Modeling Risk

Friday, October 1, 2021

By Cristian deRitis

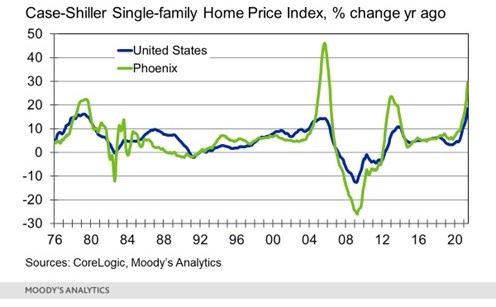

U.S. home prices rose by 19% over the prior year in June 2021, the fastest pace of growth in 45 years. Price increases in certain states and metropolitan areas have been even more eyepopping, with prices in the Phoenix metro area rising by over 30%.

As memories of the 2007 housing boom and bust are still fresh on the minds of many investors, how concerned should risk managers - and homeowners - be by this latest development? Moreover, what steps should they take to mitigate their exposures?

A Theory of Value

Real estate appears to be an ideal investment. When the rest of the economy falters, real estate values tend to hold up. Even during the 2007 housing crisis, homes prices recovered within a matter of years after recording sharp declines. As long as property owners could wait out the cycle and continue servicing their debts, the likelihood of a positive return on their investments was high in nearly all parts of the country.

Fast forwarding to today, while there are fundamental reasons supporting the recent increase in prices, the record-setting pace is over three standard deviations away from the typical growth rate of 5% per year from 1976 to 2020 (see Figure 1).

Figure 1: Record-Setting Home Price Growth

Based on this statistical observation alone, risk managers need to entertain the possibility that properties could be significantly overvalued. What's more, they must consider a variety of potential actions to eliminate or reduce their risk of incurring losses during a market correction.

While history suggests that prices will eventually recover in the event of a decline, this process could take years, given changes in demographically-driven demand. Property owners and lenders, meanwhile, need to evaluate their tolerance for slower home price growth and a protracted recovery.

Fundamental Support

The convergence of three major trends are supporting the observed rise in home prices today.

Shifting demographics offer the most compelling explanation, with members of the millennial generation (born between 1981 and 1996) entering their peak homebuying years. Simultaneously, Baby Boomers, born between 1946 and 1964, are choosing to remain in their homes rather than downsize as they enter their retirement years. This combination of rising demand and restricted supply is pushing prices ever higher.

On top of these structural shifts, the stimulus measures introduced to combat the COVID-19 recession have not only further stoked demand (through low interest rates) but also further restricted supply - via a foreclosure moratorium on government-backed mortgages.

Moreover, the limited availability of construction materials and workers is limiting the number of new homes being built. And if that's not enough, recent hurricanes, floods and wildfires have further reduced available housing stock.

While supply-chain bottlenecks and worker shortages are expected to be resolved over the next few quarters, demographic tailwinds will continue to support strong demand for the next 10 years, particularly for lower-priced starter homes.

Demographic Determinism

Though encouraging, this sanguine outlook shifts dramatically as we look beyond 2030. The U.S. fertility rate has trended sharply downward since 2007, falling well below the replacement rate and showing no signs of slowing - let alone reversing - any time soon.

Fewer births will translate into fewer future homebuyers - just as the mortality rate for Baby Boomers rises. More open immigration policies could fill some of this gap in demand, but relief may be limited, as birth rates are declining even faster in other parts of the world and the need for workers is rising globally.

What Should We Do?

Given these differences over the short- and long-term outlooks, the risks to property owners and portfolio managers depends critically on their time horizons.

Home prices are expected to remain firm in the short-term. Growth rates will, however, likely weaken from their record-setting highs, as the inventory of homes available for sale rises with new construction and the end of the federal foreclosure moratorium.

On the demand side, as rising prices affect their ability to secure down payments and service monthly mortgage payments, more potential homebuyers will continue to withdraw from the market. As the Federal Reserve shifts from an accommodative to a tightening monetary policy, rising interest rates will further reduce demand, prompting a deceleration in price growth - with sellers no longer receiving multiple offers for their properties.

If the job market remains robust, home prices are expected to stabilize rather than decline. Millennial homebuyers stand to benefit from rising wages. This should allow the incomes of homeowners to grow into the currently elevated level of home prices. Price-to-income ratios, moreover, should return to their historical averages over time.

Not Just Downside Risk

There are multiple upside and downside risks to this forecast, as we look farther into the future. On the positive side, interest rate increases are expected to be modest and relatively slow over time. Though rising, mortgage rates should remain below their long-run averages, keeping monthly payments from increasing dramatically.

As they inherit the estates of their Baby Boomer parents, the millennial generation also stands to see its overall wealth increase significantly. This could reduce debt burdens and prop up home prices, with homebuyers using these assets for down payments.

On the negative side, the increased frequency of flooding, wildfires and other natural disasters threatens the value of properties located near vulnerable areas, such as forests and flood plains. Consequently, these areas could prove increasingly unattractive for future buyers, and existing property owners may suffer losses in value. Complicating matters even further, zoning restrictions on the number of housing units that property owners can construct on a given lot hampers their ability to build replacement units and to increase density in other areas.

Somewhat counterintuitively, measures used to combat climate change - such as land conservation and prohibitions on building in threatened areas - could end up restricting housing supply in higher-risk areas, pushing home values upward in other areas.

Parting Thoughts

Defining equilibrium asset prices is one of the oldest and most challenging problems in economics. Prices are dynamic and situational, making them incredibly difficult to forecast.

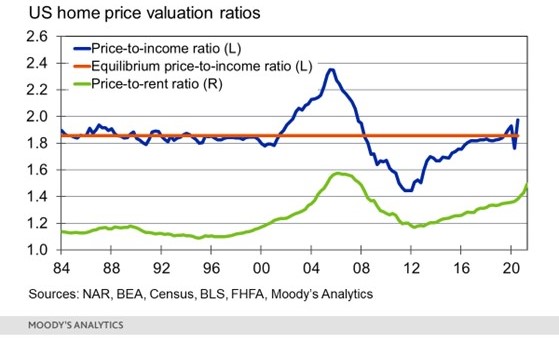

Real estate prices are no exception. Valuation metrics (such as the price-to-rent and price-to-income ratios depicted in Figure 2) do not fully capture changing conditions, but can provide useful context. By these measures, prices today are elevated in the United States and many other parts of the world - but not substantially, under the assumption of growing incomes and continuing demand for workers.

Figure 2: Ratios Point to Overvaluation

Portfolio diversification and insurance contracts are useful tools in the current environment for mitigating the downside risk related to a home-price correction. However, the most important and cost-effective tool in risk managers' toolkits remains the power of “no.” Investments in improved underwriting models that leverage new data sets and modeling techniques can prevent loans with higher default probability from entering a lender's portfolios in the first place.

Given the trends on the horizon, the old mantra that real estate prices depend on “location, location, location” needs to be modified to “location, location, timing.” While short-term prospects remain strong, the longer-term outlook is significantly more pessimistic.

Cristian deRitis (PhD) is the Deputy Chief Economist at Moody's Analytics. As the head of model research and development, he specializes in the analysis of current and future economic conditions, consumer credit markets and housing. Before joining Moody's Analytics, he worked for Fannie Mae. In addition to his published research, Cristian is named on two US patents for credit modeling techniques. He can be reached at cristian.deritis@moodys.com.

•Bylaws •Code of Conduct •Privacy Notice •Terms of Use © 2024 Global Association of Risk Professionals