, other merchants in town who did not accept SIMEC notes complained to the authorities after seeing their sales plunge. The Bank of Italy eventually stepped in to assert its authority, and the grand experiment with the “people's currency” ended.

This Time Is Different (Maybe)

The SIMEC experience isn't unique in human history. The concept of money, and who gets to define it, has been debated since the beginning of time. In this sense, cryptocurrency is just the latest in a long line of currencies. Most either fail or, like the British pound, are surpassed by other currencies over time.

Bitcoin and other cryptocurrencies are experiencing a surge in popularity now - but if history is any guide, they are unlikely to replace the dollar or the euro anytime soon. The single most important reason is that national governments have exclusive authority to define “legal tender” for paying public and private debts. Assuming the U.S. Treasury will continue to demand that taxes be paid in U.S. dollars, individuals and businesses will continue to conduct most of their affairs in dollars.

That's not to say that cryptocurrency markets will necessarily fall by the wayside. On the contrary, as long as the community of crypto users and speculators continue to believe the currency has value, it will continue to exist and thrive. Whether or not crypto achieves broader adoption depends on a number of factors - including price stability, ease of use, and security.

Risk managers whose firms have no direct exposure to cryptocurrency may be tempted to ignore this market altogether. But doing so would be a mistake. With the cryptocurrency market now worth over $2 trillion, it certainly merits watching in terms of potential risks and opportunities.

While the number of crypto afficionados is still relatively small, it would be unwise for financial services companies to turn a blind eye to these, or any, potential customers.

Digital Currency Revolution?

Beyond the direct impact of Bitcoin and other cryptocurrencies on commerce, the trends we see in crypto markets may be indicative of changes coming to the broader economy. Central banks around the globe are at varying stages of exploring or releasing their own digital currencies, with significant implications for monetary policy, credit, banking and legacy payment systems.

As the name implies, a central bank digital currency (CBDC) is a natively digital currency issued directly by a central bank that, in theory, removes the need for third parties such as commercial banks or credit unions.

The strategic risk to lending institutions would be enormous if CBDCs were adopted on a widescale. If consumers had access to an interest-bearing CBDC, and if they were able to move such an instrument easily and securely, they would have little need for a bank account. Indeed, they could not only make payments directly to retailers and other service providers but also obtain loans directly from other CBDC users.

Moreover, if they are perceived as being safer than traditional currency, CBDCs could further weaken the business case for traditional financial institutions.

Today, government deposit insurance provides consumers with a guarantee that the funds they deposit in banks and credit unions will be protected if their financial institution should fail. But consumers might see a CBDC as providing an even stronger guarantee, as it would come directly from the central bank - without any limits or risk that a government may renege on its promises. As a result, commercial banks and credit unions may have to pay higher interest rates to attract borrowers, and may risk experiencing runs during times of stress as depositors seek out safer alternatives.

However, while the adoption of CBDCs could be an existential threat to the financial industry, the likelihood of this occurring anytime soon is remote - given the size and scale of the current system, as well as concerns regarding privacy, security and transaction speed.

Potential Market Disruptions, and the Increased Need for Risk Managers

The implications of these new digital assets are far-reaching. For example, a movement to digital currency could disrupt the tight relationship between payments and revolving credit we have today.

Credit card issuers currently receive some transaction fee income with every swipe of a consumer's card, but they earn the bulk of their profits from the interest income paid by borrowers who roll over their balances. Divorcing the transactional and credit aspects of a credit card could expose issuers to greater competition, reducing their market share. This is already happening to some extent, as consumers are increasingly turning to alternative lending products offered by fintech lenders - such as “buy now, pay later.”

Traditional banks therefore need to begin planning now to both mitigate against the risks and take advantage of the opportunities that digital currencies could provide. This is an opportunity for risk management professionals to shine, because crypto-risk experts will be needed to help institutions understand and engineer responses to these complex and dynamic issues.

To raise awareness across the enterprise about digital currencies, and to educate teams about their potential, a strengths/weaknesses/opportunities/threats (SWOT) analysis of an institution's unique position in the marketplace may be a good first step. Based on this summary, business leaders can decide how best to position their institutions for the future, via proper allocation of investments in crypto data, tools and risk-mitigation models.

Figure 2: A SWOT Analysis of CBDCs

|

Strengths

|

Weaknesses

|

|

Opportunities

|

Threats

|

Parting Thoughts

We've only scratched the surface when it comes to understanding completely the possible consequences of a digital financial system. Indeed, the risk implications (e.g., privacy, security and regulatory concerns) - and opportunities - for monetary policy have yet to be fully understood.

While organizations should be carefully working through the potential ramifications of a digital revolution, it is important to highlight that changes are likely to be gradual. The operational complexity of moving to a blockchain system, alone, is enormous.

Cryptocurrencies today already struggle to keep up with a limited number of transactions. Consequently, scaling up to a $100 trillion global economy won't occur overnight. However, while risk managers and their institutions have some time to prepare, they need to use it wisely, as crypto-driven change could come quickly once it takes hold.

History has a way for setting the table for the future. While the SIMEC failed in the early 2000s, many people in Guardiagrele remember this experience positively - and are less skeptical of a new form of digital currency as a result.

As we have learned in recent years, we shouldn't discount an emerging trend just because it starts out small.

Cristian deRitis is the Deputy Chief Economist at Moody's Analytics. As the head of model research and development, he specializes in the analysis of current and future economic conditions, consumer credit markets and housing. Before joining Moody's Analytics, he worked for Fannie Mae. In addition to his published research, Cristian is named on two US patents for credit modeling techniques. He can be reached at cristian.deritis@moodys.com.

•Bylaws •Code of Conduct •Privacy Notice •Terms of Use © 2024 Global Association of Risk Professionals