Risk Management - Transition Risk

Tuesday, April 5, 2022

By Greg Rogers

The effects of climate change and the transition to a low carbon economy present emerging financial risks. These physical and transition risks present clear threats to corporations, banks, and investors, including employee retirement savings and pensions. Under some scenarios climate change could foreseeably threaten the entire financial system.

European and U.S. financial supervisors and regulators are becoming keenly aware of climate risk. The Basel Committee on Banking Supervision (BCBS) and the U.S. Office of the Comptroller of the Currency (OCC) both recently held public consultations on proposed principles for management of climate-related financial risks by banks. BCBS and OCC agree that:

General statements like these point in the right direction. However, more specificity about the nature of climate-related financial risks is needed for financial institutions to effectively manage them.

Greg Rogers

Risk identification

The phrase “climate-related financial risk” is used to encompass a wide variety of risks under two broad categories: physical risks and transition risks. The challenge is to understand how physical changes to the climate and the transition to a low carbon economy translate to financial risk, and to prioritize the risks of greatest concern.

Systemic risk

In 2016, the European Systemic Risk Board (ESRB) issued a report on the systemic risk posed by climate change and the transition to a low carbon economy. The ESRB started with the premise that keeping global warming below 2°C will require substantial reductions in global greenhouse gas emissions over the next few decades and that this implies a decisive shift away from fossil fuel energy and related infrastructure. The ESRB then considered two scenarios – a benign scenario and an adverse scenario that it called “too late, too sudden”.

In the benign scenario, the transition to a low carbon economy occurs gradually, adjustment costs are manageable, and the repricing of carbon assets does not entail systemic risk.

In the too late, too sudden scenario, policy action to control emissions occurs late and abruptly in a way that threatens the overall financial system. The sudden transition harms GDP, as renewable energy supplies are limited and more expensive. There is a sudden repricing of carbon-intensive assets, which are financed in large part by debt. The continuing rise in severe weather events increases the liabilities of insurers.

A common theme in both scenarios is the repricing of carbon-intensive assets in response to seemingly inevitable future policy actions to curtail carbon emissions.

Impairment risk

It is self-evident but nonetheless worth stating that anthropogenic carbon emissions do not produce themselves. Long-lived tangible assets do.

Examples of long-lived tangible assets, sometimes referred to as real, fixed or physical assets, include land, buildings, machinery and equipment, and vehicles. Examples of carbon-intensive real assets include fossil fuel reserves, coal and natural gas power plants, internal combustion and jet engines (and the factories that produce them), aluminum and cement plants, commercial and residential buildings, and land. These assets appear on corporate balance sheets as “property, plant, and equipment.”

By definition, long-lived tangible assets have useful lives greater than one year. In many cases, they are expected to remain in service beyond the 2050 target date for carbon neutrality, or “net zero”. In this sense, the as-yet-unrealized emissions embedded in the remaining lives of long-lived carbon-intensive assets is the future that has already happened.

The principal financial barrier to mitigating the worst impacts of climate change is the need to prematurely retire much of the world’s vast stock of carbon-intensive assets and replace them with low or zero emission alternatives. Replacing these assets ahead of schedule will require a tremendous amount of capital investment that is generally not figured into existing business models. This may pose a risk to the business model itself.

The transition to a low carbon economy implies that a wide range of existing and especially newer carbon-intensive assets will become stranded. Stranded assets are assets impaired by premature write-downs, devaluations, or conversion to liabilities. Impairment risk is also likely to be correlated with physical risks (as governments respond to increasing droughts, rising sea levels and extreme weather events with policies to control carbon emissions and incentivise renewable energy) and across companies, sectors, regions, and asset classes. Impairment risk is the principal climate-related financial risk to financial institutions.

Risk assessment

How can we measure and assess impairment risk, which will unfold over coming decades, at different speeds across sectors and jurisdictions?

One tool is scenario analysis – an important forward-looking analytical approach that can take into account uncertainty over future possible pathways of emissions and policy choices. But that very uncertainty also makes this is a complex and difficult exercise to complete and to then communicate with regulators, investors and beneficiaries.

A simpler alternative is to measure the impairment risk of existing physical assets. We can do this by estimating the cost of future (or “unrealized”) emissions embedded in physical assets relative to the value of those assets. Because net zero implies that by 2050, all assets must be carbon neutral, assets subject to carbon offset costs will have lower value relative to those that do not. In simple terms, if the goal is net zero, high carbon, low value assets are at greater risk of becoming stranded than low carbon, high value assets. At some point, high carbon, low value assets become a de facto liability. Because impairment risk is a function of unrealized emissions over the remaining economic life of the asset, carbon-intensive assets with longer lives are at greater risk of becoming stranded than short-lived assets.

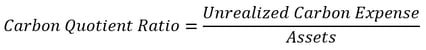

The Carbon Quotient (CQ)[1] ratio is a measure of impairment risk. It is defined as:

Where:

Unrealized Carbon Expense is unrealized emissions (tCO2e) times an imputed carbon price ($/tCO2e);

Unrealized emissions are future greenhouse gas emissions (tCO2e) that will result from the continued use of emission-producing physical assets over their remaining life, calculated as current period realized emissions times asset life; and

Assets is the carrying value (cost less accumulated depreciation, depletion and amortization) of emission-producing physical assets.

Ideally, the imputed carbon price should reflect the cost to remove carbon from the atmosphere. In this way, the ratio reflects a scenario in which carbon neutrality is mandatory now and not at some distant point in the future.

The CQ ratio differs in important ways from the most commonly used measure of transition risk today – carbon intensity. Carbon intensity (tCO2e/$M sales) measures corporate emissions relative to revenue. A significant shortcoming is that it employs the wrong numerator – current period emissions. By accounting solely for current period emissions, carbon intensity omits consideration of the unrealized emissions baked into long-lived assets. Carbon intensity assumes two assets with identical emissions and revenues pose identical risk, even though one will produce carbon emissions for another five years and the other 50 years.

Carbon intensity also employs the wrong denominator. It uses flows (revenues) when it should instead use stocks (assets). Revenues don’t produce carbon emissions. Assets do. Whereas carbon intensity incentivizes firms to reduce real emissions (or dilute them with unrelated revenues), the CQ ratio incentivizes firms to decarbonize real assets. Because it measures emissions relative to assets not revenues, the CQ ratio works for all asset classes – listed equity and corporate bonds, business loans and unlisted equity, commercial real estate, mortgages, and motor vehicle loans. Residential homes and personal autos, for example, don’t have income statements.

Risk response

The proper identification and assessment of impairment risk helps avoid distraction by idiosyncratic environmental, social, and governance (ESG) risks that are not reasonably likely to have material financial impacts across a large portfolio of loans and investments. It can also inform effective risk responses, such as the following.

Asset selection, portfolio management, and loan underwriting

Active asset managers can use measures of impairment risk to distinguish between climate leaders and laggards in the same sector and to assess the exposure of portfolios to climate change. Passive asset managers can use them to develop climate-aware index funds with lower impairment risk. Banks can use them to underwrite loans and assess the value of collateral.

Engagement

To mitigate risk at the source, financial institutions, including those with purely passive investment strategies, can use measures of impairment risk in corporate engagement — actions meant to influence companies to be more proactive and transparent about their efforts to address financially material risks from climate change.

The power of net zero is that it sets both a destination and a deadline. This means one can create a customized map for getting to net zero on time, track progress, and forecast an estimated time of arrival for any emission-producing asset or portfolio of assets.

Figure 1 Net Zero Transition Pathway

Figure 1 illustrates a net zero pathway for a hypothetical company. The yellow line shows a net zero pathway, starting with a CQ ratio of approximately 300% in 2010 and ending with a CQ ratio of 0% in 2050. The solid green line shows changes in the company’s CQ ratio over the 10-year period from 2010 – 2019. The dotted green line shows the forecasted future CQ ratio based on historical results.

Banks and asset managers can use a chart like this to engage with corporate managers on their firms’ strategies to reduce climate risk and achieve net zero targets. Because the chart reflects actual changes in emissions and assets, discussions can focus on specific past actions and future plans to achieve carbon neutrality through a combination of year-over-year emission reductions from energy efficiency improvements, capex on low carbon assets, disposals of carbon-intensive assets, and conversion to renewable sources of electricity. When results are off track, the parties can discuss plans for a course correction.

Communications

Financial institutions can educate stakeholders on impairment risk and efforts to mitigate it by publishing loan and investment decision‐making policies in precontractual client materials and on their website. Increased transparency will produce more informed clients and investors and reduce operational risks from financial greenwashing.

Accountability

Financial institutions can foster accountability for their contribution to the climate crisis by charting their own transition to net zero across their investment and loan portfolios and regularly reporting results against targets to clients and investors.

[1] Carbon Quotient and CQ are trademarks of C.G. Rogers & Co., LLC.

Greg Rogers created Carbon Quotient™ analytics to help investors, banks, and corporations measure, manage and report climate-related financial risk. Greg is author of the seminal desk book on financial reporting of environmental liabilities and risks (Wiley, 2005), Fellow and Advisor to the Master of Accounting Program at Cambridge Judge Business School, and a senior policy advisor to Carbon Tracker.

•Bylaws •Code of Conduct •Privacy Notice •Terms of Use © 2024 Global Association of Risk Professionals